Several weeks ago,

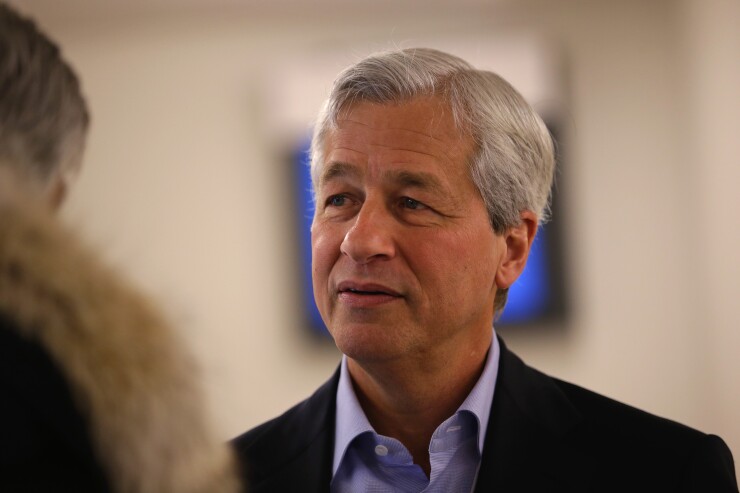

His comments demonstrate a distinct lack of understanding of the reality that bitcoin, in fact, has an incredible value proposition and stands to replace some of the antiquated characteristics of the current financial markets.

Bitcoin has been the speculation of much-heated debate recently. It’s been dismissed by critics as a fraud and a Ponzi scheme, while simultaneously being praised as the greatest financial invention in the last century.

Its previous associations with illicit markets and its extreme volatility has commanded the attention of the general public as to the nature and possibilities of cryptocurrencies, as well as the risks.

While bitcoin’s value has fluctuated, in general it has risen steadily. Bitcoin veterans know there are many people who hold most of their wealth entirely in crypto. When the price falls, these bitcoin aficionados view it as an opportunity to convert more of their holdings from fiat.

The legacy market participants struggle to understand why this might be the case. What gives confidence to bitcoin holders to ride out a downturn without losing confidence? Why are many crypto investors interested in the wild west of ICOs rather than the regulated stable legacy markets?

The answer is that the crypto economy has a much greater value proposition than any legacy market. The ability of a third party to delay, censor or monitor transactions is a risk, and the elimination of any risk automatically increases confidence. Risk is also a form of cost, and the crypto ecosystem is always more cost efficient and secure.

To understand this value proposition is also to understand that the value differential between the legacy and crypto ecosystem is not just large, but precipitously large. This causes immense economic pressure that will rapidly move capital from legacy systems to the crypto economic system. The progress on this has been slowed by crypto’s cumbersome user interface. Once this is addressed, the dam will break.

Builders of economic systems in crypto have been the winners since 2009 in fortune and their stature among their peers. They are the ones that will continue to reap rewards as this technology continues to mature and become more widely adopted.