Second of two parts

Top executives at Vanguard Group expect robust growth in 2009 from its target-date and exchange-traded funds, but in this economy analysts are skeptical.

F. William McNabb, Vanguard's president and chief executive, said the true test of a fund company is how it invests during a downturn. In addition to investing in online technology — including Web seminars, streaming videos, and podcasts — to improve "basic communication" with customers, Mr. McNabb wants to invest in Vanguard's target-date fund and exchange-traded fund businesses.

He said that consolidation in the fund business and among 401(k) administrators will help Vanguard boost assets.

Some analysts, however, have serious doubts about fund companies' growth prospects in 2009.

"If this is a prolonged market problem, like in 1973 and 1974, nothing will be selling next year," said Geoffrey Bobroff, the president of Bobroff Consulting in East Greenwich, R.I. "Right now we as an industry have too much capacity, too many products, and not enough interest from investors for any fund company to be excited about next year."

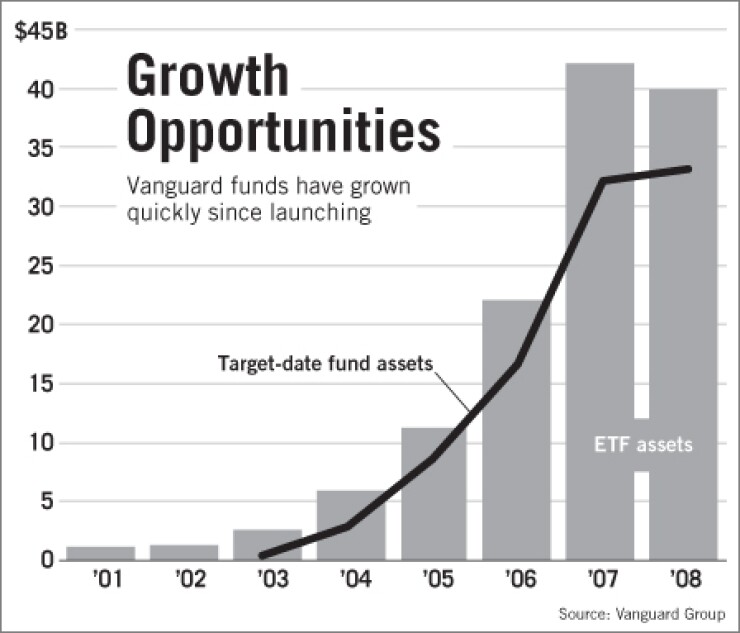

Mr. McNabb said that consolidation among 401(k) administrators and investment managers will help Vanguard's target-date funds add assets. The company launched its first six target-date funds in 2003 and followed with five more funds in 2006. It had $33 billion of assets under management in its target-date funds as of Oct. 31.

Chris D. McIsaac, a principal at Vanguard and the director of its institutional asset management unit, said the division has had its strongest year — $17 billion of net cash inflows as of Oct. 31 — because of its target-date funds, which have vaulted its assets by 3.1%.

Mr. McIsaac said that he expects assets to increase in 2009 as more employers use target-date funds as the default option in 401(k) plans.

According to a study Vanguard released in November, by the end of last year 96% of the automatic-enrollment plans it administered used target-date funds as the default options for new participants.

Growth will continue, Mr. McIsaac said, as employers begin to "re-enroll" 401(k) plan participants into target-date funds. Through re-enrollment, investors are automatically moved into target-date funds each year unless they opt to remain in their current retirement portfolio.

Mr. McIsaac said that this practice "is a bold stroke for plan sponsors to take, but it can be prudent for investors. … Most investors don't have a well-diversified retirement portfolio. They are either too conservative, with most of their holdings in money market funds, or taking too much risk, with their assets held in company stock."

Mr. Bobroff said that investors will not rush to invest in target-date funds.

"I think as an industry, we have not been as candid with investors about the heavy equity exposure in target-date funds, and thus investors weren't ready for the declines that these investments have felt in the past year," he said. "I just don't think these products are going to get the kind of growth Vanguard is hoping for."

According to the Investment Company Institute, net new cash flow into target-date funds reached a record $92 billion last year. Mr. McIsaac said many providers are offering target-date funds and this has "generated more interest in these products as more people get informed about them."

He said that Vanguard's target-date funds can stand out in a crowded field because they are less expensive, index-based, and conservatively managed (like its other products, he noted).

He said that the Malvern, Pa., company needs to advertise and market these products better.

"There are a lot of great things about Vanguard, and we have benefited from word-of-mouth advertising, but I wish we were more vocal and assertive in our views about target-date funds," he said. "We aren't a marketing powerhouse by any stretch of the imagination."

Vanguard does not plan to launch an advertising campaign in the immediate future to support the target-date funds, Mr. McIsaac said.

Mr. McNabb said he also expects growth from Vanguard's exchange-traded funds, which now number 38. It launched its first ETF five years ago.

"ETFs have allowed us to take the index story out to a new audience and they are embracing it," Mr. McNabb said. "We are delivering our ETFs to RIAs, banks, financial advisers and financial planners, and most of the other large players have targeted institutions with their ETFs. … ETFs are really taking hold and the index story is playing well. We are really just hitting the tip of the iceberg."

Martha Papariello, a Vanguard principal who runs its financial adviser services business and its ETF distribution, said that $22 billion of Vanguard's $75 billion in net cash inflows through November were from its ETFs.

Vanguard, which had $40 billion of ETF assets under management as of Nov. 30, is the third-largest ETF provider, trailing Barclays Global Investors and State Street Corp.

Vanguard said it had an 8% share of ETF assets in the industry as of Nov. 30, but Ms. Papariello said it had 17% of ETF net cash flow in the industry through November.

"It is hard for anyone to beat us on cost, and I think that message has won us a lot of customers," she said.

According to State Street, as of Nov. 30 there were 735 exchange-traded funds in the United States, with $477.4 billion of assets under management by 23 companies. Barclays had $229.5 billion of ETF assets under management in 177 funds and State Street had $141.4 billion in 80 funds.

Ms. Papariello said Vanguard has no interest in developing niche ETFs. "It can be a distraction to launch products just for the sake of launching products," she said. "You have to look past the surface with a lot of these companies that are launching ETFs. Oftentimes, it can be very hard for them to generate assets when they launch a bunch of niche products."

Mr. Bobroff is skeptical of companies that expect ETF growth next year. "If investors don't have an appetite for equity markets, why would they have an appetite for ETFs?" he asked. "I don't see why investors will invest in an ETF as a practical matter right now."

Ms. Papariello said the ETF market "is still in the late stages of its infancy" and "we'll see fewer new entrants as seed capital dries up, but there will still be some new entrants and there will be a slow roll-up of smaller competitors. It is a product sector that is developing."

Tim Buckley, the managing director of Vanguard's retail investor group, said Vanguard will try to improve its relationship with its retail customers in the new year and to continue its customer segmentation efforts. Vanguard currently segments customers by assets; it will begin segmenting by age to "more proactively reach out to client with the right products," Mr. Buckley said.

He said this could lead to more cross-selling and, ultimately, more assets. "We have to earn the right to cross-sell," he said. "We can't just cross-sell like this is McDonald's. Segmenting this way will help us understand their needs before we just talk to them about some product. We want to cross-sell where it is appropriate, but we will never try a hard sell. That just isn't our style."

Mr. Buckley said he think that assets held in income-oriented products, such as variable annuities, will expands as retirees begin to live off of their nest egg. "This is a bigger downturn than anyone expected, but it doesn't change our primary approach," he said. "We want to continue to improve what we do for our clients and continue to provide diversification and flawless execution."