-

TCF Financial in Wayzata, Minn., posted higher quarterly results after reporting an uptick in lending for equipment purchases.

January 30 -

Stimulus spending and Obamacare are making health care a viable way for banks to diversify their loan portfolios.

January 25 -

BancAlliance, a young cooperative for small banks, has the capital and lending team in place to make a splash in an area that hasn't had much action since the financial crisis: equipment finance.

June 27

More community banks are looking at equipment finance as a way to

Smaller banks have historically shied away from equipment finance because it requires a lot of expertise that typically has an up-front cost. But a desire to book assets at higher yields has made the business more attractive, industry experts say.

"Commercial-and-industrial assets are performing well in comparison to other assets," says Scott Wheeler, president of Wheeler Business Consulting in Fallston, Md. Banks also need products "to reengage with small businesses, and this allows them to do that."

Interest in equipment finance has been steadily rising. Roughly a tenth of the 78 firms that joined the Equipment Leasing and Finance Association last year were community banks, says Ralph Petta, the trade group's chief operating officer. Banks are drawn to the business because of attractive yields and delinquencies and write-offs that are near historic lows, Petta says.

Equipment deals generally have shorter durations, which could prove useful when interest rates start to rise, Wheeler says.

Bank of Birmingham in Michigan

The $148 million-asset bank, a unit of Birmingham Bloomfield Bancshares, has approved about $10 million in transactions and has a strong pipeline for future deals, Farr says. "Our plan is to grow as a bank as quickly as possible without taking on a lot of unforeseen risk," he says.

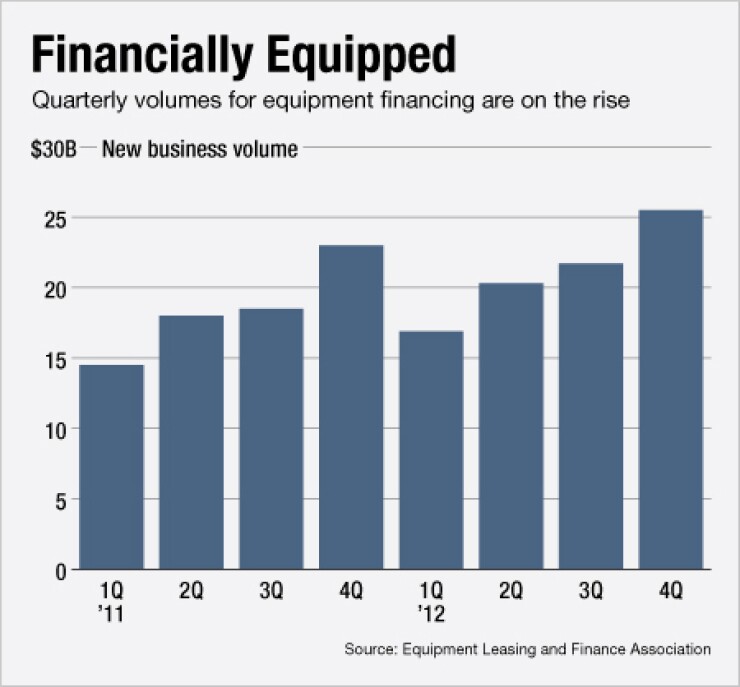

New business volume at financial institutions rose almost 25% in 2012 from a year earlier, to $53 billion, according to the Equipment Leasing and Finance Association. Demand should continue to rise as businesses that delayed equipment investments start to make upgrades, Petta says.

Wheeler Business Consulting, which specializes in equipment leasing, is getting "calls almost daily" from banks interested in the business but are often hesitant to pull the trigger, Wheeler says.

Equipment financing has "nuances that need to be understood," before a bank jumps in, Petta says. "It's not insurmountable, but if you are treating equipment financing like a plain vanilla bank loan then you are not doing your homework," he says.

There are generally three outcomes at the end of an equipment-finance lease, says John Deane, chief executive of The Alta Group. Roughly 85% of the time, clients decide to buy the equipment from the bank or extend the lease for a shorter period of time, he says.

A client could also decide that it no longer wants the equipment; the bank then takes possession of the machinery. In those cases, the bank must market the returned equipment, hiring workers to flip the machinery or working with an outside company, Petta says.

It is also challenging for inexperienced lenders to accurately calculate equipment value at the end of a lease, industry experts say. The amount of wear that equipment endures during a lease can vary greatly and will influence its residual value.

Lessor-lessee relationships often differ from those between a lender and borrower. Bank of Birmingham is not the primary bank for many of its equipment finance clients, so the bank is usually less familiar with them, Farr says.

Equipment finance is "more of a transaction than a relationship business," says Mark Hoppe, president and chief executive of Taylor Capital Group (TAYC), which formed a leasing business in June by

The cultural difference can make it difficult to integrate an equipment financing unit into a bank, Wheeler says. It requires lenders to be aggressive finding clients and a willingness to adjust to market changes.

About half of equipment financing or leasing deals are conducted through relationships with equipment vendors, Deane says. Banks must underwrite deals fast because "end users have made the decision to get the equipment and want to get it quickly," he says. Vendors also want to make sure that they don't lose sales because the financing takes too long, he says.

To overcome these challenges, smaller banks often work with existing leasing companies or hire teams of experienced lenders to start equipment financing groups. Working with a leasing firm lets community banks gain expertise and enter the market faster, Deane says. A leasing company often teaches a bank's employees how to sell equipment financing and assess residual values. It also lets banks test the waters before fully committing.

"It's like dating before getting married," Deane says. "You can try it out for a while and, if you like it, you can get more serious."

Bank of Birmingham hired Robert Leonard, an equipment finance veteran, to launch its business. The bank plans to cap equipment financing at about 20% of its $150 million loan book, Farr says. It can "be tricky" to hire experienced lenders, but "it would be difficult to learn as you go," he adds.

Taylor Capital's ability to hire a team also has added benefits, says Hoppe, who helped start LaSalle's equipment finance business. The $5.1 billion-asset company's equipment financing division funded about $85 million in transactions last year.

The group has approved about $115 million since its creation in a variety of industries such as food, trucking and power, Hoppe says.

"We do feel there is pent-up demand for equipment," Hoppe says. "We see it in our local C&I clients that have postponed investment in equipment. That will change as they get more confidence in the economy."

Sectors that are fueling equipment finance include construction,

The $431 million-asset company hired Rich Garwood, who has more than 25 years of experience, to run the group. Marlin, the parent of Marlin Business Bank, specializes in equipment lease financing in more than 60 categories. Most of its business comes from partnerships with vendors, so it has to understand the needs of the vendor and the client.

"Knowing your customer and understanding the market is critical," says Dyer, who adds that he has heard of more banks wanting to enter equipment financing but hasn't seen new competition.

"Traditional banks have a lot of policies they have to stick to, but you need to be more adaptable" in equipment financing, Dyer says.