Want unlimited access to top ideas and insights?

As

It’s easy to see why. Fintech lenders have swooped into the market, offering low-cost options to consolidate credit card debt. Entrance costs are also relatively low, given the simplicity of servicing loans with fixed monthly payments and the fact that personal loan portfolios can easily be sold.

But as more banks begin offering personal loans

What makes personal loans different than other business lines is that consumer credit scores typically are high at the time of origination, but then tend to drift downward in the subsequent months, Roger Hochschild, Discover’s president and CEO, said in an interview after the company’s quarterly conference call late Thursday.

“It is very tricky to underwrite, because you get one decision,” Hochschild said when asked what he has learned about consumer behavior from Discover's push into personal loans. “It’s not like a card, where you have ongoing data and you monitor it. You decide who to give a line increase to and who you don’t."

Customers tend see their credit scores jump after they refinance high-cost credit debt with a personal loan, and then decline after they load up again on new credit card debt.

“You get a short-term pop, and then it drifts back,” Hochschild said.

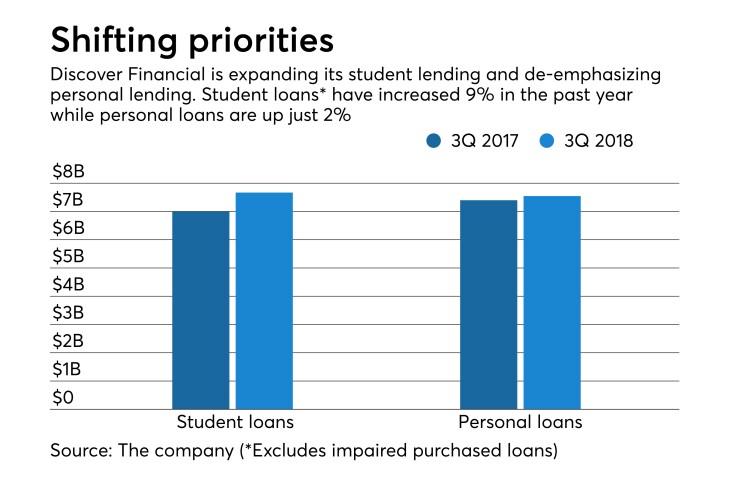

During the third quarter, Discover’s personal loan portfolio rose 2% from a year earlier to $7.5 billion. Meanwhile, the net principle charge-off rate on the portfolio climbed 90 basis points to 4.09%.

The Riverwoods, Ill., company expects personal loan charge-offs to jump by an additional 60 basis points during the fourth quarter compared to Sept. 30 and reach an average rate of 5% for 2019.

Discover officials emphasized that their more cautious strategy contributed to the sharp increase in charge-offs. As the company slows down originations and tightens underwriting, problem loans become a larger portion of the overall portfolio.

“Those loans that we booked do need to season, so even once we change our underwriting criteria, losses will drift up,” Hochschild said.

Reflecting on the broader personal lending market, Hochschild said most banks have entered the business at a time when interest rates are at a record low, and consumer credit quality is mostly strong. But as rates rise and consumers take on more debt, underwriting unsecured personal loans has become more difficult.

“I think you’re seeing it become very competitive and much more complex,” Hochschild said.

The credit quality worries are coinciding with the start of Hochschild's tenure as head of Discover; he replaced longtime CEO David Nelms earlier this month.

Hochschild emphasized during the call that, as one of Nelms’ longtime deputies, he has no plans to change the $105.8 billion-asset company’s strategic direction.

Asked during the interview where he sees the best opportunity for organic growth, he pointed to the company’s direct-banking business, which recently launched a

“I would point to the noncard part of the business,” he said. “I think even though we’re the second-largest student lender, there are still many people that don’t even know we’re in that business.”

Private student loans (excluding impaired loans it purchased) rose 9% during the quarter to $7.7 billion. Discover, of course, is primarily a credit card issuer, with cards accounting for approximately

Additionally, Hochschild said he is also exploring potential payments-related partnerships with technology companies in Silicon Valley, whose names he declined to name.

Like

Discover does not break out its tech spending in its quarterly financial reports, but overall expenses rose 7% during the third quarter to just over $1 billion. Profits, meanwhile, climbed 20%.

“I think that banks that don’t keep up in terms of investing in machine learning and migrating to the cloud will have a cost structure that’s fundamentally uncompetitive in a couple of years,” Hochschild said.