Synovus Financial is warning of potential challenges in its small-business loan portfolio as increasing costs and lingering supply-chain issues may cause borrowers to fall behind on their payments.

Many banks bulked up their small-business lending units during the COVID-19 pandemic as they came into contact with more prospects through the Paycheck Protection Program.

The $56.4 billion-asset Synovus had roughly $1.6 billion in small-business loans below $1 million on its books at the end of last year, according to its most recent call report. As more of its collection of government-backed PPP debt is forgiven, the Columbus, Georgia, company’s remaining loans “would be something we would watch,” Synovus Chief Credit Officer Bob Derrick said on a call with analysts Thursday.

“Over time, they don't have the leverage that their larger counterparts have relative to input cost and supplier negotiation,” Derrick said. “So we can certainly see some margin squeeze there.”

Of the $788.8 billion in PPP loans doled out since April 2020, about $718.9 billion has been forgiven, according to data from the Small Business Administration.

But even as the U.S. economy has emerged from the pandemic, rising prices and difficulty stocking inventory has delayed a full recovery for many small businesses.

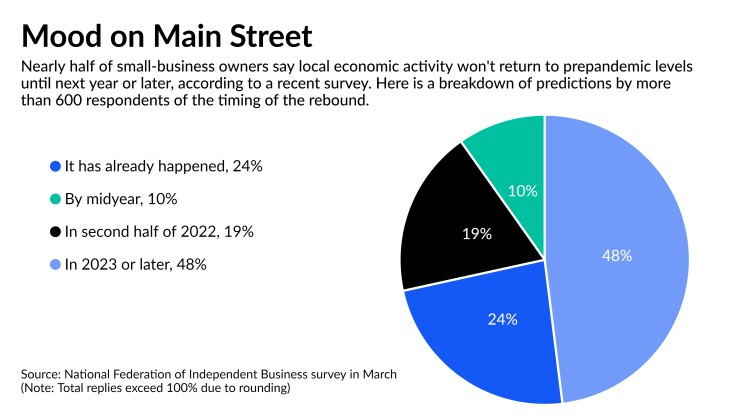

Nearly half of small-business owners surveyed by the National Federation of Independent Business in March said they think it will take until 2023 or later before their local community’s economy has recovered to prepandemic levels.

“The small-business recovery continues to be held back due to soaring inflation, ongoing supply-chain disruptions and staffing shortages,” Holly Wade, executive director of the trade group’s research center, said in a release last month announcing the survey results.

Synovus doesn’t yet see any potential problems reaching a level that would be material to its 2022 guidance for overall loan performance. The company has required a large portion of small-business borrowers to put up some physical collateral to guard against any potential losses, Derrick said.

“The good news for our portfolio is over half of that is secured by real estate of some type, which gives us a little comfort in the loss-given default scenario,” Derrick said.

Synovus reported $162.7 million in net income during the first quarter, down 9% from a year earlier. Net interest income for the first quarter was up 5% year over year to $392.2 million, while its $105 million in noninterest revenue was roughly flat.

The company reported 4% year-over-year loan growth and added $11.4 million in provision for potential loan losses, which Derrick said would run in line with the growing loan book.

Synovus forecast 6%-8% loan growth for the year after previously estimating a 4%-7% increase.