Momentum is building to improve capital rules. Recently, Federal Reserve Chair Janet Yellen publicly

We share that view and believe these consequences could become much worse in a period of financial stress.

The supplementary leverage ratio, or SLR, is just one of more than a dozen ways that the largest banking organizations are required to monitor their capital positions. Although the SLR is intended to serve as a backstop for risk-based capital standards, the banking agencies demanded higher and higher amounts of non-risk-based capital in the years following the crisis, to the point that the leverage ratio has become the binding capital requirement for many large banks.

Meanwhile, the SLR in the U.S. is twice the international standard. This heightened requirement affects U.S. competitiveness and the ability of U.S. banks to provide financial services to their clients. More troubling is the fact that excessive amounts of capital needed to maintain the leverage ratio can actually increase — rather than reduce — risks to the financial system, impeding banks’ flexibility when responding to changes in economic conditions and assisting their customers in adjusting to changing economic winds.

Keep in mind that the leverage ratio is a totally risk-blind measure of capital. Unlike risk-based capital requirements, a leverage ratio can compel a bank to load up on relatively risky assets. As the financial crisis showed, running blind to risk can be dangerous.

In 2013, I

These concerns may already be a reality.

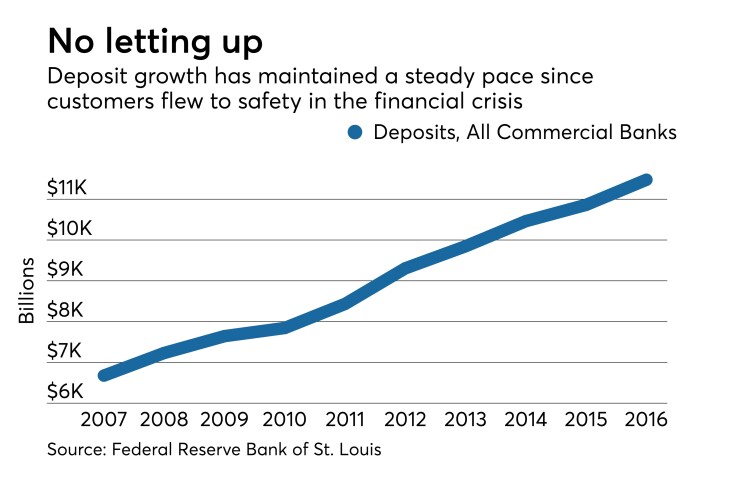

Banks play a pivotal role in reinforcing stability during periods of financial market uncertainty. In times of economic stress, customers tend to flood the U.S. banking system with deposits as they search for financial safe havens. As cash on deposit surges, banks invest those funds in safe assets, such as Treasury securities and deposits at the Federal Reserve, so that these funds are available if and when the customer needs them. Particularly at large custodian or investment banks, investing customer funds in risk-free assets — as opposed to loans or other holdings susceptible to loss — ensures that customers can safely withdraw them.

A bank’s risk-based capital remains steady when it invests customer deposits in these safe assets because they receive a zero percent risk weight. However, investments in Treasury securities and central bank placements reduce a bank’s leverage ratio because all assets are treated equally under the SLR. This makes it difficult to accept new deposits, which now have an added cost. Worse, sudden changes in customer deposit inflows can make banks’ leverage ratios volatile. Many banks saw huge deposit inflows at different points during the financial crisis.

Effectively, the leverage ratio is an incentive for banks not to serve as a safe haven for depositors in a crisis. The leverage ratio should not penalize banks for conducting this core banking function. In effect, banks that absorb deposits in times of crisis act as shock absorbers for the broader economy, providing a calming influence. During the last recession, banks accommodated a surge of nearly a trillion dollars in customer deposits.

Fortunately, the Treasury Department and the Fed recognize the issue.

The Treasury Department has provided specific

This change would create a more rational and effective leverage ratio that is concerned with a bank’s genuine balance sheet risk and is more focused on protecting the financial system as a whole. By their nature, cash or near-cash holdings pose none of the credit risk that capital standards are designed to capture.

The leverage ratio’s effects on customer deposits can also be viewed beyond the lens of risk.

Banks’ custodial services form the “nuts and bolts” of institutional investment activity in good economic times and bad. These services allow pension funds, mutual funds and other long-term investors to manage day-to-day financial transactions, including the movement of cash resulting from their investments. These services often result in banks receiving large levels of deposits when, for example, a mutual fund sells an investment and deposits the proceeds with a bank. Refusing cash deposits or passing increased costs resulting from them to customers could erode the ability of banks to support payment, clearing and settlement activities. If the cost of maintaining pension plan and other retirement savings assets increase, or if the services available to pension funds and mutual funds are reduced, it will be detrimental to U.S. pensioners and therefore the economy as a whole.

Fed Gov. Jerome Powell

The consequences of the supplementary leverage ratio are clear and significant. This “fresh look” is coming none too soon.