The federal government operates three programs that are 100% dedicated to delivering responsible, affordable credit options to help low-income, low-wealth and other disadvantaged communities. They are the Community Development Financial Institutions Fund, the Small Business Administration’s Microloan program and the SBA’s Prime program.

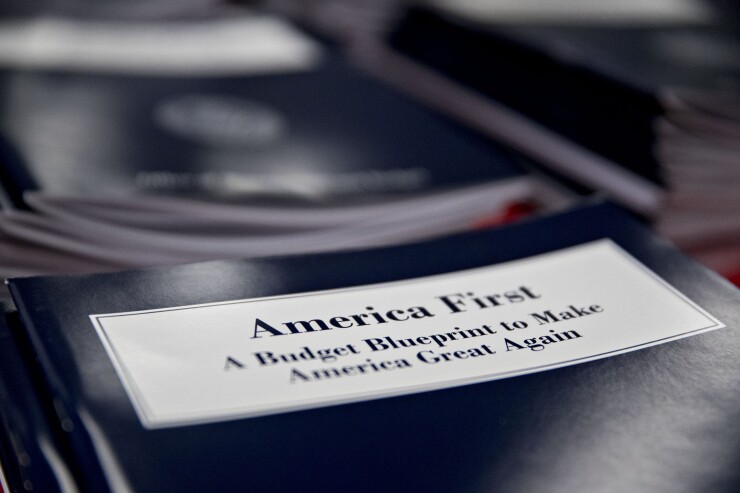

All three are threatened with devastating cuts under President Trump’s proposed 2018 budget.

This is a shortsighted idea that hurts hardworking Americans. Ironically, the people who will be hurt the most

Many American households, particularly those that are low-income, require credit to weather economic shocks such as unexpected expenses (i.e. car repair) or a sudden loss of a job. Obviously, access to credit helps people manage the unexpected expenses that are a part of life.

In calling for the elimination of CDFI Fund grants, the president’s budget said that in contrast to when the fund was created 20 years ago, “private institutions [now] have ready access to the capital needed to extend credit and provide financial services to underserved communities.”

But the reality is there are many people who are unable to qualify for mainstream credit or reside in areas without access to mainstream financial institutions.

This is where CDFIs and other nonprofit lenders come in. They are often the only lenders that will provide a loan to someone who is credit invisible (lacking a credit history) or has poor credit. According to Experian, 64 million Americans have no credit history or a thin credit file. Sure, there are payday lenders and car title loan companies that may be able to help them, but at what cost?

Many CDFI customers have had unfortunate past experiences with alternative lenders. Often, they turned to payday loans to handle emergencies like fixing the refrigerator or avoiding phone or utility disconnection. Although the loan may have solved the immediate problem, afterwards the borrower found himself or herself stuck in an unsustainable cycle of debt. By the time they repaid the loan, most borrowers spent two or three times the amount of the original loan in fees alone. In fact, a 2014 study by the U.S. Postal Service’s inspector general found that “25% of U.S. households rely on costly non-bank services to manage their everyday finances, causing low-income families to spend the same share of their income on interest and fees as an average family spends on food.”

Instead of providing a panacea, unaffordable loans exacerbate a family’s financial instability and create overwhelming psychological and physical stress. By contrast, a loan from a CDFI, if managed well, will save significantly on interest costs while also building a credit history. Once a borrower has a positive credit history and a strong credit score, he or she can graduate to the financial mainstream—qualifying for credit cards and mortgages.

We need to support and praise the lenders who help the most vulnerable, not leave the lender with nothing to lend. If the Treasury Department and the Small Business Administration lose their funding for these critical financial lifelines for the most vulnerable consumers, it will only exacerbate the financial insecurity and economic precariousness for too many Americans.

If the administration is truly committed to helping those who are struggling economically and suffering psychologically, they will not allow huge cuts to these most valuable of programs. And for lawmakers who represent states that depend on CDFI funding, we encourage you to protect this vital source of safe and stable funding for your constituents and their families.