The last decade has seen the rise of a large pack of technology-enabled products that operate at the edges of the U.S. banking system. Prepaid cards, payment apps and online loans are among the innovations that have made traditional banks less relevant in the lives of many households and businesses.

This trend led

But during the coronavirus crisis, banking relationships have turned out to matter a great deal — and in ways that could scarcely have been anticipated just a month ago. Thus far, consumers and small businesses that maintained robust relationships with banks appear to have collected an outsized share of the congressionally appropriated relief dollars. Many Americans who lack such ties have received second-class treatment.

In the consumer realm, the key issue is whether a particular individual is among the more than 80 million Americans who previously gave direct deposit information to the Internal Revenue Service. These relatively fortunate households have already received stimulus checks of up to $1,200 per adult and $500 per child.

By contrast, tens of millions of Americans who did not provide direct deposit information to the IRS have not yet gotten their stimulus checks.

One reason individuals might fall into the latter category: They are among the estimated 6.5% of U.S. households that do not have a checking or savings account. These folks will likely have to wait weeks or even months to receive their emergency funds from the government — an outcome that they could scarcely have imagined would result from failing to maintain a bank account.

Lower-income households, less-educated households, black households and Hispanic households are all more likely to be unbanked than other households, according to a 2017 survey by the Federal Deposit Insurance Corp. Members of those same groups are also more likely to need their stimulus checks right away, because as the FDIC found, they typically save comparatively little money for unexpected emergencies.

“Differences by income and education were especially pronounced,” the agency wrote in a report summarizing its findings. “For instance, only 28.9 percent of households with less than $15,000 in income saved for unexpected expenses or emergencies in 2017, compared with 73.8 percent of households with income of $75,000 or more.”

In the small-business arena, where millions of companies are now vying for scarce emergency relief dollars, the value of a deep banking relationship has proven even more critical.

Under the $349 billion Paycheck Protection Program, the federal government is funneling money to small businesses in an effort to dissuade them from laying off employees. But demand has far outstripped supply, and the program’s design has so far given an edge to companies that have relationships with banks over those that do not.

Banks generally got access to the Paycheck Protection Program sooner than other lenders, and they often accepted applications only from their own customers. Bank of America

Meanwhile, online lenders such as PayPal, Intuit, Square, OnDeck Capital and Funding Circle did not get approved for the program until most of its funds had already been allocated.

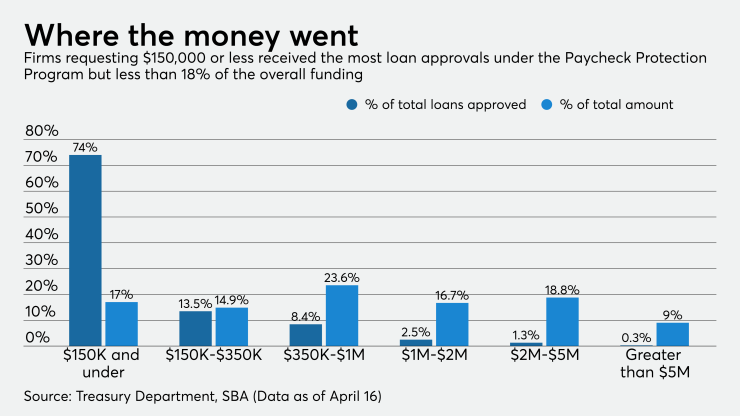

One result of this inequity in timing was to advantage relatively large businesses over smaller ones, since bigger firms are more likely to have robust relationships with banks.

Last year, the Federal Reserve found last year that 57% of employer firms with annual revenue of more than $1 million had gotten funding from banks, compared with just 24% of employer firms with annual revenue of $100,000 or less.

With speed of the essence, the Paycheck Protection Program’s paperwork requirements gave another advantage to relatively large companies. “They have accountants, they have controllers,” noted Duncan MacDonald, a frustrated small-business owner who recently launched a

Sole proprietors and independent contractors were eligible to apply for relief, but it was not until 11 days after the program’s launch that the government issued guidance on the documentation they would need to provide. By that point, nearly all of the appropriated funds had been claimed, though Congress does appear poised to provide additional money soon.

Through April 16,

Companies that lack deep relationships with banks have so far been “tremendously disadvantaged” under the Paycheck Protection Program, said Gwendy Brown, vice president of research and policy at Opportunity Fund, a California-based nonprofit lender.

Opportunity Fund, whose borrowers have an average of three employees, is seeking to be approved as a lender under the Paycheck Protection Program, but has yet to receive the go-ahead.

Brown argued that the Paycheck Protection Program has functioned as “re-redlining” that is being funded by U.S. taxpayers. She pointed to Fed data from last year showing that only 23% of black-owned employer firms had previously received bank financing, compared with 46% of white-owned firms, while also noting that the federal emergency relief program has offered advantages to companies with deep banking relationships.

Perhaps it should not be a surprise that at a moment of unforeseen economic crisis, banks have played a central role. The U.S. government is seeking to distribute an unprecedented amount of cash very rapidly; there is an undeniable logic in using the financial institutions to which it has the closest ties as the distribution network.

It remains to be seen whether this short-term advantage will translate into long-term gains for banks that face tough competition from forward-leaning fintechs. But for now, thousands of traditional banks have Uncle Sam to thank for boosting the value of their customer relationships.

Bankshot is American Banker’s column for real-time analysis of today's news.