WASHINGTON — As the House prepares to vote again today on the $700 billion bailout bill, it's becoming clear that many details are unsettled.

There are the obvious questions like how the Treasury Department will price the assets it plans to buy and how its auction process will work.

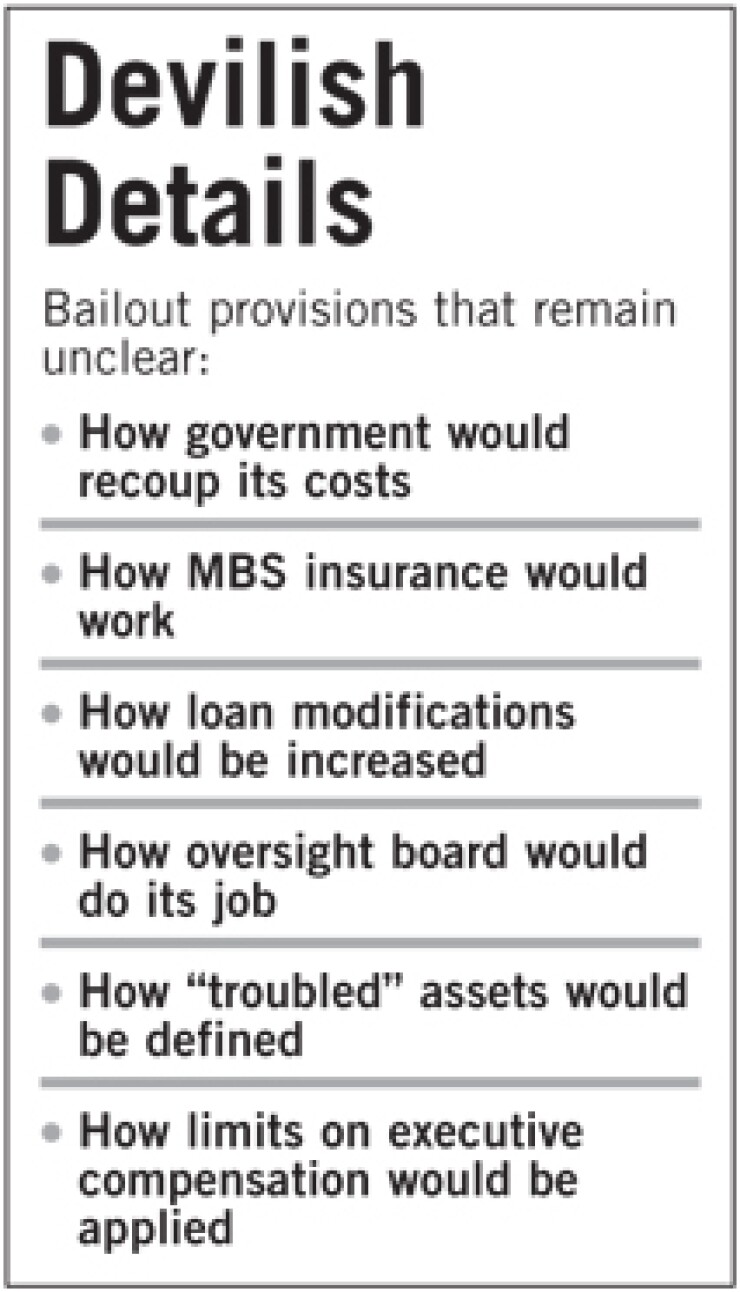

But many other holes exist, including how the insurance program for mortgage securities will work, how the government's losses will be recouped from lenders, whether executive compensation limits apply only prospectively, and whether restrictions are inherited by a healthy institution that buys one participating in the program.

"All of these open questions are going to keep an army of lobbyists and lawyers busy for the next few years," said Howard Glaser, an independent lobbyist specializing in housing. "Many questions are going to be deferred until we are out of an emergency situation."

Jaret Seiberg, an analyst at Stanford Washington Research Group, said the Treasury must have discretion over the details of the program is to succeed.

"We don't have a lot of history with doing these types of stabilization programs, so they need the ability, if one approach fails, to move on to the next one without having to go back to Congress," Mr. Seiberg said. "That's what this bill gives them. That's part of the beauty in the structure of the bill."

The bill also imposes a tight deadline on Treasury to fill in some of the blanks.

"Investors are going to be real curious to see the program guidelines that have to be issued within 45 days or 48 hours of the first asset being purchased," said Andy Laperriere, the managing director of International Strategy and Investment Group.

Rep. Bobby Scott, D-Va., voted no when the House first took up the bill on Monday, and said he would do so again because, even at 451 pages, too much remains in doubt. A vote could come as early as today. "We need more discussion on how this proposal will actually solve the problem," Rep. Scott said Thursday on CNBC. "Just restating 'We have a problem, we have a problem' does not do anything to address what this bill will actually do, if anything."

One question is what limitations would be put on a healthy institution if it buys a bank that had participated in the program. "If a troubled institution that participates in the program is subsequently acquired by a bank not participating in the program, imposing the executive compensation provision on the healthy bank could have a chilling effect on the pool of acquirers," said Lawrence Kaplan, a lawyer at Paul, Hastings, Janofsky & Walker LLP.

The bill only applies the executive compensation limits prospectively and only while the Treasury holds an equity or debt position in the financial institution.

The bill's insurance program for troubled assets requires the Treasury to set risk-based premiums at a "level necessary to create reserves sufficient to meet anticipated claims, based on an acquirable analysis and to ensure that taxpayers are fully protected." But that leaves a lot of questions, and the Treasury is not required to actually use the program. Many sources suspect it won't.

"I don't understand the economics behind the insurance program," Mr. Seiberg said. "Only the holders of the riskiest MBS will seek insurance, so how do you make that at a price that is at all attractive when you are having to insure the riskiest product? It's like your barn is on fire, then you call in and want to get insurance."

Anne Canfield, executive director at the Consumer Mortgage Coalition, disagreed. "The insurance program might turn out to be the most workable part of the bill," she said. "It will offer financial institutions an opportunity to book their assets at par by agreeing to purchase an insurance policy and pay a premium to Treasury."

The bill is designed to recoup the program's costs through a fee on all financial institutions to be levied five years after enactment. But it only requires the president to propose a means for doing this.

"Whether this provision is even constitutional is open to question, and the taxpayer should not find comfort in a bill that may or may not be introduced five years from now," said an analysis by the firm Womble Carlyle Sandridge & Rice.

A provision to increase loan modifications leaves open how, under what criteria, and when the Treasury would encourage loan workouts. The bill also would allow the Treasury to use loan guarantees and credit enhancements to facilitate the loan modifications.

"The problem with the loan modifications is no one has been very good at it," Mr. Glaser said.

The measure does include oversight of the Treasury's implementation of the program. This oversight has been touted by both Republicans and Democrats, but the oversight board has no veto power over the Treasury's actions and likely will not be set up until after the program is implemented.

The oversight board would consist of heads of the Federal Reserve Board, Federal Housing Finance Agency, Securities and Exchange Commission, Housing and Urban Development, and a chairperson to be selected by Congress.

House Financial Services Committee Chairman Barney Frank, D-Mass., said Thursday that the bailout program would likely start before the oversight board could be set up.

Brian Gardner, a political analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., said: "The oversight boards themselves can advise, they can't control. Reports to the Congress will possibly have some impact. … But at the end of the day Treasury has a lot of flexibility to run the program in the way it sees fit."

While the legislation defines "financial institutions" and "troubled assets," it also gives the Treasury leeway to interpret the terms.

Joseph Mason, chairman of banking in the finance department at Louisiana State University, said all the uncertainty is likely to benefit the industry.

"Which of these unknowns are a downside for the industry?" he asked. "Can you name one? Because I can't. … So the industry comes up the same or better. That is a piece of legislation everyone can back — and they are backing it."