Small banks are saying later to the booming buy now/pay later business.

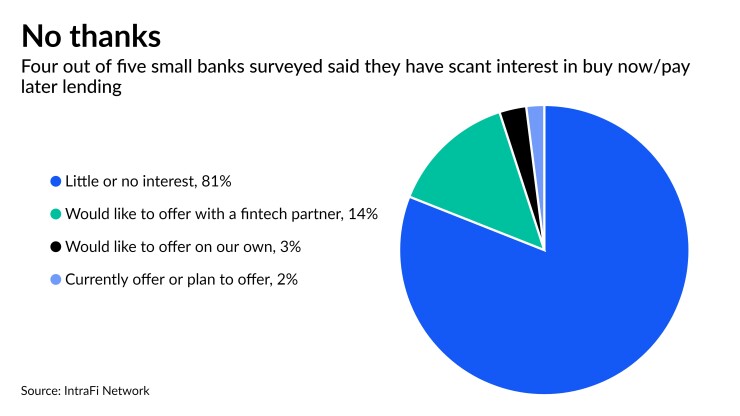

About eight in 10 community bank executives have “little to no interest” in offering the consumer installment loans, according to an IntraFi Network survey of key executives at banks with up to $10 billion in assets.

Some 14% of the executives said that they would like to offer the loans in partnership with an outside fintech company, rather than doing so on their own. Only 2% of those surveyed said they were either already offering the service or actively planning to do so.

“Banks are not lining up to offer BNPL, and those that are would prefer doing so in partnership with a fintech,” said Paul Weinstein, a senior adviser at IntraFi.

Worldwide, the buy now/pay later boom reached more than $100 billion in loans last year, according to Cornerstone Advisors. Leading providers include PayPal, Affirm, Klarna and Afterpay, which is being acquired by Block, the company formerly known as Square.

Buy now/pay later providers often allow consumers to pay off purchases at checkout over four payments without being charged interest — even with little or no credit history.

Merchants pay the providers a fee, often a percentage of the transaction up to 8%. Consumers who miss payments are often charged late fees, which may provide another source of revenue.

Some large banks, including Goldman Sachs and Capital One Financial,

But other banks are more skeptical of the fast-growing product. Cullen/Frost Bankers, a $50.9 billion-asset company in San Antonio, Texas, has an aggressive organic growth plan, but it does not include the buy now/pay later business, according to CEO Phil Green.

“What could go wrong there, right?” Green said in a recent interview.

In December, the Consumer Financial Protection Bureau

The IntraFi survey, which was conducted in early January, took the pulse of CEOs, chief financial officers and other leaders at 426 small banks.

It showed that some bankers are expecting the easy flow of deposits to begin to slow. About 40% of those surveyed said they believe deposit competition would moderately increase 12 months from now, up from 29% who gave the same forecast three months earlier.

"There’s going to be a tighter market for deposits,” Weinstein predicted.

More than half of the executives surveyed said they expect loan demand to increase at least moderately over the next year. But it could take time for the industry’s suppressed loan-to-deposit ratios to return to normal. Loan demand has been reduced during the COVID-19 pandemic, as consumers and businesses have used government stimulus funds to build reserves.

About 43% of the small bank executives surveyed said they expect loan-to-deposit ratios to return to pre-pandemic levels sometime in 2023, while another 39% said it won’t happen until 2024 or later.

IntraFi’s findings also suggest that the pandemic may have altered how small banks view their branches. Among banks that have closed branches since the start of 2020, about 53% of those surveyed pointed to a lack of foot traffic as a result of customers’ increased use of online banking options.

“COVID is not identified as the primary reason,” Weinstein said. “But clearly the virus has accelerated digital channels so that you don’t have to go into your branch anymore. People have become much more comfortable with online banking."