-

The OCC and FDIC are holding off on easing debt limits in response to the coronavirus pandemic, leaving billions of dollars locked up at banking subsidiaries that could be used for lending amid the deepening economic crisis.

April 7 -

After Congress temporarily lowered the leverage ratio used by smaller institutions, the federal agencies said they would allow a one-year transition before banks have to comply again with the regular standard.

April 6 -

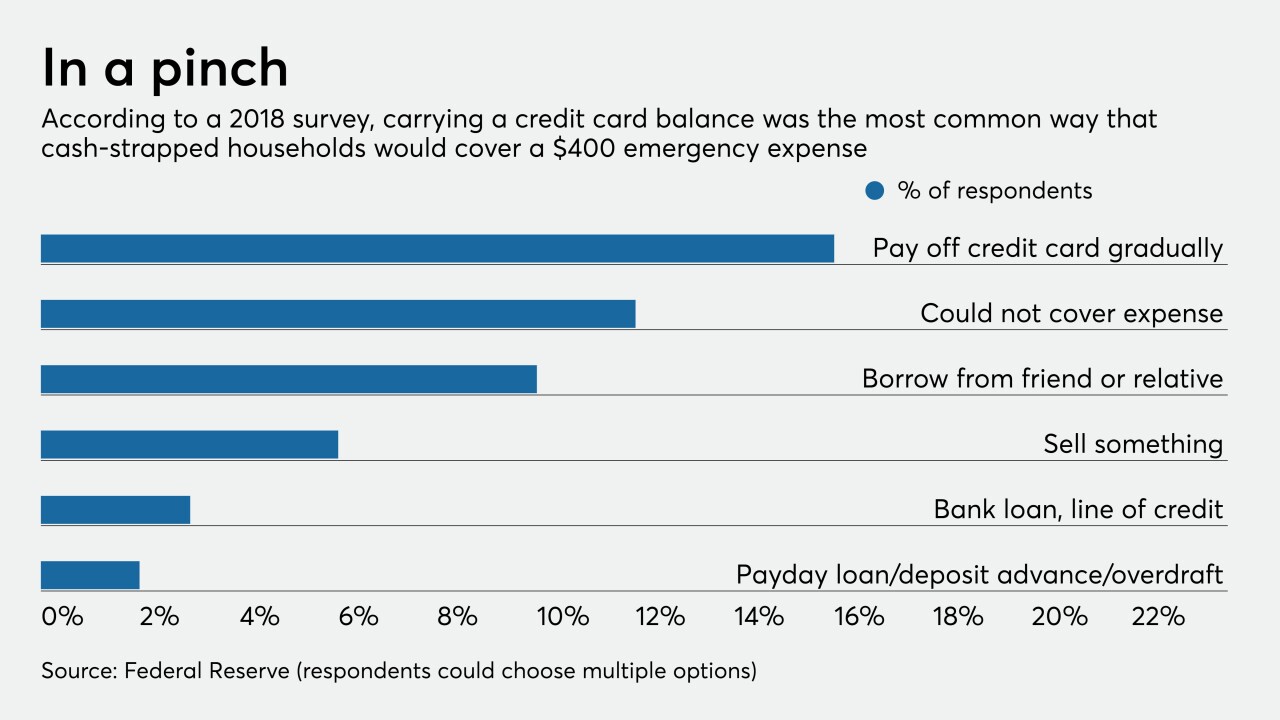

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

March 31 -

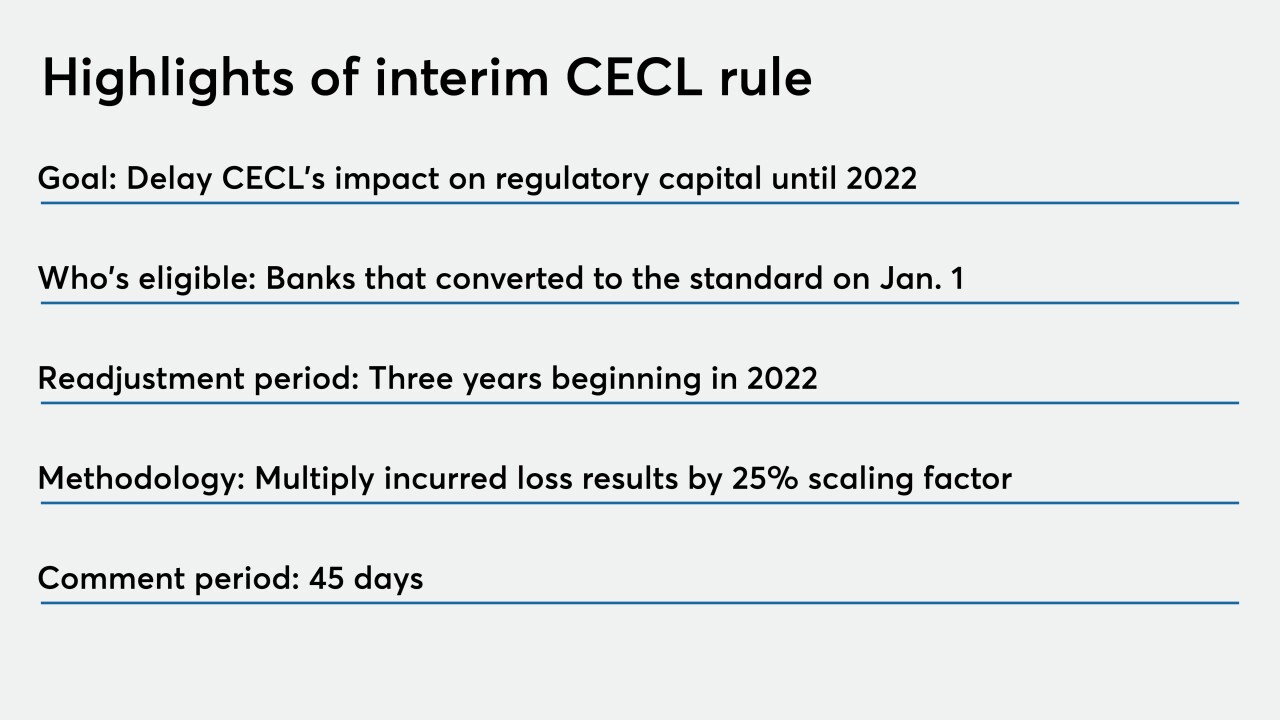

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," several banking agencies said.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," the regulators said.

March 22 -

The Ohio Democrat argued that the public wouldn't be able to meaningfully provide feedback on rules given the stressful circumstances related to the outbreak.

March 20 -

The Comptroller's Office has provided banks with guidance on how to structure relationships with data aggregators. Now the bureau needs to focus on the bank-consumer connection.

March 20 Plaid

Plaid -

The agencies said banks could receive Community Reinvestment Act credit for activities addressing the virus fallout, and clarified earlier guidance encouraging banks to dip into their capital buffers.

March 19 -

Groups often will oppose mergers on Community Reinvestment Act grounds. But the proposal would tighten standards for when the agency includes “adverse comments” in the process.

March 19 -

Regulators issued a rule that gives banks the OK to dip into capital to help households and businesses cope with the economic impact of the coronavirus.

March 17 -

After resigning last year under pressure from federal policymakers, the former executive received no severance benefits or annual incentive award.

March 17 -

The agencies were up and running Monday but have taken steps to allow employees to work from home.

March 16 -

The Comptroller's Office has provided banks with guidance on how to structure relationships with data aggregators. Now the bureau needs to focus on the bank-consumer connection.

March 16 Plaid

Plaid -

The OCC and FDIC said banks should consider waiving fees, be flexible with loan repayments and that they would not be penalized if they close branches for precautionary reasons.

March 13