One year into his tenure, the clock is ticking for Wells Fargo CEO Charlie Scharf, as frustrated investors itch for a comprehensive cost-reduction plan.

In January, Scharf described the San Francisco company as “extraordinarily inefficient.” Six months later, he argued that its expenses were at least $10 billion higher than they should be. So when Wells Fargo reported its third-quarter earnings on Wednesday, Wall Street was anticipating a detailed road map for cutting costs.

What Scharf provided instead was a promise to give an update in three months about shorter-term spending cuts, but no commitment about when the company will release a long-term plan for slashing its expenses.

“Wells really dialed back expectations,” said Kyle Sanders, an analyst who covers the company for Edward Jones. “The hopes for a credible plan keep getting pushed out further and further.”

On Wednesday, shares in Wells Fargo fell about 6% to $23.25, even as a broad index of bank stocks declined by 1.8%. Since Jan. 1, the company’s stock price is down by 56%.

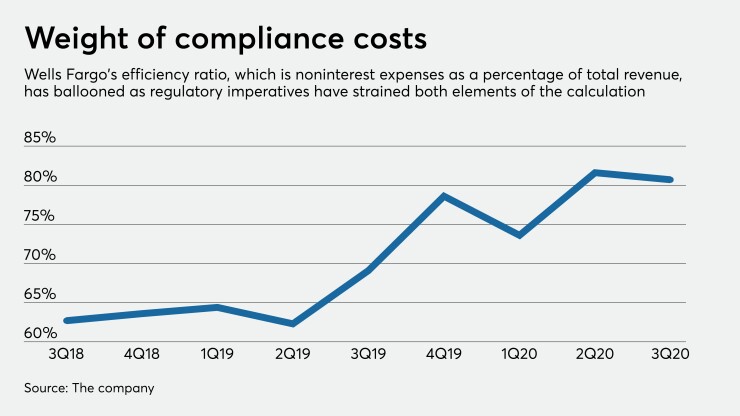

The prospect of dramatic cost reductions has loomed over Wells Fargo’s quarterly earnings reports since Scharf’s arrival, and the pressure to take action has increased over the last 12 months. During that time, noninterest expenses at Wells have increased from an already high 69.1% of total revenue to 80.7%.

To be sure, Wells Fargo has begun reducing the size of its roughly 260,000-person workforce. The company took a $718 million restructuring charge in the third quarter, predominantly related to severance payments. But those layoffs represent a small fraction of the long-term cost savings that investors want to see.

On Wednesday, the company identified a few areas where executives see the potential to cut costs, but it provided scant details. Those moves include downsizing the firm’s corporate real estate portfolio, making further reductions to its branch network, and simplifying products and services.

“As part of our simplification efforts, we will be reducing the number of different checking accounts we offer,” Scharf said during a call with analysts, “making it easier for both our customers and our bankers, while also reducing expenses associated with supporting legacy products.”

Scharf indicated that the economic impact of the COVID-19 pandemic and the company’s ongoing regulatory troubles have made it difficult to develop a comprehensive cost-savings plan.

“The regulatory work,” he said, “I can’t stress it enough, it’s a gating factor for us to be able to take advantage of all the opportunities that we have in the franchise.”

For nearly three years, Wells Fargo has been operating under an asset cap with the Federal Reserve Board, which has constrained the bank’s ability to generate revenue and also led to higher spending on regulatory compliance. On Wednesday Scharf again declined to speculate on when the Fed might lift the cap.

Wells Fargo’s earnings have also been crimped in recent years by the costs of compensating customers who were harmed by the bank’s misconduct in various realms, including auto lending, mortgage lending and deposit-taking.

In the third quarter, the $1.9 trillion-asset bank accrued another $961 million for customer remediation, which followed a similar charge of $765 million three months earlier.

During a call with reporters in July, Wells Chief Financial Officer John Shrewsberry said that he believed the worst was over with respect to remediation charges. But on Wednesday, Shrewsberry, who will be succeeded later this week as finance chief by Mike Santomassimo, acknowledged that his earlier assessment was wrong.

“We’ve had new leaders in the businesses, as well as in the remediation center,” he said. “And that group believed that they were substantially there at the end of the second quarter. And there was more to do. And it happened in the third quarter.”

“I’m sitting here today feeling similar to how I felt at the end of the second quarter,” Shrewsberry added. “It wouldn’t surprise me if people waited until the end of the next quarter to make sure that we lived up to that.”

Wells Fargo reported $2.04 billion in net income during the third quarter, which was down from earnings of $4.61 billion in the same period a year earlier, but an improvement over the $2.38 billion loss the company reported in the second quarter of this year.