A painful setback.

That is how Florida bankers like Jay Fant described the worsening of fourth-quarter credit-quality measures in a widely read report on the state's banks. Those measures had been improving for nearly a year.

Reality is setting in that the state that was among the first to crash during the real estate crisis is likely to be the last to escape.

"Florida is going to be the caboose on the recovery," said Fant, the chairman and chief executive of the $440 million-asset First Guaranty Bank and Trust Co. in Jacksonville. "It's just a painful, painful time."

As credit quality brightens elsewhere, states such as Florida and Georgia keep taking major hits.

Florida still lacks the higher real estate values and lower unemployment necessary to attract investors and real estate buyers.

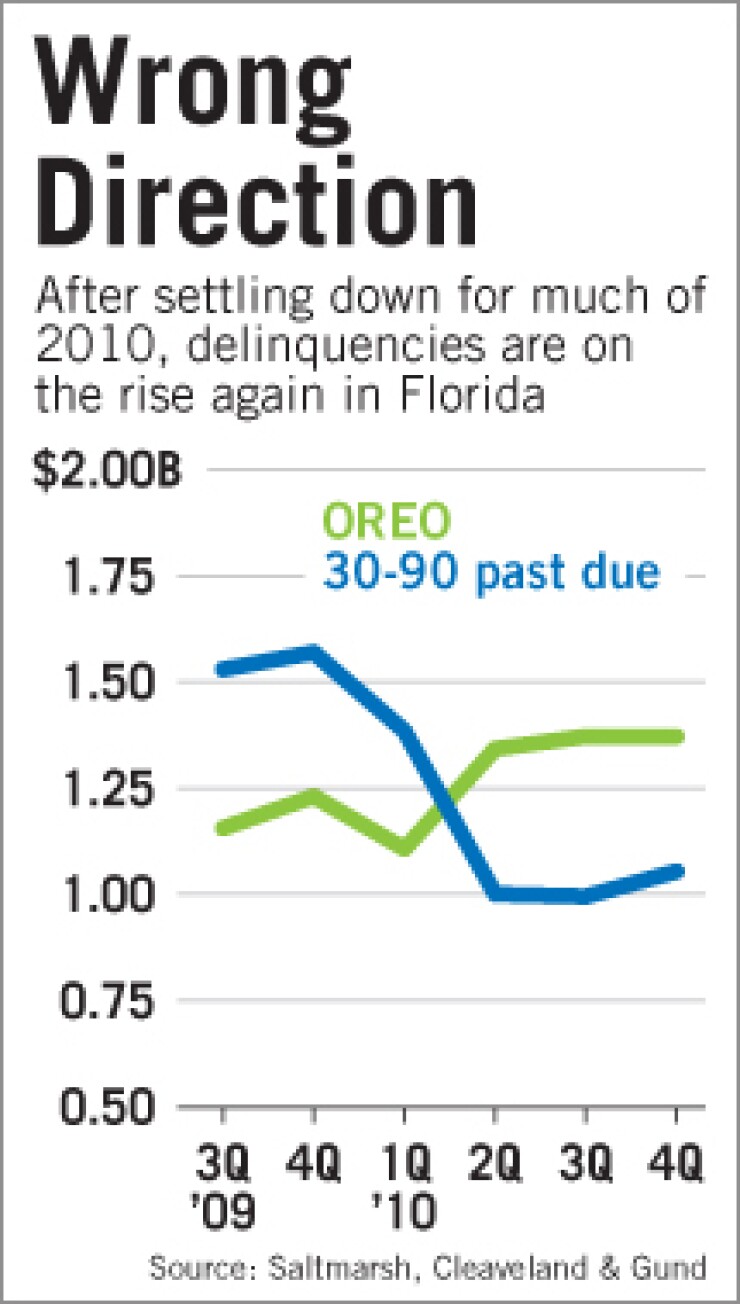

Delinquent loans in the state rose nearly 6% in the fourth quarter from a quarter earlier. That ended three straight quarters of declines, according to research by a Florida accounting firm.

Though a single quarter does not make a trend, the relapse reinforced concerns that a second dip could be on the horizon.

"Even if everything stopped today and there were no more new bad loans, it is still going to take a while to clean the existing ones up," said Bill Massey, an accountant at Saltmarsh, Cleaveland and Gund, which prepared the report.

Total nonaccruing loans among Florida banks fell each quarter last year, including an impressive 20% dip in early 2010, according to the Pensacola, Fla., accounting firm.

Such improvement came nearly to a halt by yearend, as nonaccruals fell only 0.46% in the fourth quarter, to $4 billion, and loans 30 to 90 days past due rose 5.9%, to $1.05 billion.

Massey said improvements from earlier in the year were slightly skewed because of bank failures and Synovus Financial Corp.'s consolidation of charters in the state.

"We are continuing to look for a period where the numbers start to improve one quarter to the next, but we haven't seen it yet" because of the fourth-quarter setback, he said.

The results shocked bankers like Eddy Arriola, the chairman of the $172 million-asset Union Credit Bank, who said delinquencies have drastically improved and inflow of nonperforming loans has slowed. Arriola was part of a group that took over the Miami bank early last year, injecting fresh capital before cleaning the bank up.

It is a different story for many other Florida bankers who have been unable to secure capital or sell bad loans at decent price. One thing that has changed from a year ago, Fant said, is that banks are starting to sell fractions of foreclosed real estate that are no longer at "laughable discounts." He said the typical discount is 25% to 40%. "But there's no volume to it," he said. "It's just pieces."

Interested buyers continue to be what Fant calls "bottom fishers," looking to buy at a 70% discount to book value. "A bank can't afford that," he said. "It's too hard for investors who say, 'Gosh, I can't put money into this bank, because I can't get a rate of return on that.' "

This paradox has kept more open-bank deals from coming to fruition in the hardest-hit states known for having the most attractive banking markets while the wave of consolidation is picking up elsewhere. Unfortunately, they are also the bankers who need the buyers and equity partners the most to survive.

"Until real estate really starts to move, there are not going to be any improvements" in credit quality, Massey said.

There have yet to be indicators of real, consistent improvement. The latest Case-Shiller index, released Tuesday, showed that in December, housing prices fell to more than four-year lows in 11 of nation's 20 major metropolitan markets, including Miami and Tampa. Tampa's housing prices fell 2.6% while Miami was down 0.5% from November.

Despite lingering issues, Paula Johannsen, a managing director at Carson Medlin in Florida, said it is likely that most of the delinquent loans have been identified either by bank management or regulators. Carson Medlin releases a quarterly asset-quality report, which showed nonperforming assets were at a median of 6.3% of total assets in Florida.

Most observers agreed that any changes in nonperforming asset levels this year would be minimal until valuations and unemployment improve meaningfully.

"Is OREO going to go down 50% this year? I doubt it. But will we move some properties? Yes," Fant said. "I just don't think we'll get to the end of the year and say, 'I'm glad that's over.' "