-

Rep. Andy Barr, R-Ky., has introduced legislation to make it easier for new community banks to open in areas that are underserved by the banking system.

April 15 -

Democrats have proposed a Congressional Review Act resolution to strike down the OCC rule, arguing it enables "rent-a-bank" schemes.

March 25 -

Federal Reserve Chair Jerome Powell said bank regulators still aim to write a universal rule updating the Community Reinvestment Act, despite years of disagreement between the agencies on how to proceed.

February 24 -

House Financial Services Committee members were at odds over whether to have support for homeowners and the State Small Business Credit Initiative, both included the $1.9 trillion stimulus plan, expire when the pandemic ends or later.

February 10 -

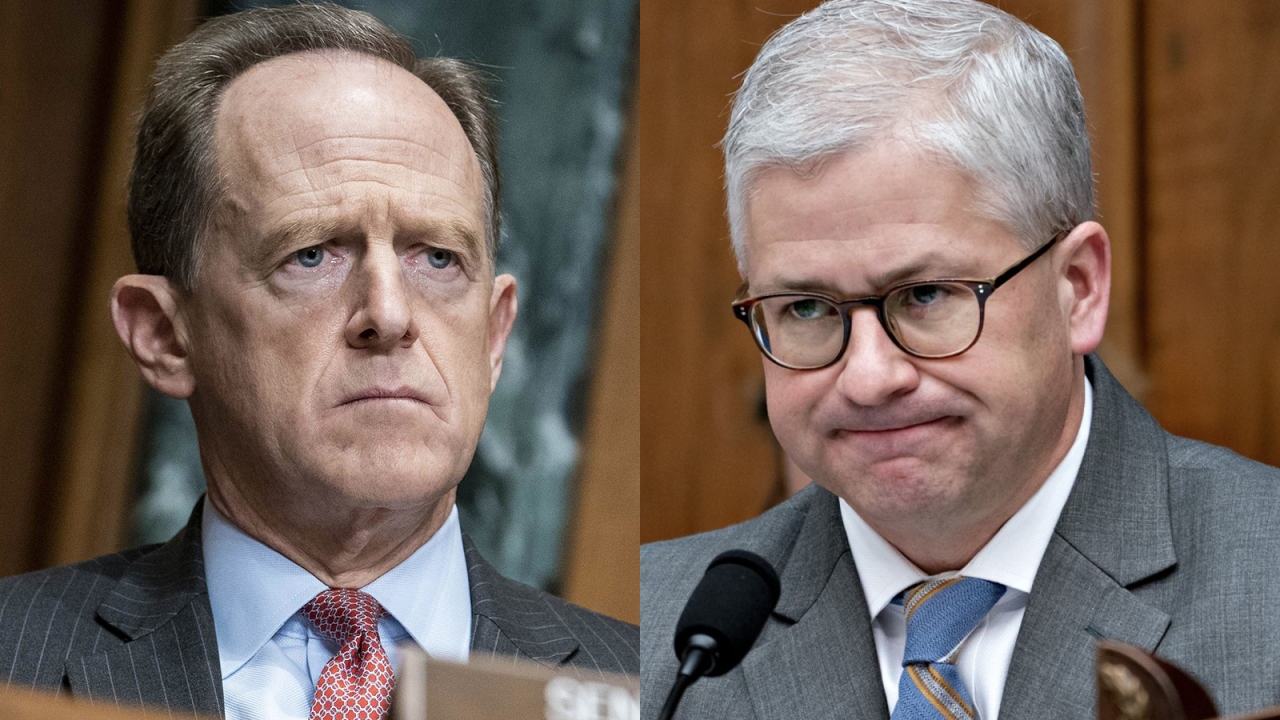

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

The California Democrat known for sharp questioning of executives was turned down for a waiver to serve on the Financial Services Committee by Speaker Nancy Pelosi, D-Calif., The Hill reported Thursday.

January 15 -

The defense spending bill includes language requiring businesses to report their owners to Fincen.

December 11 -

The head of the House Financial Services Committee is already exerting influence by handing the president-elect a laundry list of Trump regulatory policies that she wants the incoming administration to reverse.

December 10 -

Following their disagreement about emergency funds mandated by the last big relief package, the Treasury secretary and Fed chief urged House lawmakers to pass another stimulus bill by the end of the year.

December 2 -

The head of the agency told a congressional panel that the agency is taking steps to prepare for the incoming Biden administration and that she plans to serve until her tenure ends in 2023.

November 12 -

The legislation would help institutions with less than $15 billion of assets avoid regulatory requirements resulting from participating in the small-business relief program.

October 23 -

Various trade organizations sent letters to a House Financial Services Committee task force saying lawmakers should "actively discharge their oversight prerogatives" as the national bank regulator considers giving licenses to companies that do not accept deposits.

September 30 -

Various trade organizations sent letters to a House Financial Services Committee task force saying lawmakers should "actively discharge their oversight prerogatives" as the national bank regulator considers giving licenses to companies that do not accept deposits.

September 29 -

Commercial real estate companies are among those left out of the Federal Reserve’s middle-market relief program, but House members said they need government-backed financing to navigate the pandemic as much as anyone.

September 22 -

Fannie Mae and Freddie Mac have been slammed for planning an additional refinancing charge to cover COVID-related losses, but the head of the Federal Housing Finance Agency defended the policy in House testimony.

September 16 -

Even though financial institutions have "slightly" stepped up assessments of diversity practices, "we are not satisfied with the level of responsiveness,” a senior Federal Reserve official said in congressional testimony.

September 8 -

The Federal Reserve Racial and Economic Equity Act would direct the Fed to consider racial inequality in employment, income and access to affordable credit when making monetary policy and in its regulation and supervision of banks.

August 5 -

Rep. Carolyn Maloney, D-N.Y., was finally declared the winner weeks after election day, while Rep. Lacy Clay of Missouri was defeated by a progressive challenger.

August 5 -

The legislation proposed by Rep. Nydia M. Velázquez, D-N.Y., goes further than recent state efforts to require better disclosures for high-cost lenders, but it would face an uphill battle in the GOP-controlled Senate.

July 31 -

Kathy Kraninger told the House Financial Services Committee that she supports proposed action to revamp the bureau's leadership framework following a major Supreme Court decision.

July 30

![“I think there is an opportunity for a harmonized [CRA] rule among the agencies,” Fed Chair Jerome Powell said in a hearing before the House Financial Services Committee.](https://arizent.brightspotcdn.com/dims4/default/8f61900/2147483647/strip/true/crop/5533x3112+0+575/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fe6%2Fd9%2F02c665a141dea8fa10b4d8a5edbf%2Fpowell-jerome-bl-022421.jpg)

![Fed Chairman Jerome Powell said the central bank had previously concluded that asset-based borrowers were able to secure financing elsewhere. Treasury Secretary Steven Mnuchin said “small hotels do not fit into [the Main Street Lending Program] because they already have other indebtedness.”](https://arizent.brightspotcdn.com/dims4/default/71a30be/2147483647/strip/true/crop/1600x900+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fb3%2F79%2F3b1db6264efa9eab86e05b296afc%2Fpowell-jerome-mnuchin-steven-bl-092220.png)