Whenever clients are unable to access their money, the bank will hear about it to no end. It doesn't matter however temporary the delay is, or how benign the glitch might be that caused the snafu. They're going to get on Twitter, Facebook and other social media venues and rant. And nobody's going to be polite about it, either.

Capital One customers

Technical glitches were to blame, and the bank later announced on Twitter that the issue had been resolved and that all balances would be accurate. But that didn't stop some customers from posting zingers.

What’s in your wallet? Not a damn thing cause of capital one ....

— #ZeddyTaughtME (@BluSatire)January 3, 2018

Days later, well after Capital One said the problems were solved, customers were still hammering the company.

It’s a new day and

— Jay (@Mousefan2)@CapitalOne continues its lies and mistreatment of its customers.January 10, 2018

But Capital One is hardly alone. Its problems were just the latest in a series of banking breakdowns that have driven customers crazy. Here's a roundup of the notable bank tech snafus, at big and little institutions, during the past year.

Barclays, February 25

In response to customers' profanity, the bank apologized profusely for the inconvenience.

Frost Bank, March 15

Citizens Bank, March 17

JPMorgan Chase, May 11

PNC Financial Services, June 20

Bank of America, July 19

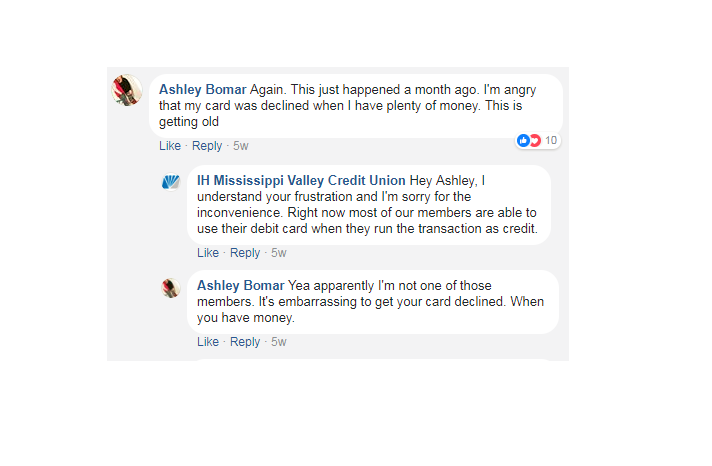

IH Mississippi Valley Credit Union, October 13