When Andrew Vahrenkamp was looking for a prepaid debit card for his 10- and 13-year-old children to hold their allowance dollars, he couldn’t find what he was looking for at traditional banks. He ended up choosing a prepaid debit card from chore app BusyKid, which he liked for its interface that allowed his kids to check off their chores, the convenient way money could get from his checking account to their cards, a low annual fee and charitable and investing components.

“The days of teens going to the mall and buying stuff with cash are gone,” said Vahrenkamp, senior research analyst at Raddon, a research and analytics company. “They have ownership of this card and it helps them learn financial habits.”

BusyKid, with 250,000 users, is one of a growing crop of fintechs with cards and apps specifically designed for Gen Z. Unlike with some past attempts at this same concept, these newcomers are gaining traction: One, Greenlight, has nearly 2 million customers. Another, gohenry, has 1 million.

A look at what these fintechs are offering gives a glimpse of the kinds of products younger customers are going for (Generation Z generally refers to kids born in 1996 or later). Their strategies also offer clues as to what banks are missing when they target young customers, who can age with a traditional institution in a way they may not be able to with a more niche service.

Many traditional banks offer student or teen checking accounts and kids' savings accounts.

Apps and accounts such as Greenlight, gohenry, Step and an upcoming Junior account for U.S. customers from the challenger bank Revolut offer kids, tweens and teens such features as debit cards they can personalize (and their parents can oversee), fast money transfers, goal tracking and more.

“There is a real misunderstanding about how teenagers and preteens need to shop and spend that some of these fintechs are seeing and banks aren’t,” said Vahrenkamp. “At the moment we see almost no Gen Z interest in calling a tech company their primary financial institution. But the risk they could is pretty high.”

What Gen Z values

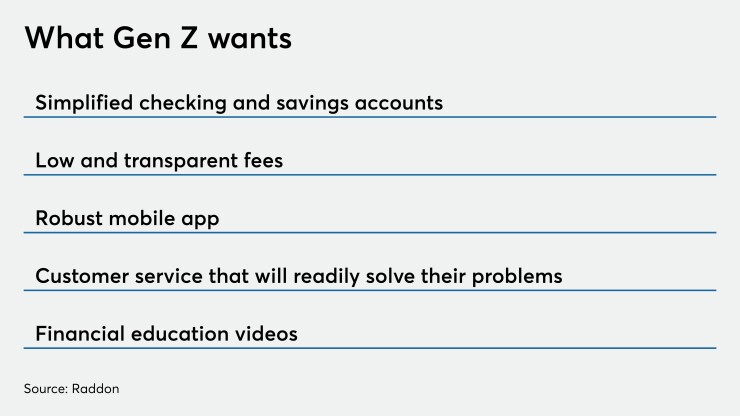

Vahrenkamp and Karen Kislin, strategic adviser at Raddon, list a number of things that Generation Z wants from banks, based on surveys they’ve done: simplified account offerings (perhaps a checking account that encourages good savings habits, such as the one offered by SoFi); low and transparent fees; a robust mobile app; and customer service that will readily solve their problems — because it’s easier than ever to switch banks if one is unhappy.

The importance of strong savings tools is echoed in observations by Carreon.

“Seeing their parents lose their jobs, watching older millennial siblings move home and the rise in higher education tuition and student debt has resulted in Generation Z having a more conservative view of finances,” she said

One more elusive feature is financial education through video tutorials. In an upcoming study, Raddon found that when asking whether consumers would bring more business to a financial institution that offered financial literacy, 63% of Gen Z respondents said yes, compared to 42% of the general population.

“My favorite advice to give financial institutions is to find their most Gen Z-looking employee, and they are now their financial literacy spokesperson for short video clips they will be posting on YouTube and Instagram,” said Kislin.

Few, if any, institutions are taking her up on this tactic.

But Greenlight, a debit card and app, and gohenry, a similar service that originated in the United Kingdom, are making a push to foster responsible habits among young customers in other ways.

Greenlight, which raised $54 million in Series B funding from JPMorgan Chase, Wells Fargo and other investors in 2019, began in 2017 as a spending account and debit card with parental spending controls. It has evolved to let kids track their savings goals, donate money to charity through an embedded Give account, manage their chores and more. Parents can pay interest on their children’s savings, and the average rate is 18%, according to the company.

In the third quarter, Greenlight plans to debut an investing component where kids can research and buy exchange-traded funds and stocks (including fractional shares) with their parents’ help.

There is no minimum or maximum age to use Greenlight, but the average age of nonparent users is 12, said Tim Sheehan, the CEO and a co-founder of Greenlight.

Although customers can find many of these features elsewhere, Sheehan said that Greenlight sets itself apart by offering a holistic view of personal finances. “There are chore apps and allowance apps. You can go to a bank and get a checking account, and open an investment account for kids,” he said. “Greenlight is all of those things.”

Young customers have been amassing more funds during the coronavirus crisis, Sheehan said. “You can see how the pandemic would affect spending, because kids do a lot of in-person transactions, but the money has been going towards savings, not just sitting in their spending account,” he said. He found that kids’ average savings account balances increased by 31% during the pandemic compared to prior to the pandemic.

“Wells Fargo invested in Greenlight because we understand the significance of helping children build healthy financial habits early on that can lead to sound money management skills in the future,” Tom Richardson, head of strategic investments for Wells Fargo Strategic Capital, said in an email. “The shift to digital money platforms is undeniably relevant in our current environment, and we recognize the increasing need for these solutions that enable parents to set their kids up for financial independence and success.”

Like Greenlight, gohenry lets parents transfer allowance money onto its debit card and add tasks for their kids to complete. Parents will get notified about transactions and can set controls over where their children spend money and how much they spend.

The service launched in 2012 and came to the U.S. in 2018. It counts one million customers around the world, targeting families with kids between the ages of 6 and 18.

Dean Brauer, co-founder and executive vice president (U.S.) of gohenry, noted that Gen Z members interact with money differently than their parents do.

“How do you teach kids to be competent with managing a budget when cash is not tangibly passing through their hands?” Brauer said. “Gen Z might be the first cashless generation, and with COVID we’re seeing an acceleration of a cashless society.”

Another thing gohenry has in common with Greenlight is a heavy focus on digitizing allowance. “Customers always tell us they want to get into an allowance regime because they believe that’s a big part of helping kids manage a budget, but with cash they often forget or don’t have the right change,” Brauer said. “When you make it automatic, it builds that consistency.”

The company is also working on more features to cater to older teens for later this year, such as account and routing numbers and peer-to-peer transfers.

Both Greenlight and gohenry charge monthly subscription fees: $4.99 a month for Greenlight (with debit cards for up to five kids) and $3.99 a month per child for gohenry.

“We didn’t want to be in a position where we were trying to push kids to spend for interchange revenue,” Sheehan said.

Kids can also customize their debit cards with a design or photograph — a gimmick, but a gimmick that works, according to Vahrenkamp.

“You’d be amazed at what people care about when it comes to a card,” said Vahrenkamp. From his own experience, he estimates that fancier or heavier cards can increase transaction volume by 10% over previous transactions with standard cards.

Features are sparser with Step, a mobile bank account that focuses on customers ages 13 to 18 and quietly launched this year. Over half a million users have downloaded the app and signed up.

The major feature that Step has rolled out so far is a peer-to-peer money transfer service.

While such services are plentiful, “none are tailored to the under-18 market,” said CJ MacDonald, CEO and founder of Step. “Venmo is great, but you still need an underlying bank account.”

Unlike the others, Step does not charge monthly fees. The company expects to make money from interchange fees along with other, yet-to-be-announced revenue streams.

For now, none of the apps have a firm plan (and they’re not necessarily searching for one) to hold on to customers in their 20s, 30s and beyond. But when it comes to competing with banks, that may not matter.

“We’re starting to see that with millennials, there is less and less of a traditional primary financial institution and they are starting to spread out across a multitude of not just traditional banks, but fintechs as well,” Kislin said. “In the midterm, the real risk is seeing more disruption of Gen Z spreading out amongst competitors.”