-

The spending plan passed in a party-line vote, but board member Todd Harper's objections indicate he could push for closer oversight if President-elect Joe Biden elevates him to the chairmanship.

December 18 -

Starting in 2022, hundreds of newly eligible institutions will be able to raise funds from investors. Bankers argued that the change will further blur the line between the two industries.

December 17 -

Credit union trade groups said the regulator’s spending plan indicates the agency isn't listening to feedback and needs to make further cuts while providing more support for de novos.

December 17 -

Hauptman said dealing with the economic fallout from the coronavirus was a top priority for the agency, along with aligning incentives and expanding the use of technology in the industry.

December 14 -

Lawmakers and the credit union regulator have packed schedules this week as both groups attempt to wrap up their 2020 business before the holidays.

December 14 -

The credit union regulator's monthly meeting will cover the agency's budget proposal and subordinated debt, among other items, along with taking another shot at an overdraft proposal that was rejected earlier this year.

December 11 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

Elizabeth Fischmann will take on the role later this month and will oversee the regulator's compliance with federal ethics laws, among other responsibilities.

December 7 -

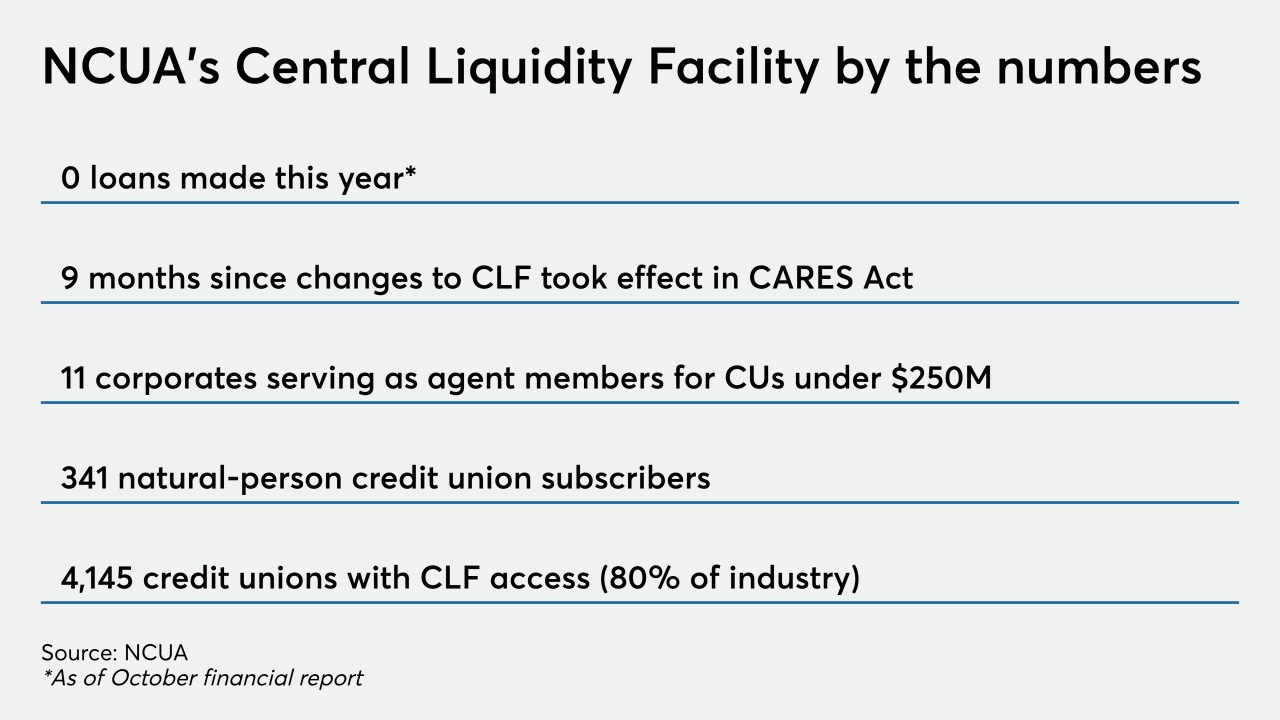

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

A number of reasonable changes to the National Credit Union Share Insurance Fund could help NCUA avoid charging premiums.

December 3