-

At the recent Google Marketing Next event in San Francisco, Google revealed a new service designed to close the loop between online advertising and offline card payments. It's a service that should have marketers salivating, but it could easily backfire.

May 25 -

There are hundreds of millions of users that store credit cards with Google but don’t use Android Devices, giving Google the chance to take advantage of data it already has to improve functionality.

May 24 NewStore

NewStore -

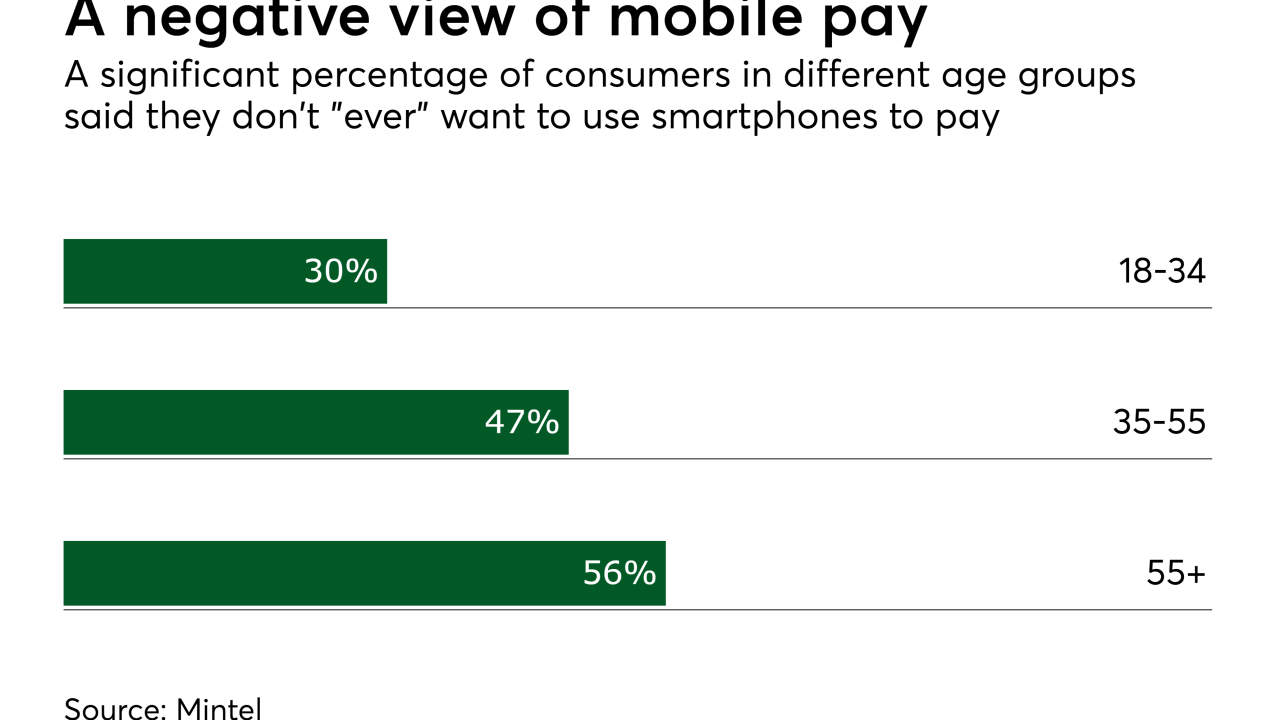

Third party mobile payment apps are resetting consumer expectations, and retailers must embrace the technology, writes Joe Leija, general manager of North America at Ingenico ePayments.

May 22 Ingenico ePayments

Ingenico ePayments -

The company behind Android Pay is giving more tools to developers and inking more partnerships in the payments industry. Here are some of the biggest developments surrounding this year's Google I/O event.

May 19 -

PayPal's strategic partnership with Google has advanced to online shopping, as Android Pay users will soon have PayPal as a funding option for e-commerce.

May 18 -

Google's new "Actions on Google" platform eliminates what is possibly the biggest source of friction in mobile commerce: Getting consumers to download an app and set up an account for purchasing.

May 17 -

Google reportedly will provide a payment request application programming interface (API) on its Chrome browser to allow users to more easily make payments on mobile devices through third-party apps.

May 16 -

Payments stayed the same for years, then started evolving rapidly. That has issuers considering different ways to help consumers manage the change.

May 11 -

Banks and credit unions are often pressured to compete with third party mobile wallets to protect their brands. But it's unclear if that strategy is helpful in attracting consumers.

May 9 -

Banks are often pressured to compete with third party mobile wallets to protect their brands. But it's unclear if that strategy is helpful in attracting consumers.

May 8 -

Third party 'pays' and app companies like Uber are making the payment almost invisible, and threatening banks' relationships with consumers, writes G. Vedanarayan and David Griffiths of VirtusaPolaris.

May 3 VirtusaPolaris

VirtusaPolaris -

Carol Hayles’ departure from CIT leaves us with one less female CEO-CFO team in banking; even Supreme Court justices get manterrupted; a Google doodle celebrates a microlender; and Sen. Elizabeth Warren strikes a pose.

April 21

-

PayPal Holdings Inc. and Alphabet Inc.'s Google deepened their relationship with a new agreement that enables payments through the tap of a phone from PayPal accounts at thousands of new retail locations.

April 18 -

Google can make up ground on its rivals with its new bank collaboration. But it will need help to expand the strategy quickly.

April 13 -

Google Play and CFSI aim to improve use of financial health apps through a storefront organized by consumers' needs and by publishing a guide for app developers.

March 27 -

Google Wallet may have passed the in-store and in-app payments baton to Android Pay late in 2015, but it has simplified its person-to-person payment capabilities by extending its Gmail integration to Android phones.

March 14 -

The cross-border payments startup will use proceeds from its Series D round to fuel growth.

March 9 -

Hiatus joins a growing market for companies that use payment analysis to help consumers manage and reduce expenses for recurring bills.

February 24 -

Chatbots, virtual assistants and the like may mean fewer direct interactions between banks and consumers, fintech leaders say. But branches will become self-service destinations.

January 9 -

The Secure Keys dongle has worked well to vet internal staff at Google, and the search giant sees a number of other uses for the hardware.

December 7