The banking sector must do more to earn positive, unsolicited mentions by members of the public in conversation, according to a word-of-mouth survey due to be released this week.

People mention their bank 3.7 times a week, while they mention the news media and entertainment sectors nine times a week and food and dining more than seven times, according to the study, conducted by New Brunswick, N.J., consulting firm Keller Fay Group LLC.

Edward Keller, the chief executive officer of Keller Fay, said in an interview Friday that the data gauges how often a customer promotes a bank in conversation.

"There's a ho-hum attitude about banks," Mr. Keller said. "High awareness and high satisfaction - if it doesn't lead to advocacy - is a missed opportunity."

Keller Fay asked about 6,200 people to keep "conversation diaries" from August to November to monitor discussion topics. The study is the company's second of its kind and the first to include banks. Keller Fay said it has not decided whether the study will be conducted annually.

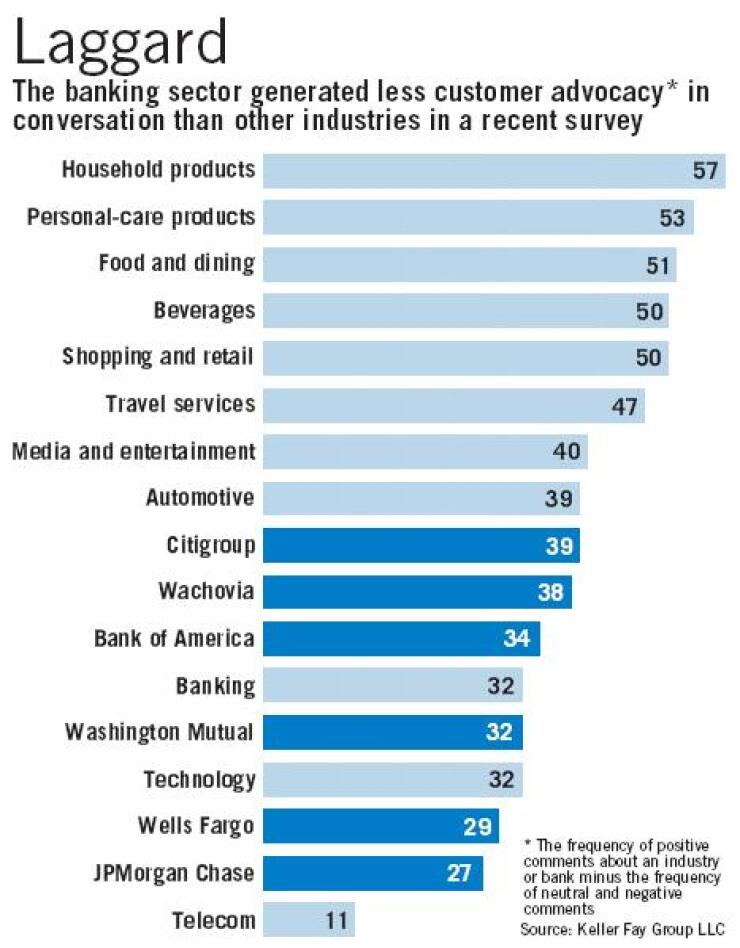

In assessing conversations on banking and other industries, Keller collected the percentage of positive comments and subtracted the percentage of negative or neutral ones to create an "advocacy" rating.

The telecommunications industry was the only group that had a lower advocacy rating than banks, the study found.

There was some good news for banks. The banking sector has gotten plenty of negative press on topics such as identity theft, but the study found that comments were negative in only 10% of conversations that mentioned banks. More than a third of the discussions about banks were either neutral or mixed, and more than half were positive.

Bankers said they are taking steps to increase brand recognition and customer advocacy.

Paul Kadin, the marketing director for Citigroup Inc.'s Citibank North America, said in an interview that the $1.88 trillion-asset New York company "certainly agrees" with the findings.

"Advocacy is a word we use as a key for customer satisfaction," Mr. Kadin said. "We pay a lot of attention to increasing the number of people who are most satisfied since they're the ones most likely to talk about their experience."

Monica Matherly, the director for Wachovia Corp.'s center of expertise, which operates under its corporate customer service excellence group, said the $707 billion-asset Charlotte company is "well aware that people don't talk about their banks" very frequently. "We're seen as very utilitarian. Banks historically haven't given customers many chances to talk about them unless they're complaining."

Citigroup, which was mentioned in 7% of conversations about banks, plans to attach the "Citi" brand to several businesses next quarter. Bank of America Corp., which was mentioned most frequently, or in 17% of bank conversations, launched an advertising campaign last month pitching the $1.46 trillion-asset Charlotte company as the "Bank of Opportunity."

Kenneth D. Lewis, B of A's chairman, president, and CEO, discussed the importance of name recognition at its investor conference Feb. 26. "It creates recognition of who we are, and it helps create better franchise value," he said. "We are now moving towards more directly telling potential customers what we can do for them."

The company did return calls seeking comment on the Keller Fay study.

Citi has installed kiosks in more than 1,000 branches over the past six months that let customers provide feedback, and it has recorded over 60,000 responses. "We're literally analyzing the words that people are using," Mr. Kadin said, and it is making changes based on the feedback, such as replacing "lick and stick" automated teller machine envelopes with self-stick ones.

Ms. Matherly said Wachovia, which was mentioned in 6% of bank conversations, is testing two things it will introduce to all branches next quarter. In June it will debut a system that has been tested in Dallas and Atlanta in which notices are sent to market leaders if a customer gives Wachovia low marks in a survey. The leader calls the customer to address the issue and "turn the matter into a positive experience."

Citi, Wachovia, JPMorgan Chase & Co., Wells Fargo & Co., and Washington Mutual Inc. were discussed in more than 5% of banking conversations in the study.

A Wells Fargo spokeswoman said executives were unavailable for comment. Brian Marchiony, a JPMorgan Chase spokesman, said, "Our top priority is providing excellent customer service, which ultimately leads to positive experiences and recommendations."