Which Americans are the most stressed about their finances?

Women with credit scores below 700, according to an analysis conducted by Elevate’s Center for the New Middle Class, an independent research arm of the online lender.

This group of women gets hit from all sides: They work more than women with higher scores, are more likely to have children and elderly parents living in their home and tend to be the head of their household.

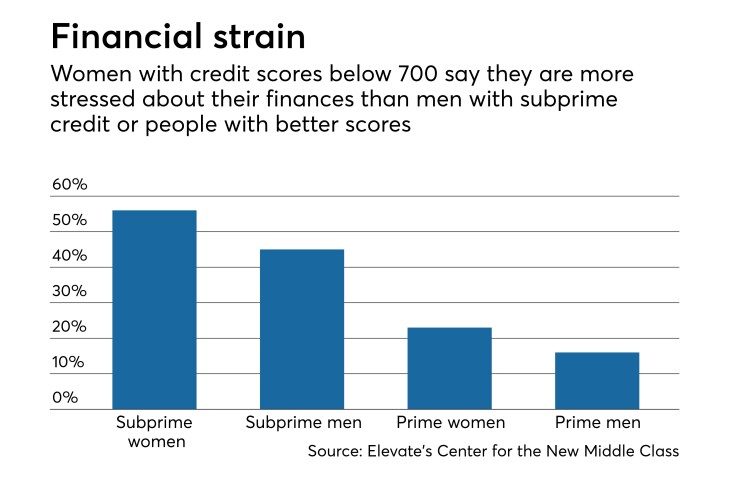

Fifty-six percent of women with subprime scores say their finances cause them significant stress. About 45% of men with subprime credit scores say the same, as well as only 23% of women with prime ratings and 16% of men with prime ratings.

Seventy percent of women with subprime credit scores work full time, versus 62% of women with prime scores. They are more likely to work hourly jobs than salaried positions. Almost two-thirds of them say they live paycheck to paycheck.

The woman with subprime credit is 41% more likely to have children in her home than a prime woman. She is also 79% more likely to have an elderly parent living with her. She is also more likely to say that she manages checking accounts, sets the financial plan and makes decisions on major purchases for the household.

Women with subprime scores are three times as likely as women with prime scores to have lost a job in the prior 12 months, more than twice as likely to have had their work hours reduced, and are much less likely to have a safety net to save them from emergency expenses.

They are four times as likely to admit to having difficulty predicting next month’s income.

They are 38% more likely than men with subprime credit to run out of money every month. More than four out of five of them run out of money at least once a year.

This leads to the need to borrow money just to get by. Almost a third of women with subprime scores have needed to borrow money to cover standard household expenses. And they borrow more than their prime counterparts for just about everything, except to purchase a home. In that wealth-generating debt, they lag significantly behind.

Only 39% of this group believe they have the skills to manage their finances, despite the fact that ongoing research from myriad sources has found women to be the primary financial managers of their households.

“Everyone talks about how women’s financial situations lag behind those of men,” Jonathan Walker, executive director for the Center of the New Middle Class, said in a press release. “However, we often forget that nonprime women have it even harder. When compared to prime women and nonprime men, nonprime women are faring worse than both groups. The data tell a story of women’s increased burden, increased responsibility and increased need for help. It’s more important than ever to arm them with the tools they need to improve their finances. Financial literacy training, coupled with the right financial products, could have tremendous societal benefit not only for nonprime women, but also for the next generation.”

The research compared the responses of 1,217 Americans using interviews conducted Dec. 6-14, 2016. Of these, 730 were women.