One of the questions I have repeatedly asked banker groups over the past 20 years still gets folks smiling and sharing stories today. I ask, "When you were a kid, how many of you wanted to be a banker?"

Almost without fail, no hands go up. I sometimes follow with, "Well, how many of you decided in high school or maybe college that banking was where you wanted to be?"

Still, only a few hands (if any) go up. I've even asked those questions to scores of the "top performer" groups that I've had the opportunity to address. The results are always similar.

I then suggest that if I asked a room of doctors or engineers or IT professionals if they grew up wanting to enter their profession, I suspect most would answer affirmatively. But not us.

A large percentage of incredibly productive bankers with long and successful careers didn't grow up with "banking" on their career bingo cards. Instead, it's one of the world's most gratifying accidental careers.

My fascination with this began almost 30 years ago during my first banking job. My first day as the manager of an in-store branch came 60 days after being hired. Sixty days prior to that, I had never considered a banking career.

Of course, I came in through a rather unique channel at a time in which scores of institutions were aggressively exploring alternative branch networks, many for the first time.

Over the course of the next decade or so, working primarily with in-store branch programs across the country, I always suspected that we were on to something that our traditional branch counterparts weren't. We didn't hire bankers so much as we developed them.

The most successful in-store programs proactively (some would say aggressively) recruited good people anywhere and everywhere they could find them.

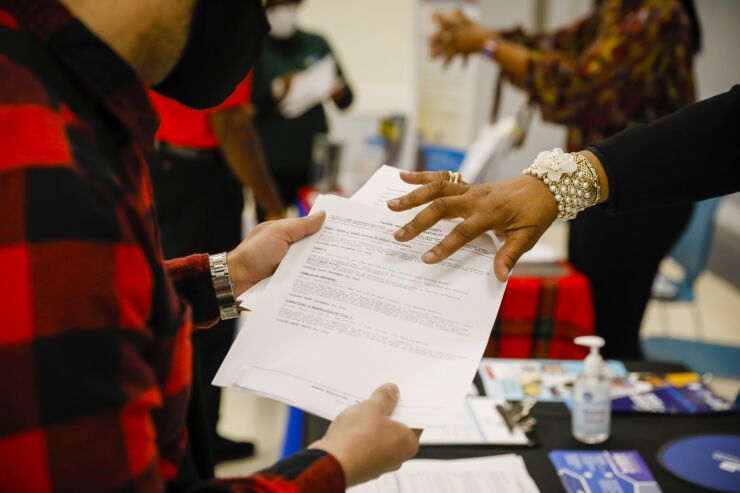

Paying compliments, handing out business cards, and asking folks if they'd ever considered a banking career became standard operating procedure.

I frequently reminded leaders that their best future team members were not looking for them. They were out there displaying positive attitudes, strong work ethics, sales talent, and exceptional customer service skills in places of business all over their communities.

Furthermore, these folks were not currently looking for jobs, much less daydreaming of becoming bankers.

To be honest, there were more than a few bank leaders who resisted the idea of openly promoting hiring for attitude and aptitude before education and experience. Their preference always seemed to be finding employees with banking or financial services experience.

They'd also strongly lean toward people with college degrees, whether or not they had ever been in jobs in which empathy, flexibility, relational skills and strong work ethics were needed.

There are several reasons so many folks who entered banking via the in-store channel later became successful team members and even senior managers in other areas of banking, as well.

First, in an industry not stereotypically known for personality or customer engagement, in-stores developed a different mold. We recruited good people in talent pools that banks seldom explored.

Beyond that, in-store bankers realized early that your work culture and the atmosphere created in a branch are critical. When folks are asked to wear many hats and handle technical jobs in less-than-serene environments, the work culture needs to be a positive one.

Smiles and laughter are both business development and employee retention tools.

Along with recruiting, some of the most important, yet often underappreciated aspects of successful in-store bank programs were the training and onboarding practices. Our people were asked to take on challenging universal banker roles, in true retail environments, with leanly staffed branch teams.

Identifying and helping them overcome the inevitable hurdles they would face was paramount.

Efficient, relevant and consistently engaging training and onboarding are essential and often the difference between building a team of talented bankers and the millstone of continually high turnover.

As we begin a year that many are expecting to present as challenging a labor market as most have seen in our careers, I'd suggest a few in-store banking lessons are as relevant as ever. This is true from alternative channels to traditional branch operations to back offices and support teams.

Good people are out there and many of your best future team members likely have jobs already. But they aren't looking for you. You must introduce yourself and sell your vision.

Those who remain the most committed to proactively finding good people and developing talented bankers will win.