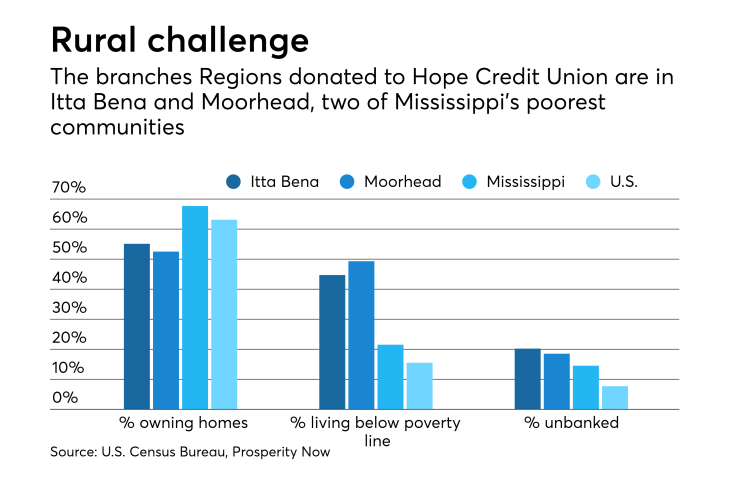

When Regions Financial decided to close its Moorhead and Itta Bena branches in Mississippi, it faced an uncomfortable truth: Doing so would leave two disproportionately poor and underserved communities without a financial institution of any kind.

But rather than pull up stakes and leave those towns to the mercy of payday lenders, the $123 billion-asset Regions donated the branches to the $247 million-asset Hope Credit Union, and kicked in another $500,000 to help Hope get up and running as fast as possible.

“If we would have just simply left, it would have left the community with no bank at all,” said Arthur DuCote, the Mississippi area president of Birmingham, Ala.-based Regions. “We of course did not want to do that, but partnering with [Hope] enables us to keep a bank in those communities.”

These aren’t the first branches Regions has donated to the credit union, either. Over the years, Regions has given eight branches to Jackson, Miss.-based Hope Credit Union, which is also certified as a community development financial institution.

The donation earned Regions a grant from the CDFI Fund’s Bank Enterprise Award program as well as Community Reinvestment Act credit.

Bill Bynum, the CEO of Hope Credit Union, estimates that roughly 40% of Hope’s members never had a bank account before joining Hope, and 85% of the credit union’s mortgages go to first-time home buyers.

Moorhead is in a census tract with a poverty rate of 48.4% and an unemployment rate of more than 24%. The Itta Bena branch is in a census tract with a 40.2% poverty rate and a 15% unemployment rate. Being present in those communities makes it easier for the credit union to work with local economic development organizations on job creation, while sending a strong message to residents that it wants their business.

“Having a presence in these communities helps tremendously,” Bynum said. “We have found that by sitting down with these individuals, by providing a solution to their financial needs, we’ve been able to help a lot of people climb out of debt traps, become first-time home buyers, and get into the economic mainstream.”

Access to banking services has long been a challenge for rural households and has become even more so as banks continue to close unprofitable branches and invest more resources in digital and mobile channels.

Of course, mobile and digital channels can be valuable tools for bank customers in rural areas, but advocates say that a physical presence in the community is important for reaching the unbanked and the underbanked in the first place. It helps bankers to better develop relationships with members of the community, and it gives them access to “soft information” to help evaluate potential borrowers who might not look so good on paper.

“When you think about places like the Delta that are persistently poor and underserved, people still have to go into those branches and you as a financial institution really have to go where the people live,” said Jessica Shappley, vice president of policy at the Hope Institute, Hope Credit Union’s policy arm. “To be sustainable in those communities, you have to physically be there and get to know who these members are.”

Other banks in the Mississippi Delta region have come up with their own creative solutions to meet the needs of low-income residents.

Often, their efforts focus on helping customers climb out of or avoid the debt traps frequently associated with payday lending.

The Bank of Anguilla offers small-dollar installment loans at an interest rate of around 14%. The bank charges no processing fees on loans under $1,000 and just a $50 processing fee for loans over that amount, said CEO Andy Anderson.

“We will make loans for any amount. We make a lot of loans of $250 or $300 for gas bills, electric bills, funeral clothes. We do all of that,” he said.

The $2.7 billion-asset BankPlus in Belzoni has earned numerous accolades over the past 10 years for its CreditPlus program, which is specifically targeted to unbanked and underbanked people who might otherwise turn to payday lenders.

People who register for the CreditPlus program must complete a three-hour financial literacy seminar to qualify for a $500 or $1,000 loan at 5% interest. Half of the loan is deposited into a savings account or CD, which is then returned to the customer once they’ve paid off the loan over the course of 12 or 24 months.

Of course, some of those customers take the course just to get the loan only to never make their first payment. But CEO William Ray said that around three-quarters of people who enroll in CreditPlus “are serious and sincere and committed to improving their credit.” He estimates that BankPlus currently has about 6,000 deposit accounts associated with people who joined for the CreditPlus program.

The course is usually offered at a neutral site, like a church or community center, which can be more inviting to people who might not be comfortable walking into a branch. Still, Ray said that branches remain vital to these communities.

“The bank being there to initially open that account and to have a person to talk to and help when there’s a question or a problem or a concern is hard to replace,” he said.