-

The decision by private-equity backers of Sterling Financial to push for a sale of the entire Spokane company, rather than to merely unload their shares, surprised investors. It also showed that investor exits are a complex business which often defy expectations.

September 5 -

Other banks say small acquisitions take too much work, but Sterling Financial says a good, small deal is better than a risky, big one.

May 6 -

Ray Davis, the CEO of Umpqua Holdings, bounces back from his failed attempt to buy American Perspective in central California with a $25 million agreement for Circle Bank in Northern California.

August 30

Banking's midsection is expanding.

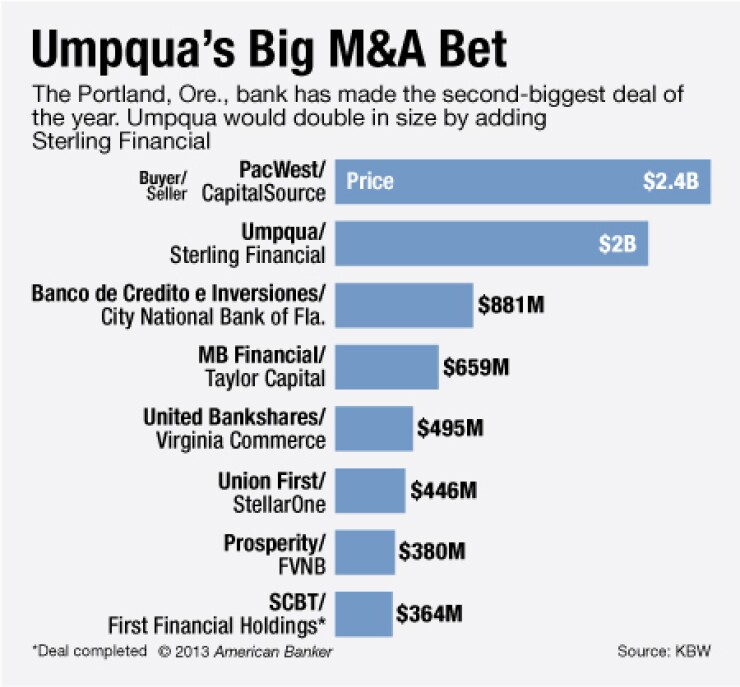

Umpqua Holdings' (UMPQ) $2 billion deal to buy Sterling Financial (STSA) in Spokane, Wash., would create a $22 billion-asset bank and the first truly regional player in the Pacific Northwest in decades. It is another bullet point on the list of banks doubling up and looking to cross the $20 billion-asset threshold, observers said.

"This is how M&A works in the post-financial-crisis world. You always had this progression of fish of different sizes, but now the bigger banks are reluctant to buy," says Frederick Cannon, director of research at Keefe, Bruyette & Woods. Instead, banks of similar sizes are paring up, and it should "create these $20 billion- to $40 billion-asset regionals who will be tough competitors."

The group includes FirstMerit's (FMER)

Ray Davis, the chief executive of Umpqua ($11.4 billion of assets), and Greg Seibly, the CEO of Sterling ($9.9 billion of assets), say deals between banks of similar size make sense today.

"We come out of the worst financial crisis of most of our careers, and people are realizing that to compete, size is important," Davis said in an interview. He will remain at the helm of the combined company.

"We saw an opportunity to do something unique in the Pacific Northwest," says Seibly, who is expected to become co-president of Umpqua Bank following the completion of the deal. "Regulatory costs are going up, fixed operations are going up. At $22 billion, we can be more efficient than either of us could be on our own."

The agreement, announced late Wednesday, is expected to close in the first half of next year.

The market reaction was mixed. Umpqua's shares fell 4.83% to $16.14 on Thursday, while Sterling's rose nearly 7% to $28.40.

For Umpqua and Sterling, the combination brings together two experienced acquirers. Since 2000, Umpqua has completed a dozen transactions, while Sterling has completed nine.

However, the deals have been small in the last several years. Pat Rusnak, the chief financial officer of Sterling, told American Banker in May that his company was

Since its $730 million recapitalization led by the private-equity firms Warburg Pincus and Thomas H. Lee Partners in 2010, Sterling has been focused on diversifying away from its roots as a thrift, and reorienting its branch network to urban markets along the West Coast. Seibly says pairing up with Umpqua speeds the process along.

"Our strategic imperatives included us talking about $20 billion and growing along the Interstate-5 corridor," Seibly says. "Think about how many $200 million to $500 million bank deals it would have taken to accomplish what we did yesterday. It would have been way more work cumulatively."

It is also a faster way to spend money raised for dealmaking. One of the driving forces in M&A currently is the

"There is an obligation to employ excess capital," Davis says. "You raise it, you have to do something with it. I don't know if one way is quicker than another - it depends on how aggressive you are. But a lot of analysts will tell you it is just as hard to integrate a small bank as it is a large one."

A big surprise was the deal's small cash component. It was a foregone conclusion among observers that

"There is hardly any cash in the deal," says Brett Rabatin, an analyst at Sterne Agee. "If you're private equity, why is this deal the deal you want? You are still very much in, you just switched horses."

Cannon said that the small cash portion likely caught the attention of the industry on Thursday.

"That was the surprise of the deal. PE is taking stock? Wow," Cannon says.