-

First City Bank of Florida had suffered “longstanding capital and asset quality issues” that were unrelated to the pandemic, the FDIC said.

October 16 -

Many community banks need brokered deposits to help fund loans, so policymakers must strike the right balance between promoting liquidity and guarding against reckless lending.

October 7 Peoples Bank

Peoples Bank -

The industry is warning regulators putting the finishing touches on the Net Stable Funding Ratio that the measure could exacerbate volatile market events like the spring selloff of Treasury securities.

October 5 -

The central bank's proposal to overhaul the Community Reinvestment Act differs markedly from the OCC's regulation in testing, data collection and other areas.

September 21 -

The Federal Reserve and the Treasury Department released a set of FAQ's aimed to clearing up misconceptions about the Main Street Lending program and encouraging more bank participation.

September 18 -

A historic influx of deposits has brought the National Credit Union Share Insurance Fund’s equity ratio close to the point where premiums would be required, but the regulator’s plan is intended to boost it.

September 17 -

The Federal Reserve Board will discuss an advance notice of proposed rulemaking on the Community Reinvestment Act at an open meeting. The central bank had previously declined to support an OCC rule overhauling the 1977 law.

September 17 -

The agency’s insurance fund dipped below its statutory minimum last quarter thanks to the rapid rise in deposits, but officials say it should bounce back without a hike in premiums.

September 15 -

The plan would encourage more risk-taking by big banks, which would put the industry and taxpayers in harm’s way, write former CFPB Director Richard Cordray and Camden Fine, onetime head of the Independent Community Bankers of America.

September 11 Consumer Financial Protection Bureau

Consumer Financial Protection Bureau -

A pandemic-driven surge in bank deposits helped drive the agency's insurance reserves below their statutory minimum.

September 9 -

Backers of lawsuits challenging federal charter and interest rate policies for nonbanks say states are sticking up for consumer protection. Others say the legal quagmire could slow efforts to improve the regulatory framework.

September 1 -

The division asked for public feedback as it weighs changes "to reflect emerging trends in the banking and financial services sector."

September 1 -

The Justice Department alleges that the bankers worked with “higher-ranking bank officials” at Washington Federal Bank for Savings in Chicago to falsify records and hide funds before the bank's December 2017 collapse.

August 29 -

The e-commerce leader’s return to the drawing board alleviates immediate concerns about its banking plans. But the company intends to reapply, and it will be harder for the industry to persuade policymakers to block industrial loan companies more broadly.

August 26 -

The agencies completed steps to ease a community bank capital measure temporarily and to delay a new credit-loss accounting standard.

August 26 -

The $18.8 billion in net income was 70% less than a year earlier as the uncertain economic picture and new accounting rules drove a sharp rise in provisions for future losses.

August 25 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

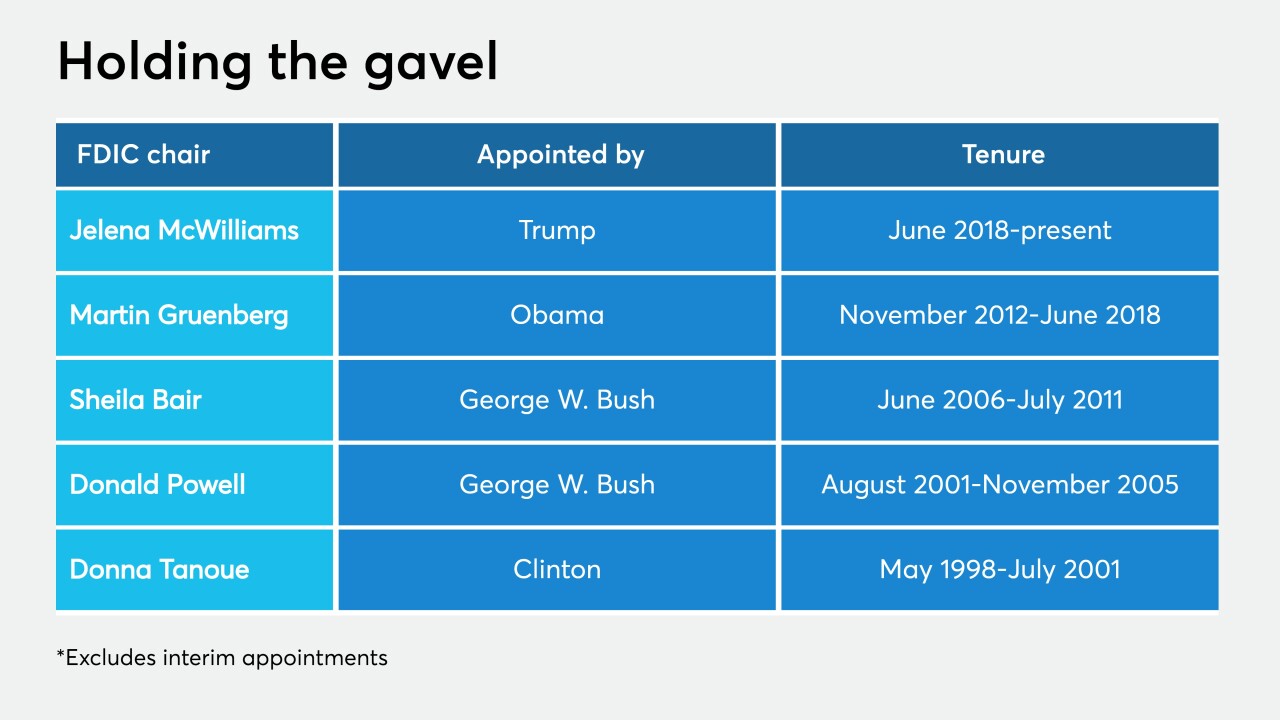

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

The federal banking agencies clarified that minor violations of Bank Secrecy Act rules will typically not result in a cease-and-desist order.

August 13