PNC Financial Services Group

PNC Financial Services Group

PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

-

Though business owners are more optimistic about the direction of the economy since the tax law was passed, it's doubtful their borrowing will increase meaningfully until they see more signs of more robust growth, bankers say.

January 16 -

Executives of large banks told investors and analysts what they wanted to hear Friday when they said they plan to increase returns to shareholders.

January 12 -

The payments resolve a number of cases that date back to 2011 and were among the largest coordinated U.S. enforcement efforts in the years following the crisis.

January 12 -

The Pittsburgh company got the tax-related boost from an increase in the valuation of its deferred tax liabilities. It was partly offset by several charges.

January 12 -

Capital One became the latest bank to feel customers' online wrath last week after reports that some customers were being charged twice for debit card activity. But it was hardly alone.

January 10 -

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

In adding Martin Pfinsgraff, until recently the OCC's deputy comptroller for large-bank supervision, and retired Air Force Brig. Gen. Linda Medler, a cybersecurity expert, the regional bank says it is trying to build a board with expertise in fields of timely interest.

January 4 -

Increases in charitable donations will be more important than ever for bank reputations, as tax breaks and a lighter touch from financial regulators rekindle public anger about the financial crisis.

December 29 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

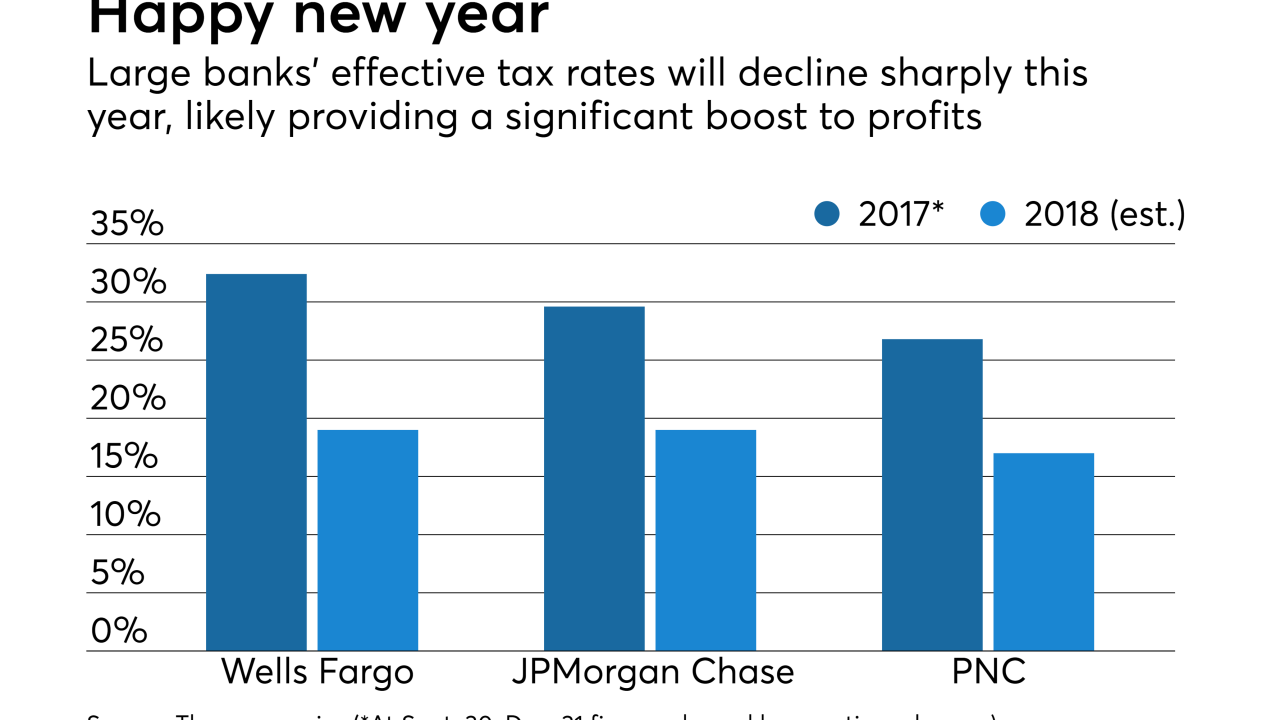

Bank of America, PNC join a growing list of banks planning to use the anticipated savings from the reduction in the corporate tax rate to boost wages for employees.

December 22