Banks with less than $10 billion of assets are losing the deposit war, even as many continue to raise rates on savings accounts and certificates of deposit to try to keep pace with their larger rivals.

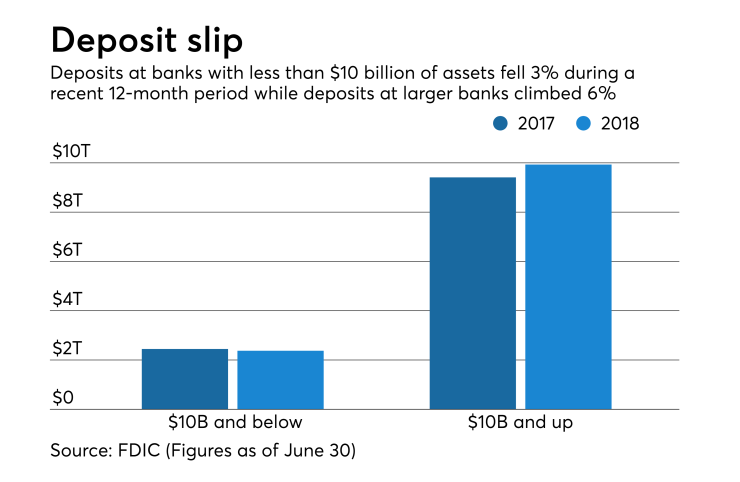

New data from the Federal Deposit Insurance Corp. shows that deposits at banks that have less than $10 billion of assets fell 3% in the 12-month period that ended June 30, to $2.37 trillion. That’s a reversal from the prior 12-month period, when deposits for this group of banks increased by 0.8%.

Meanwhile, deposits at banks with more than $10 billion of assets climbed 6% during the most recent 12-month period, to $9.9 trillion.

The data suggests that smaller banks may need raise rates even more aggressively if they hope to reverse these trends, according to industry analysts. Without a pressing reason to switch banks, many consumers so far have decided to stick with regional and large banks, even though many are paying comparatively paltry rates.

And competition for deposits is only going to intensify as big banks continue to invest heavily in consumer-facing technology and selectively add branches in deposit-rich markets. Though branch traffic has been declining steadily for years, branches are still viewed as effective channels for gathering the core deposits banks need to fund loans.

Several large banks are also building separate, online-only banks as vehicles for gathering deposits in markets where they don’t have physical branches.

Neil Stanley, the CEO of the CorePoint, a deposit consulting firm in Omaha, Neb., said that smaller banks need to consider increasing deposit rates and improving their deposit and loan products to give consumers more compelling reasons to switch from banks that have vast branch and ATM networks and, generally, more sophisticated mobile banking technology.

Otherwise, “it’s not enough motivation to switch” away from a larger bank to a smaller one, even if the smaller institution pays a slightly better rate on CDs or money markets, he said.

The largest banks for months have

Bank of America’s total deposits jumped 2.8% during the period, to $1.32 trillion, according to the FDIC data. Wells Fargo’s rose 1.7% to $1.28 trillion, JPMorgan Chase’s increased 0.4% to $1.32 trillion, and Citigroup’s climbed 1.1% to $510 billion.

Big banks can only hold off raising rates for so long, however. John Gerspach, chief financial officer at Citigroup, said at the Barclays Global Financial Services Conference this month that he expects big banks to start

Deposit growth has been even more robust at midsize and online-only banks.

At the $15.4 billion-asset MidFirst Bank in Oklahoma City, deposits increased 6% to $8.3 billion during the 12-month period. And at the $18.2 billion-asset FirstBank in Lakewood, Colo., they climbed 5.6% to $16.5 billion. Neither bank completed an acquisition during that time frame.

Meanwhile, online-only banks have aggressively juiced their deposit holdings by offering some of the industry’s highest rates on CDs.

Goldman Sachs’ deposits jumped 20.6% to $128 billion in the 12-month period that ended June 30. Ally Financial saw a 16.2% increase, to $100 billion, while deposits at Synchrony Bank climbed 11.5% to $62 billion.

The rapid growth at online banks could explain why several of the country’s largest banks, including JPMorgan Chase, Citigroup and Citizens Financial Group, are

At the same time, some large and regional banks are adding branches in select markets, even as they close branches in other areas.

Bank of America, for example,

“Obviously the big banks can’t acquire anymore, so the only option for us is to open our own branches,” JPMorgan Chairman and CEO Jamie Dimon said earlier this year.