By creating a close tie between digital debit cards and the major third-party mobile wallets, Bank of America is doing something few banks are — and expecting a payoff in broader use of digital financial services and “top of wallet” spending.

BofA on Tuesday launched a digital debit card amid other changes to its mobile banking app, including the ability to pay in stores, in apps and online through mobile wallets such as Apple Pay, Samsung Pay and Google Pay.

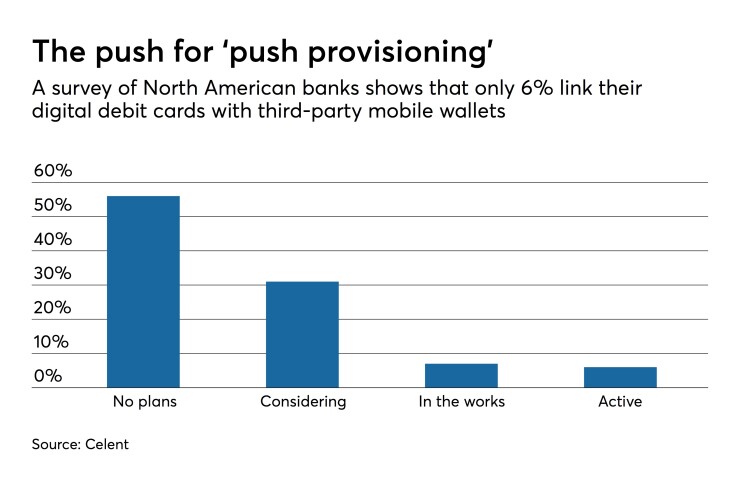

This may sound routine, but most banks aren’t doing this. In a Celent survey of North American financial institutions conducted early this year, only 6% of banks have this capability, called “push provisioning.”

BofA has insisted for years that it doesn't need to build its own mobile wallet. But it sees an early-mover advantage in faster card issuance and gaining an early foothold among consumers as the source for broader mobile payments.

“The advantage for us is consumers don’t have to wait for plastic to engage with us,” said Brent Reston, chief digital executive for retail banking at Bank of America. “They can use the mobile app immediately and hopefully we see some engagement and some top of wallet benefits as well.”

The move gives BofA’s customers the chance to use digital financial services right away, which encourages uptake and can benefit other Bank of America mobile plays like its involvement in the Zelle P2P app, which BofA operates along with other large banks as a rival to Venmo.

It typically takes five to seven days for debit cards tied to new accounts to be usable. By offering a digital version of a debit card, the bank hopes to have customers making payments immediately. The feature is available to any consumer online banking user, and BofA hopes to boost the digital portion of the 5 million cards it issues annually, Reston said.

“Consumers can now open a checking account in any channel, download the app and see their digital debit card,” Reston said, adding current consumers can also benefit from faster reissuance for lost cards. “They can add it to Apple Pay or another wallet as well as use it at [our] 16,000 ATMs to make deposits to withdraw cash.”

BofA's move is somewhat reminiscent of JPMorgan Chase's decision to provide a cash-back incentive in 2017 for consumers who use a mobile wallet (regardless of whether it's Chase Pay or a third-party app). The incentive was part of the rotating rewards for the Chase Freedom card, which changes its rewards lineup every quarter.

Third-party mobile wallets (sometimes called "the Pays") are overcoming several long standing obstacles to growth, driven by factors such as merchant adoption and consumer demands for speed in making payments and accessing accounts.

Apple Pay has made progress in winning over holdout merchants in the past year, and is set to launch Apple Card in partnership with Goldman Sachs as an alternative to traditional banks and fintechs.

As the Pays have become popular, there has been some move to ease user experiences for consumers that use those wallet apps. Google and PayPal, for example, just expanded their collaboration to include PayPal integration for online merchants that accept Google Pay, removing navigation for consumers who won’t have to sign in to PayPal when using it inside Google Pay.

But given the still-low penetration of mobile wallets — less than 10% of retail payments in most global markets — banks are not yet quickly adopting push provisioning.

“Being able to issue a card-based token directly into a digital wallet such as Apple Pay can be very handy if the card is lost or stolen, so that the customer can continue to transact while waiting for the card to arrive,” said Zil Bareisis, a senior analyst at Celent. “It also further helps with fraud, as the card is added to the wallet from within the issuer’s secure mobile app. Finally, it can help create new digital payments products fostering innovation. However it's not something that's widespread among banks yet."

While Reston mentioned his wish to push BofA’s cards to the top of consumer’s wallets, the strategy for now is more about boosting overall card and mobile usage than jockeying for position on third-party apps. Apple, for example, maintains most control over the position of cards in its mobile wallet. Reston said attracting BofA consumers to enroll a digital debit card will push greater overall usage of BofA’s services — and if consumers have a BofA debit card and checking account, they already have a primary relationship with the bank.

“Mobile wallet usage is still low, so I don’t know if there is some grand battle over becoming the top of wallet,” Reston said. “Right now it’s more about engaging consumers. It’s more about encouraging the use of digital channels.”

The digital debit feature will be available to all consumers who register with Bank of America’s mobile app, though it will not be automatically loaded. The app’s user experience walks users through the process, including images of their cards on screen.

BofA is also rolling out a foreign exchange app called Mobile Orders in the coming weeks, to allow clients to place orders for foreign currency through their mobile app and track progress. Clients who are traveling internationally can choose a specific financial center for pickup or delivery. Small businesses can preorder bills and coins in a specified denomination.

“This is part of our high-tech/high-touch strategy in which customers are able to spend less time waiting to do some of the upfront work,” Reston said. “This gives consumers one point of access to foreign exchange in a mobile app in a manner that wasn’t available before.”