WASHINGTON — After ramping up staffing during the last few years to shoulder its burden from the financial crisis, the Federal Deposit Insurance Corp. — thanks to a slowdown in failures — is starting to tighten its belt.

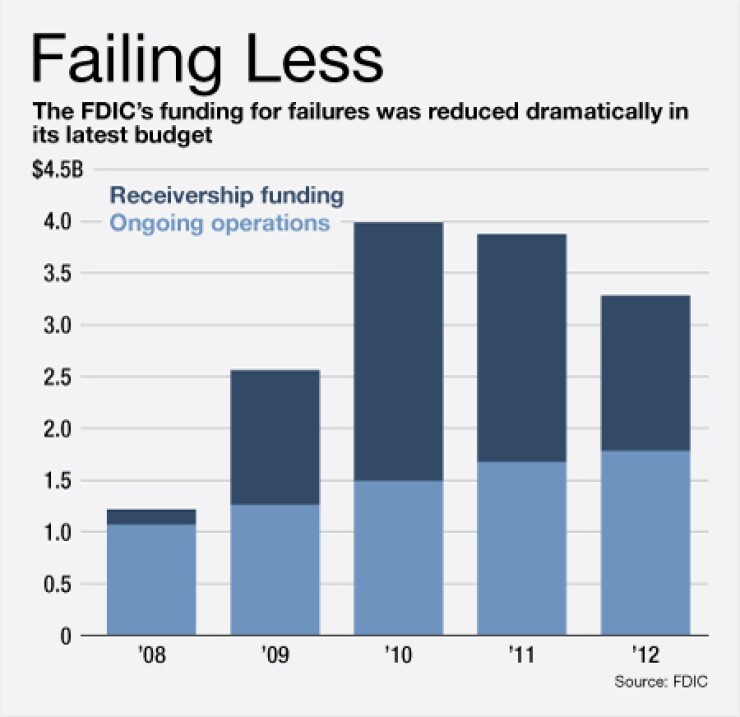

With its workload steadily dropping from the height of the crisis, the agency Wednesday approved a 2012 budget of $3.28 billion, 15% lower than this year's budget. The FDIC plans to eliminate over 500 non-permanent positions related to resolution operations.

While other budget areas will grow to handle new duties related to the Dodd-Frank Act, including the FDIC's new role with systemically important institutions, spending on failed-bank work will drop nearly 32% from this year's budget to $1.5 billion.

"We are on track to see a steady reduction in the budget for the next several years" as the agency lowers nonpermanent staffing, said Thomas Peddicord, deputy director in the FDIC's finance division.

Even though the 2011 budget showed a slight decrease of 0.7% from the previous year, the 2012 numbers unveiled Wednesday are the clearest sign to date that the FDIC - as it typically does following a crisis - is scaling down. By comparison, budgeting more than doubled in 2009 compared to the previous year, and rose by over half in 2010. Whereas authorized 2012 staffing is 6% less than the previous year, it had grown by 22% in 2009, and by 29% in 2010.

Yet the staff reductions are largely in temporary positions which had been added exclusively to handle increased workload from the crisis. FDIC officials have said the hiring of contract employees, many of them former agency veterans, was intended in part to avoid the sting of the dramatic downsizing that occurred following the savings and loan crisis.

Martin Gruenberg, the acting FDIC chairman, said the aim is for future reductions to also be in nonpermanent personnel who "were brought on board with that explicit expectation."

"Although the proposed budget includes substantial contingent funding to ensure that we can quickly address any unexpected economic difficulties that might occur, fewer banks appear to be in danger of failing today, and we expect the trend toward reduced failure activity to continue in 2012 and beyond," Gruenberg said.

Last year, 157 institutions failed, but with less than a month left in 2011, only 90 institutions have been closed.

Despite the budget reductions, the agency also approved an "unassigned contingency reserve" of over $113 million to deal with unforeseen circumstances. The reserve is "administered by the" agency's chief financial officer "to ensure that the Corporation is prepared to respond quickly to an unexpected increase in failures or related workload that arises during the year," the budget proposal said.

Next year, the agency plans to eliminate 462 nonpermanent positions in its Division of esolutions and Receiverships, plus 119 other nonpermanent jobs related to failure work. The budget also suggested there could be reductions in future years in supervisory resources.

"The number of problem … institutions appears to have peaked, but limited changes are reflected in authorized staffing due to the continuing high number of such institutions," the agency said.

Still, the agency boosted spending for operations other than resolving failed banks by 6.3% to $1.78 billion. The FDIC expects to add just over 50 permanent positions for regulatory functions required by Dodd-Frank. That includes 28 more positions for the responsibilities the FDIC inherits from the Office of Thrift Supervision, which was eliminated in the reform law. It also includes 24 permanent positions to staff the Office of Complex Financial Institution, which handles the FDIC's new authority under Dodd-Frank to wind down systemically important nonbanks that fail.

Peddicord said the agency is still analyzing what the staffing needs for the large-institution section will be over time.

"I suspect that we are going to be getting further refinements," he said.