WASHINGTON — The industry has eagerly awaited revisions to the Volcker Rule, but so far regulators' proposal to

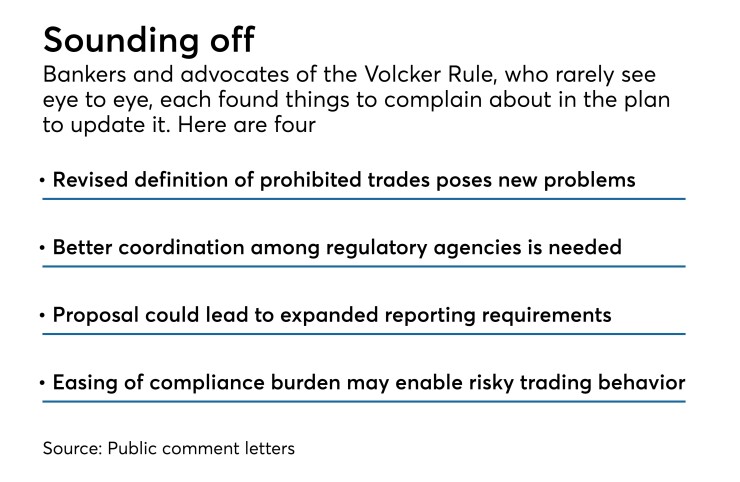

Bankers and industry representatives argue in comments letters that a

"We appreciate and support the ... goal of simplifying compliance" but "we are concerned that aspects of the proposal would add new complexity and compliance burdens that do not have a commensurate policy benefit, which would lead to unnecessary impairment of financial intermediation," wrote Kevin Fromer, the president and CEO of the Financial Services Forum, in a comment letter to the regulators.

The focus of industry criticism is a proposed alternative to how regulators identify short-term trades banned by the rule. Under the current regulation, positions held for less than 60 days are presumed to be part of a bank's "trading account" and are therefore prohibited. Yet banks can attempt to rebut that determination.

But the regulators' definition for short-term intent has been seen as unwieldy, leading them to propose replacing it with a new category that applies the ban to accounts where trading instruments are recorded at fair value.

However, commenters said the so-called "accounting prong" would only exacerbate the problem.

"The Accounting Prong would expand the 'trading account' well beyond what is contemplated by the statute or established in the Final Rule," wrote Gregg Rozansky, senior vice president and senior associate general counsel for the Bank Policy Institute.

"It would also import accounting standards that have no relation to the Volcker Rule's objectives and are developed by an organization that has no bank regulatory focus, and has discretion to change those standards at any time without needing to consider how the changes could affect the Volcker Rule's definition of 'trading account.'"

Yet on the other side, investor and consumer advocates — who had hailed the ban, first proposed by former Federal Reserve Board Chairman Paul Volcker, when it was added to the Dodd-Frank Act — as well as some Democratic lawmakers see the effort to ease banks' compliance burden as a capitulation.

“The New Volcker Rule proposal … is premised on an overly optimistic view of the compliance culture and risk management incentives of banking entities," wrote Dennis Kelleher, president and CEO of Better Markets, and Joseph Cisewski, special derivatives consultant and special counsel for the group. They added that the proposed plan "impedes effective supervision and enforcement of… the Final Volcker Rule, and is based on unsupported assertions of banking entities subject to the trading prohibitions and restrictions.”

Overall, just under 60 comment letters were submitted to the five agencies undertaking the revamp: the Fed, Federal Deposit Insurance Corp., Office of the Comptroller of the Currency, Commodity Futures Trading Commission and Securities and Exchange Commission.

Large banks' objections to the proposal were first reported earlier this year by the Wall Street Journal, with the accounting prong raising particular concern.

Fromer said the new method for determining prohibited trades would cancel out more positions than those currently under the rule.

“The accounting prong would go far beyond a back-stop role and would cover a significantly broader range of trading activities and assets than the current short-term intent prong or, for that matter, the market risk capital prong,” he wrote.

The American Bankers Association recommended that the accounting prong be abandoned and that the regulators instead focus on revising the current "rebuttable presumption." The agencies could clarify that trades held for longer than 60 days are allowed, exempt instruments that mature within the 60-day window and refine the process for rebutting a regulator's finding that a certain position is banned, the ABA said.

“The impact [of the proposal] on regional and midsize banks is especially pronounced: adding the accounting prong could sextuple the proportion of these institutions’ assets currently subject to the Volcker Rule,” wrote Timothy Keehan, vice president and senior counsel for ABA, in the group’s comment letter.

Hal Scott, John Thornton and R. Glenn Hubbard of the Committee on Capital Markets Regulation agreed that “the accounting test would make the Volcker Rule more, not less, burdensome.”

But despite the industry's concerns about the accounting prong and other aspects of the proposal, the strongest criticism of the effort to revamp the Volcker Rule has come from those who were most in favor of the ban when it became law.

"Instead of weakening the Volcker Rule’s implementation, regulators should enhance its supervision and enforcement," wrote Sheila Bair, former chairman of the FDIC, and Gaurav Vasisht, senior vice president and director for financial regulation at Volcker Alliance. "Recent news reports highlight instances of banks making enormous profits and suffering outsized losses from trading activities, apparently without much scrutiny from regulators."

Thirty-one Democratic senators, including Elizabeth Warren of Massachusetts and Sherrod Brown of Ohio, also submitted a letter expressing their disappointment with the proposal.

“Loosening the Volcker Rule for Wall Street banks opens the door for them to once again engage in risky trading behavior and put the financial stability of our economy at risk,” the letter said.

To be sure, financial institutions have lauded the effort by the agencies to simplify the trading ban, and they praised elements of the proposal. The proposal would reduce restrictions on the types of risk-mitigating activities exempted from the ban, particularly for institutions with limited trading operations.

In general, the industry has applauded the proposed tailoring of Volcker Rule requirements for companies with smaller trading desks.

"As trading activities in the United States are highly concentrated among the largest and most complex institutions, we believe that the approach described in the Proposal ... is an appropriate structural framework under which to tailor application of the Final Rule," wrote 10 regional and midsize banks in a joint letter.

But commenters urged the agencies to go further. The ABA's Keehan noted that "the proposal would reduce the documentation requirement for common hedging activity undertaken in the normal course of business" for banks with significant trading operations, but he said the ABA would like to see the requirement eliminated entirely.

Some organizations also expressed the need for better coordination across the agencies in implementation of the rule.

“The Volcker Rule requires the involvement of all five agencies, leading to interpretive and implementation uncertainties, coordination difficulties and substantial delay,” wrote Rozansky of the Bank Policy Institute.

This could be improved if protocols and processes were put in place to facilitate interagency coordination, such as entering into formal memoranda of understanding and information sharing agreements, suggested Fromer.

“Ultimately, administration of the Volcker Rule should be aligned with business-as-usual supervision and examination,” he wrote.

The proposal also seeks to refine the reporting metrics required under the rule by eliminating certain metrics but adding new ones. But industry representatives urged the agencies to avoid expanding banks' reporting responsibilities.

“The Proposal would significantly expand the number and scope of the metrics reporting requirements, negating the benefits of any simplifications in the compliance approach,” wrote Kenneth Bentsen, Jr., the president and CEO of the Securities Industry and Financial Markets Association.

Meanwhile, some commenters on the other side of the issue said there is no current evidence to justify tailoring of the reporting requirements.

“We are unaware of any metrics reporting, as the Agencies have elected to disclose no results,” wrote Public Citizen in its comment letter. “Therefore, it is impossible to weigh the impact of these changes. In the absence of such data, we cannot support these tailored metrics reporting proposals.”