-

The industry called for modifications to the regulator's phase-in proposal on the new credit loss standard while acknowledging the broader changes it wants are up to the Financial Accounting Standards Board.

October 28 -

At a time when the industry is focused on serving members and assisting with the economic recovery, executives shouldn't be burdened by a costly new credit loss methodology.

October 1

-

Measures designed to give banks and credit unions more flexibility to help customers weather the coronavirus pandemic are set to expire Dec. 31 unless Congress renews them.

September 18 -

Two bills — one providing relief from a loan accounting standard and another extending forbearance measures — would collectively contain credit losses.

September 4

-

Russell Golden, who just stepped down from the Financial Accounting Standards Board, says he wants to be remembered for encouraging open discourse over new rules and efforts to simplify financial accounting.

July 7 -

Lawmakers should go further than their recent criticism of the Financial Accounting Standards Board's loan-loss rule and just hand over its duties to the Securities and Exchange Commission.

June 12 -

Rodney Hood, chairman of the National Credit Union Administration, told the Financial Accounting Standards Board that complying with the Current Expected Credit Losses standard could adversely impact the industry's net worth.

April 30 -

Banks would have drowned if lawmakers hadn't delayed the new accounting standard during the coronavirus pandemic.

April 24 -

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

April 7 -

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

Policymakers should abolish the new accounting standard because it could distract banks at exactly the moment they need to be focused on pulling their communities from the brink of recession.

March 25 Signature Bank of New York

Signature Bank of New York -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23 -

The FDIC's call for FASB to postpone the loan-loss accounting standard's effective date could put pressure on other agencies to follow suit.

March 20 -

The new accounting standard meant to prevent another financial crisis could actually trigger one.

January 31 Ludwig Advisors

Ludwig Advisors -

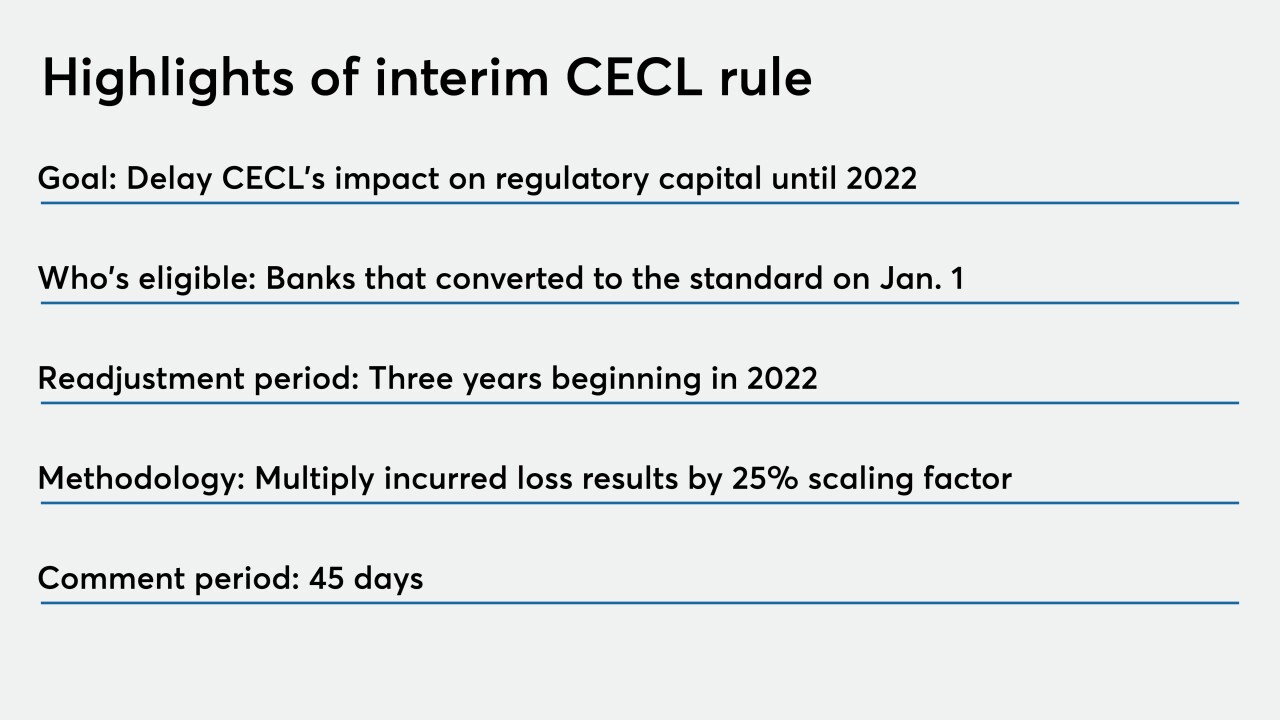

The four prudential agencies, which will enforce the new credit loss methodology developed by the Financial Accounting Standards Board, said they want to promote consistency.

October 17 -

FASB delayed implementation for the majority of banks and credit unions until 2023, but many in the industry still oppose the rule, despite regulators' attempts to ease the path forward.

October 17 -

The accounting board delayed implementation for the majority of banks and credit unions until 2023.

October 16 -

The National Credit Union Administration should help soften the effects of the new standard on regulatory capital through rulemaking.

October 7 National Credit Union Administration

National Credit Union Administration -

Readers react to plans by Democratic presidential candidates to reform college tuition, credit unions buying more banks, whether the next president could fire the CFPB head and more.

September 19 -

The association filed a comment letter urging FASB to delay CECL implementation for all banks, while asking a key accounting group to support its effort.

September 17