-

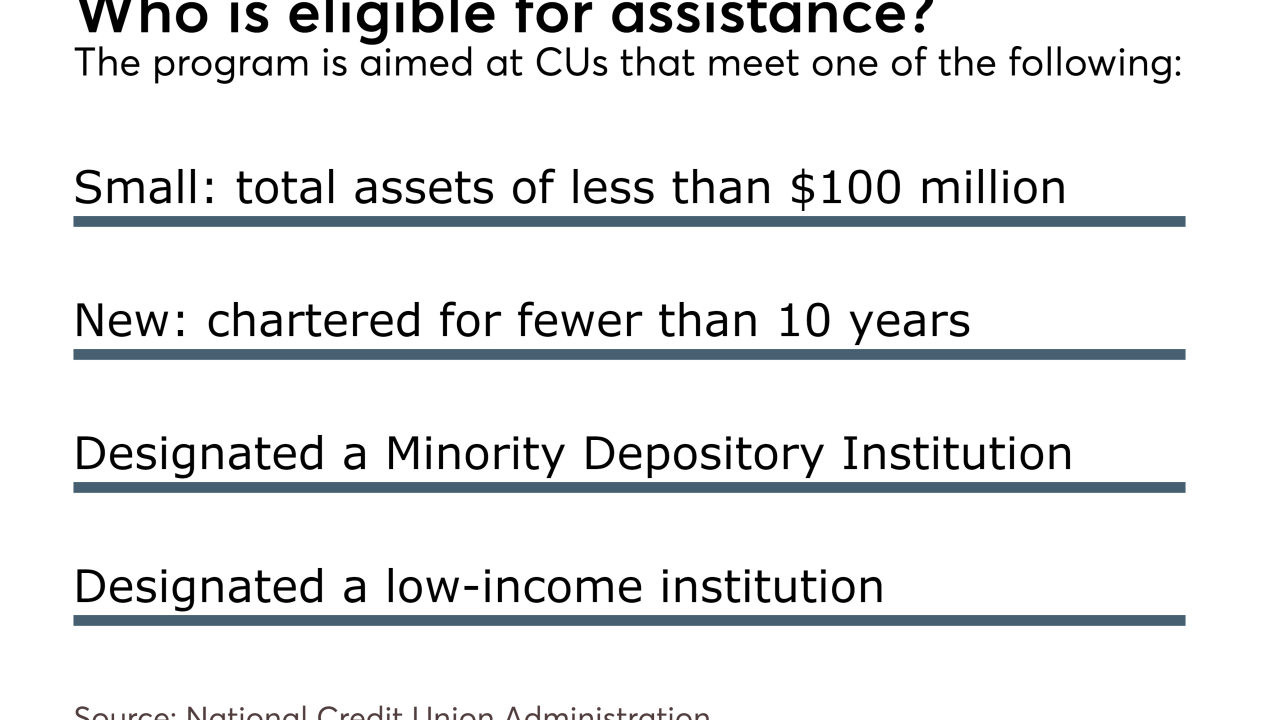

Applications for the regulator's consulting services are due May 31.

May 3 -

Regulator now has recovered nearly $4.8 billion in various suits related to the mortgage meltdown in 2008.

May 1 -

That was just one of the five prohibition orders issued by the National Credit Union Administration in April.

April 28 -

The $1.8 billion-asset institution converted to a federal charter out of a desire to broaden its member base and make member business loans.

April 25 -

The trade association's lawsuit challenging new field-of-membership rules may have the opposite effect, as more credit unions consider expansion before the litigation is resolved.

April 13 -

President Trump has been in office for nearly 12 weeks, but he still hasn’t nominated several critical positions among financial services regulators. Following is a guide to what’s vacant now, and when other posts will be available.

April 10 -

Former CU employees pleaded guilty to embezzlement and bank fraud charges, among others.

March 31 -

One credit union leader is urging Acting NCUA Chairman McWatters to go to bat for more sensible mortgage rules coming out of the CFPB.

March 30 America's Credit Union Museum

America's Credit Union Museum -

The credit union's expanded FOM will cover multiple counties and townships.

March 29 -

As the House Financial Services Committee prepares for a hearing on the struggles of chartering new financial institutions, CU observers debate whether or not the credit union movement – amid an ongoing trend of industry consolidation – actually needs any new entrants.

March 21 -

Foster previously served as deputy director of public and congressional affairs from 2008 to 2011.

March 20 -

Gulf Winds FCU immediatley assumed the failed credit union's members and deposits.

March 17 -

In January alone, before new field of membership rules took effect, NCUA approved nearly 25% of the number of charter expansions as in 2015 and 2016. Could that be just a taste of what’s to come?

March 9 -

The federal agency released data culled from fourth quarter 2016 call reports that showed the "great divide" between large and small credit unions continues to widen.

March 6 -

The regulator has banned a half dozen former credit union employees from participating in the affairs of any federally insured financial institution.

February 28 -

The industry had cause to celebrate when the regulator revamped its MBL and FOM regulations, but several fights are brewing.

February 24 -

At its February meeting, the NCUA Board approved a routine measure to reauthorize an 18% interest rate cap on loans, but suggested that it’s time for Congress to make some changes.

February 23 -

A month into the comment period, NCUA has yet to receive a single response to a proposal that could provide credit unions easier access to market capital. The issue is unusually complex, experts say.

February 21 -

The trade group says that by merging the Share Insurance Fund and Corporate Stabilization Fund to issue dividends now – instead of in 2020 – the regulator could avoid instituting new premiums to the NCUSIF.

February 13 -

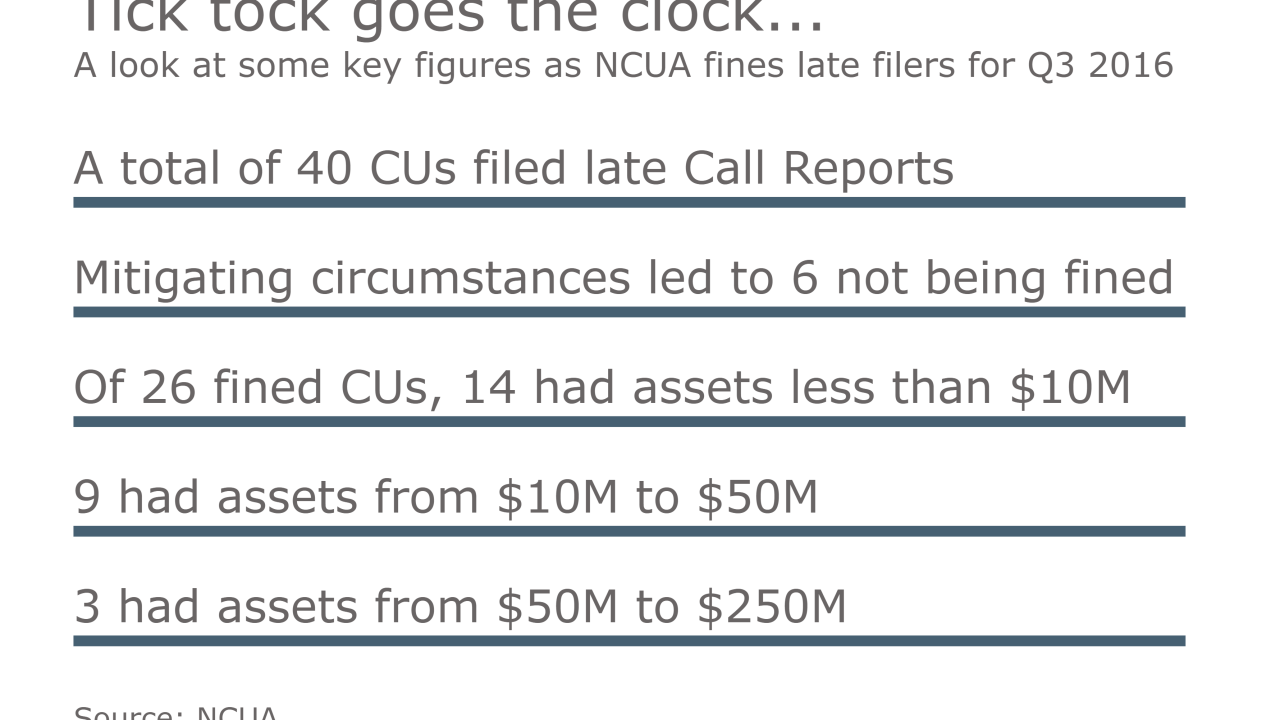

No CUs with assets of more than $250 million were subject to civil monetary penalties for filing late Call Reports.

February 8