Expect a lot more brackets on either side of banks' net income numbers.

In its annual review of the banking sector, Moody's Investors Service projected Tuesday that most U.S. banks will be unprofitable through 2010 as they book a whopping $470 billion in losses. The ratings agency said that the 69 financial institutions it covers are expected to set aside $600 billion in loss provisions during the next two years as they lose more money on bad commercial and consumer loans and residential mortgages.

"There is a substantial amount of chargeoffs to come. We're only starting in the cleanup that's required," said Craig A. Emrick, a Moody's vice president and senior credit officer. "It's more bad news for banks."

Moody's is maintaining its negative outlook on banks, after reducing its outlook to negative, from stable, a year ago.

Emrick said that, essentially, things are going to get worse before they get better for U.S. banks, which charged off about $90 billion in loans last year.

The ratings agency said in its "Banking System Outlook" study conducted last month that, "with a small number of exceptions, almost all U.S.-rated banks would be unprofitable in 2010."

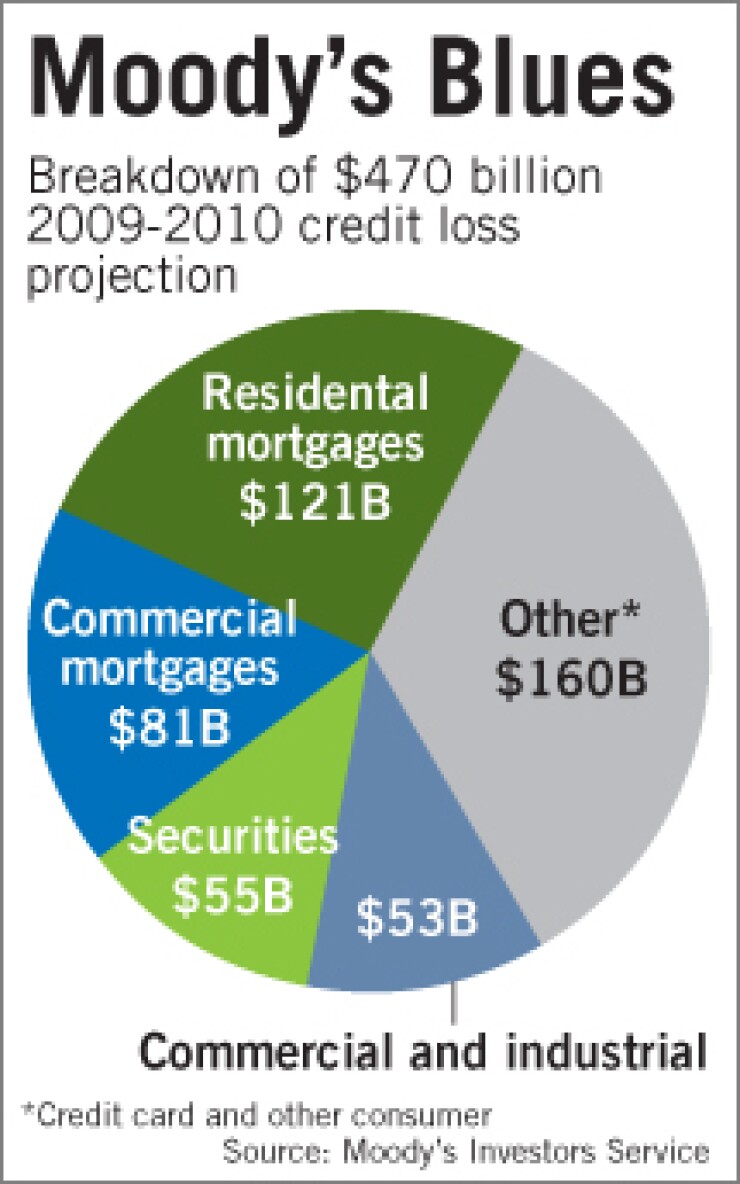

Of the $470 billion in losses it expects, 34% will be in credit cards and consumer loans, 26% in residential mortgages, 17% in commercial mortgages, 12% in securities and 11% in commercial and industrial loans, Moody's said.

It expects bank credit ratings to remain depressed after falling steeply in the last 12 months as the housing and credit crisis deepened. Moody's has downgraded 35 banks — just more than half its coverage universe — in the last year, including such institutions as Wells Fargo & Co. and Bank of America Corp. The median Moody's stand-alone debt rating on banks fell a full notch, to A2 from A1, in the last year, which Emrick described as a "significant" decline.

Moody's rates nine banks as non-investment-grade. It said it does not expect that number to rise should losses meet its projections because its current ratings are based on an assumption that banks will lose $470 billion in these two years, Emrick said. The number of non-investment-grade banks could more than double, however, should losses reach $640 billion in a worst-case scenario Moody's has modeled on the prospect that the global economy nosedives from here.

Depressed ratings could be a heavy drag on banks as they try to climb out of the recession; lower ratings make it more expensive for them to borrow, raise capital and line up acquisition financing, if they aim to do deals, Emrick said. Lower ratings also hurt a bank competitively as businesses become more likely to shy away from saving their money in a lower-rated institution, he said.

Moody's does its annual banking sector review every May. In last year's report, Moody's said its median bank rating could fall a full notch under its most severe forecast.

"The worst economic scenario anticipated at that time was a global recession," Emrick said. "And that's what happened."