Andrew Samuel was very busy as Sunshine Bancorp neared an important anniversary.

In July the Plant City, Fla., company completed its third year since its mutual-to-stock conversion. That is a big milestone for any converted mutual, which must wait three years before it can be sold.

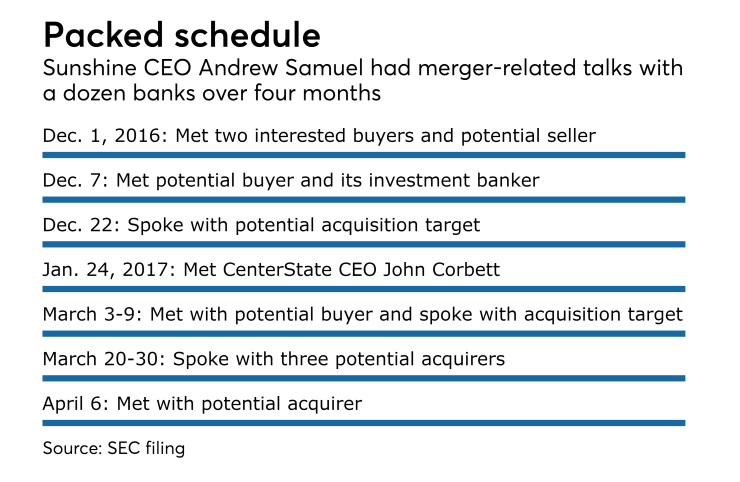

Samuel, Sunshine’s president and CEO, had merger-related talks with at least a dozen other bank executives between December and April. Three of those banks were potential acquisition targets, and nine of the conversations were with banks interested in buying the $956 million-asset Sunshine, including CenterState Banks in Winter Haven, Fla.

In each case, Samuel had to warn potential buyers that he wasn’t in a position to entertain offers since Sunshine had not yet passed the three-year limit.

Still, those preliminary conversations helped expedite Sunshine’s

Samuel, who

While Sunshine was not yet ready to sell, its board had already discussed potential merger partners with investment bankers a few months before Samuel’s meetings took place, the filing said. Samuel also received regular updates on Florida’s M&A market from firms that specialized in helping smaller institutions pursue mergers.

Sunshine’s first contact with its eventual buyer took place on Jan. 24 when Samuel met with John Corbett, CenterState’s president and CEO, and Stephen Young, the company’s chief operating officer. The executives discussed CenterState’s acquisition history and growth opportunities, along with industry challenges. No offers were made.

In mid-February, Corbett met with a representative of CenterState’s correspondent banking division, which accounts for about 8% of the company’s assets and a quarter of its 2016 net income. Sunshine is a customer of that division. The discussion allowed Samuel to learn more about the business, the filing said.

Samuel had more meetings with CenterState executives, while simultaneously discussing M&A with other potential buyers and sellers. While he couldn’t address a sale price, Samuel was able to talk about his company’s financial performance, stock price and potential cost savings with potential suitors.

Sunshine’s investment bank also kept in touch with several institutions to gauge their interest in a deal as the third anniversary neared. A number of the institutions eventually indicated that they could not offer a price high enough to make a deal work, largely due to significant appreciation in Sunshine’s stock price.

CenterState, however, quickly submitted a written nonbinding offer when the anniversary passed, proposing an all-stock deal that valued Sunshine at $21.58 to $22.08 a share.

During a July 17 meeting of Sunshine’s board, its investment bank reiterated that most potential acquirers were unwilling to submit an expression of interest.

“The reasons for not pursuing a transaction … included being preoccupied with other merger transactions, challenges involved in integrating previously acquired banks, having regulatory or compliance issues with banking regulators, having limited interest in Sunshine’s branch footprint, or an inability to make an offer within the price range” of CenterState’s offer, the filing said.

Samuel was authorized to move forward in talks with CenterState. By mid-July the companies were conducting due diligence.

CenterState was also in the early stages of negotiating to buy HCBF Holding in Fort Pierce, Fla. Its board authorized Corbett and his team to hold talks with HCBF and Sunshine, knowing that reaching deals with both would push the company above the $10 billion-asset threshold that would trigger caps on interchange fees and mandatory stress testing.

CenterState previously disclosed that crossing the regulatory threshold will reduce its annual profit by $6.5 million, with interchange caps beginning in the third quarter of 2019.

Coordination became critical at this stage.

Corbett told Samuel about his talks with HCBF on Aug. 3, noting that CenterState wanted to announce both deals simultaneously. A day later, the three banks executed confidentiality agreements on Aug. 4 that allowed HCBF and Sunshine to learn more about each other’s transactions, the filing said.

Sunshine’s board unanimously approved the company’s sale to CenterState on Aug. 11. CenterState’s directors unanimously voted for buying Sunshine and HCBF at a meeting the following day. The acquisitions were announced on Aug. 14.

The acquisitions “are the logical next step to fulfill our vision of becoming Florida's bank,” Corbett said in a press release announcing the deals, which are expected to close in the first quarter. CenterState agreed to pay $417 million in cash and stock for the $1.9 billion-asset HCBF.

Samuel, meanwhile, agreed to a two-year noncompete clause that starts whenever he leaves CenterState and bars him from being associated with a competing business that has operations within 35 miles of an existing Sunshine branch. CenterState’s filing estimated that Samuel’s compensation tied to the sale will total $14.1 million, including $5.4 million in cash and pension-related benefits valued at $7.6 million.