Citigroup, which has been investing millions of dollars in minority depository institutions, is taking things one step further — it’s going to send them business prospects, too.

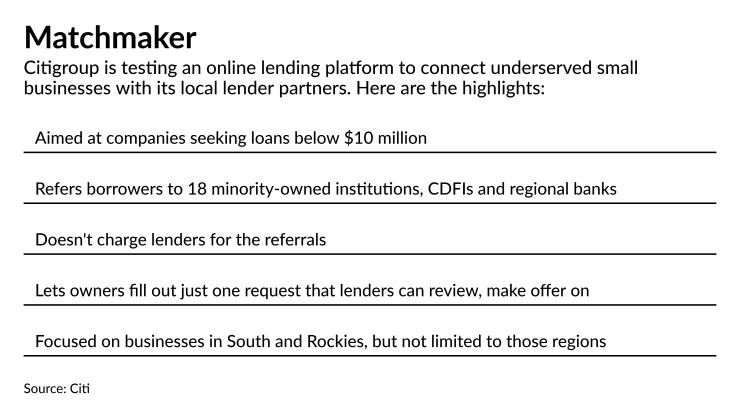

The company on Wednesday began testing an online lending platform called "Bridge built by Citi" that it described as a “meeting place” where small and midsize businesses seeking loans can connect with 18 banking institutions — primarily minority-run banks and community development financial institutions — seeking access to technology that lets them reach customers outside their local markets.

Some regional and midsize banks are participating, too, to help handle slightly larger loans.

Citi says it won’t benefit financially nor will it receive Community Reinvestment Act credit for this project, which was born out of its D10X internal incubation program. There are no fees for lenders or borrowers during the pilot phase.

That has led many — including the bankers invited to participate — to ask: What does Citi gain from its efforts?

“We get that question a lot from all the banks we’ve spoken with,” said Rohit Mathur, a senior vice president at Citi who helped develop Bridge.

Mathur says that Citi sees this venture as an investment in smaller companies that need more capital and want options in finding a bank; to bolster its partnerships with minority depository institutions and other banks that are not considered its competitors; and to promote innovation.

Citi’s rationale makes sense, observers said.

“Banks are trying to understand what they don’t know in fintech,” said Christopher Marinac, director of research at Janney Montgomery Scott. “I think every bank realizes we need to think smarter and be more agile. Citi is trying to do this in a low-risk way where it can try to have some of the innovation rub off on its team.”

It’s also part of a series of efforts by banks, begun after the racial equity protests of 2020,

“It’s a great way for Citi to check off what is probably a big item on everybody’s ESG road map — democratization of access to capital for small and medium-sized businesses,” said David O’Connell, a senior analyst on the commercial banking and payments practice team at Aite-Novarica, referring to the environmental, social and governance practices being adopted by large companies.

Businesses in search of a loan of up to $10 million will complete a request for proposal on the Bridge website, supplying details such as how much they are seeking, why they need the loan as well as basic financials such as three years of net income. Participating banks will review the RFPs and respond with nonbinding pricing and terms, after which borrowers can compare their options.

Both sides can track the loan process in real time. Once borrowers select a bank, they and their lender continue the conversation off Bridge.

The process is meant to be efficient. Businesses do not upload any documents while filling out their RFP, which the creators estimate will take 15 to 45 minutes. Banks can filter by location or size of the loan when poring through requests to pinpoint better matches.

The idea for Bridge predated the pandemic, even if the reliance on digital technology to form relationships in small-business banking during the pandemic accelerated the need. “We saw this as something that would happen eventually,” said Harte Thompson, a senior vice president at Citi who also helped develop Bridge. “COVID pushed us to move a lot faster, with people more willing to move to digital ways of connecting.”

One change that resulted from the pandemic: Businesses that weighed in during development asked for space to describe the impact of COVID on their financial results.

Eighteen banks concentrated in the South and Rockies are part of the pilot, from minority institutions such as Citizens Trust Bank in Atlanta and Optus Bank in Columbia, South Carolina, to larger regional players such as First Horizon Bank in Memphis and First National Bank of Omaha.

The goal was to offer a range of options; for example, the community banks and CDFIs will focus on smaller loan requests, while larger banks can fulfill the $9 million to $10 million credits.

“We heard from borrowers that their preferences vary,” said Thompson. “If it is a $1 million loan and a couple of banks are interested, some prefer a smaller community bank while others prefer a larger regional bank.”

Mechanics and Farmers Bank in Charlotte, North Carolina, came on board after Citi, which has an equity position in the bank, pitched the idea. M&F lends to companies in North Carolina that generally produce gross revenue of $500,000 to $5 million.

“We still predominantly have a manual process for our small and medium-sized businesses in terms of collecting the financials, meeting with the customer and asking them questions,” said James Sills, president and CEO of the $358 million-asset M&F. It made strides during the pandemic, such as letting customers upload documents into a secure portal and holding conversations over Zoom. But, “every business customer wants to do it faster,” Sills said. “They want decisions to be faster.”

Bridge also can let M&F cast a wider net in North Carolina than a small institution with six commercial lenders normally could. M&F will be limiting its search to companies in the state and to loan amounts up to $4 million to any one borrower at first; it will also prefer applicants that report profits over the previous three years.

“We have been lending to all types of business owners throughout our history, but we do predominantly lend to African Americans,” Sills said. “Given the wealth gap and history of our institution, this allows us to lend beyond the five markets where we are located.”

Citi has

“By investing in MDIs, Citi is doing its part to promote and encourage the growth of financial institutions that are critical to the strength and vitality of underrepresented communities,” said Harold Butler, head of minority depository institution engagement at Citi.