-

Hamilton State Bancshares in Hoschton, Ga., has agreed to buy Cherokee Banking in Canton, Ga.

August 27 -

Increased stability among Georgia's banks also increases the odds of consolidation in the once-beleaguered state.

August 1

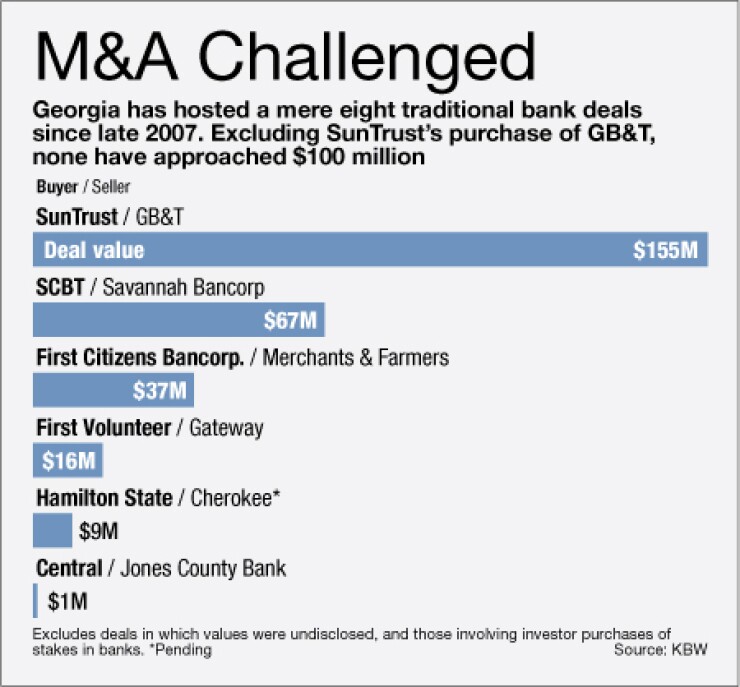

Normally an $8.5 million bank acquisition would get overlooked, but not in a hard-hit state like Georgia where only a handful of open-bank deals have occurred in recent years.

Traditional bank M&A nearly ground to a halt there after the state suffered a deeper recession than most other areas of the country. Many banks that were heavily concentrated in residential and construction lending suffered credit problems, making them unattractive takeover targets if they survived at all.

But experts predict that the deal announced this week between

"Open-bank activity has been rare," says R. Lee Burrows, Jr., the chief executive of Banks Street Partners, an investment banking firm in the Southeast. "However, with credit finding firmer footing and acquirers having a stronger currency, we are on the cusp of a tremendous amount of M&A activity in Georgia."

Hamilton's agreement to buy the $168 million-asset Cherokee for $8.5 million in cash is the first open-bank deal in Georgia announced this year, according to research from Keefe, Bruyette & Woods. It is only the third since the beginning of 2012 and the only one of those that involved an in-state buyer. In contrast, there have been roughly a dozen failed-bank transactions in Georgia since the start of 2012.

The deal is a "watershed event for community banks in metro Atlanta now that a bona fide regular-way merger has occurred," Christopher Marinac, an analyst at FIG Partners, wrote in a research note. The initial price-to-tangible book is 101%, Marinac said.

The pace of deal activity is expected to quicken through the first half of next year as the economy recovers and potential sellers have worked through most of their problem loans, experts say. Banks are earning better supervisory ratings, and regulators are terminating enforcement actions, adds Steven Dunlevie, the chair of Womble Carlyle Sandridge & Rice's financial institutions team. Additionally, stock prices have risen this year, giving potential buyers a stronger currency to make deals.

"There will be some movement with consolidation in Georgia and in particular in Atlanta as banks are feeling better," Dunlevie says. "Not all banks are out of the woods yet, but the optimism is palpable."

There are roughly a dozen well-capitalized banks in Georgia that need to find ways to put their capital to work, Burrows says. Asset growth continues to be one of the biggest challenges for banks. Now that potential sellers have become stronger, buyers will begin to look for deals to grow, he adds.

"If you have 20% capital then you are in a pie-eating contest," Burrows says.

State Bank Financial (STBZ) in Atlanta is one of those well-funded banks, says Jefferson Harralson, a managing director at Keefe, Bruyette & Woods. It has been an aggressive acquirer of failed banks, and management has indicated plans to continue to look for deals.

Other well-armed players include Community & Southern Bank in Atlanta and Hamilton, which enjoy private-equity backing, Harralson says.

Community & Southern's chief executive concurs that his bank is on the prowl. "The company sees many acquisition opportunities on the horizon in the Southeast," CEO Patrick Frawley said in an email.

A recovering United Community Banks (UCBI) in Blairsville, Ga., could also look for deals next year

"You are looking at a lot of banks with significant capital levels," Harralson says. "I've been surprised we haven't seen more deals. I thought they would put this money to work sooner."

In March 2011 the $1.4 billion-asset Hamilton raised $231 million. With a Tier 1 capital ratio of almost 16%, the bank needs to put some of that money to good use, says Robert Oliver, the company's chairman and CEO.

Since 2008, Hamilton has acquired four failed banks as it expanded throughout Atlanta's suburbs. The Cherokee deal allows it to fill in a gap in the northern metro area, Oliver says.

"Our growth strategy is to be acquisitive," Oliver says. "We saw the failed-bank platform as the most attractive avenue when the economy was in worse shape. Now with the slowdown in the number of failures, we are trying to find selective acquisitions that are good fill-ins for us from a strategic standpoint."

Despite the city's recent troubles, Atlanta remains an attractive market for banks, experts say. It is one of the largest metro areas in the U.S. and is seen as the economic driver for the Southeast. The population of Cherokee County, where Hamilton would expand with this deal, continues to grow, Oliver says.

However, Atlanta is full of megabanks and tiny banks and lacks strong midsize players. Healthier banks in the region have an opportunity to fill the void by building a $5 billion- to $10 billion-asset institution through acquisitions, Harralson says. That process might take three to five years, he cautions.

Typical deals could involve buyers that have at least $1 billion of assets and sellers in an asset range of $100 million to $500 million, experts say. There are currently about half a dozen discussions about potential deals, mostly in the Atlanta area, Dunlevie says. Of course these deals may never materialize, but talks between bank executives and investment bankers are likely to increase in coming quarters, he adds.

"No one is going to go crazy, but this is a measure of optimism," Dunlevie says. "People will explore these conversations and boards might decide that a combination is in the best interest of both parties."