WASHINGTON — Banks so far have been able to avoid much pain from the pandemic, but the decision by the Trump administration and congressional leaders to put coronavirus relief negotiations on the back burner is making some in the industry nervous.

The economic recovery has shown encouraging signs since widespread business closures and stay-at-home orders this past spring depressed revenues and led to a historic rise in unemployment.

But some of that turnaround may be attributed to the massive stimulus package Congress enacted in March. With relief coffers running dry, coronavirus cases still rising in many parts of the country without an available vaccine, and regional restrictions on business reopenings still in place, bankers are beginning to worry about the government shifting its priorities.

“The underlying economy in Main Street across America, I think, remains relatively strong. The million-dollar question is how long … restrictions on businesses and gatherings, how long it goes on," said Noah Wilcox, chairman of the Independent Community Bankers of America and CEO of the $278 million-asset Grand Rapids State Bank in Grand Rapids, Minn.

President Trump tweeted on Oct. 6 that he was rejecting a $2.4 trillion stimulus plan offered by House Democrats and was encouraging Senate Majority Leader Mitch McConnell, R-Ky., to focus instead on confirming Judge Amy Coney Barrett to the Supreme Court.

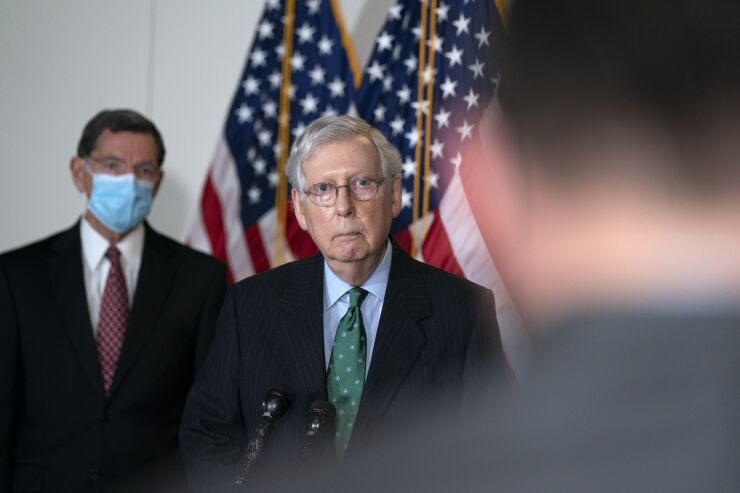

For his part, McConnell said Tuesday that the Senate would vote on a targeted aid plan later this month, which is much less ambitious than the aid package supported by Democrats. The Republican plan would amount to roughly $500 billion in aid, including additional funds for Paycheck Protection Program. But House Speaker Nancy Pelosi, D-Calif., has already rejected a $1.8 trillion stimulus proposal from the White House.

“When the full Senate returns on Oct. 19, our first order of business will be voting again on targeted relief for American workers, including new funding for the PPP," McConnell said Tuesday. "Unless Democrats block this aid for workers, we will have time to pass it before we proceed as planned to the pending Supreme Court nomination."

Bankers say that it is imperative that the White House and lawmakers get back to the negotiating table to approve additional economic stimulus as the pandemic continues to keep people out of work. Some in the industry want more federal aid available for businesses to maintain employment, similiar to the objective of the PPP.

"Every metric I look at says the sky is sunny and clear. But I don't believe that that's necessarily sustainable," said John Asbury, CEO of the $19.7 billion-asset Atlantic Union Bank in Richmond, Va. "My biggest fear is not that we have to wait a month. My biggest fear is we wait many months or, you know, we don't ever get it. And so I feel like there should be a motivation on the part of the parties to come to an agreement now and get it over with.”

Trump has said he would be willing to sign a standalone bill to send individuals $1,200 stimulus checks, but it is unclear whether House Democrats would ever support such a plan that did not include additional relief measures, especially just three weeks before the presidential election.

If Congress continues to stall on negotiations to provide fiscal stimulus, analysts say the fragility of the economy could result in a spike in loan defaults.

“Obviously, if there’s less money getting pumped into the economy and less money that is going to go to people who would be paying back loans or rents or whatever the case may be, it’s going to have an effect; it’s going to filter through different parts of the economy,” said Ian Katz, a director at Capital Alpha Partners. “So if you are someone who is making loans and you are hoping to get it paid back and the person who is paying you back doesn’t have the money, obviously that’s a problem.”

Still, bankers say the current economic situation is not an emergency.

Wilcox so far has not seen an uptick in borrowers defaulting on loans.

“I don’t think it is at that point, certainly not in the markets that I serve, but I am hearing that same thing anecdotally from bankers across the country,” Wilcox said. “In my case, I don’t have any mortgage delinquencies and I haven’t made any modifications on any mortgages.”

But consumer advocates agreed that if negotiations on a stimulus plan continue to stall, credit quality could take a hit.

Nikitra Bailey, executive vice president at the Center for Responsible Lending, said an extended delay on coronavirus stimulus would likely put borrowers at risk of default in the upcoming months.

“We know that a delay is likely going to produce more hardship and will force more people into defaulting on their existing bills, bills like their mortgage loans and other types of debt,” Bailey said.

At the beginning of the pandemic, regulators encouraged lenders to work with borrowers to make adjustments to loans or defer payments on loans if they had been negatively impacted by the pandemic. The

James Ballentine, executive vice president for political affairs and congressional relations at the American Bankers Association, said that part of the reason banks have been able to help keep the economy afloat is because of their strong capital position.

"Banks were well capitalized before the pandemic arrived and remain so today," Ballentine said. "They have dramatically increased provisions for loan losses to ensure they are ready for whatever lies ahead. Further credit loss provisioning will be dictated by the evolving economy, including the potential for Congress and the administration to agree on any additional pandemic response from the government."

But Jesse Van Tol, CEO of the National Community Reinvestment Coalition, said that he has heard from borrowers that lenders are beginning to request that their customers start repaying loans.

“I’ve seen … lenders starting to batten down the hatches and start to push for repayment as possible, maybe less flexibility or less of an open mind about flexibility,” Van Tol said. “I don’t know if that is being driven by a concern over credit losses. I think people know how bad this can get and creditors want to avoid being the ones caught on the short end of the stick.”

Asbury of Atlantic Union Bank said that if Congress ultimately decides to enact additional coronavirus stimulus, it should focus on helping businesses maintain employment.

“Without question, additional stimulus, particularly that which will help maintain employment, such as more funding for heavily impacted small businesses … would be a very good thing and a very helpful thing,” Asbury said. “What about an additional round of stimulus checks? I think that unquestionably that's helpful, but that doesn't necessarily provide any sort of sustainable benefit.”

He added that it would also be helpful for Congress to automatically forgive PPP loans of less than $150,000. The

“The industry has been very vocal that we support automatic forgiveness below $150,000,” Asbury said. “It's costing businesses real money to pull together the information they're going to need to pull together and an effort and time in order to apply and obtain forgiveness.”