PNC Financial Services Group

PNC Financial Services Group

PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

-

New president of Promontory Interfinancial Network says recession will cause "hundreds" of nonbank disruptors to fail; lenders face dilemma over offering Main Street loans to noncustomers; PNC Financial expands, diversifies executive leadership team; and more from this week’s most-read stories.

July 11 -

Less than three weeks after making a $1.05 billion pledge to fight racism, the Pittsburgh company promoted two Black bankers to its top-level management committee.

July 7 -

With stimulus money running out and forbearances set to expire, consumer spending is bound to shrink. That's bad news for business owners and their landlords, the Pittsburgh bank's CEO says.

July 1 -

The Pittsburgh-based company said the funds will be used to support community development, minority-owned businesses and charitable organizations that work to promote social justice.

June 18 -

They join an ever-expanding list of companies choosing to close offices early Friday to observe the day that commemorates the end of slavery.

June 17 -

Leaders of companies including Citizens, Comerica and Truist offered more upbeat assessments of loan demand and credit quality than they have in recent weeks. But others warned of weakness in key sectors such as energy and real estate, and said forbearance policies may be hiding potential pitfalls.

June 9 -

Flush with capital from the sale of its stake in BlackRock, PNC is willing to go big on an acquisition but would be wary of buying a bank with a heavy concentration of consumer loans, CEO William Demchak said.

June 9 -

The challenger bank OakNorth has been peddling its lending platform to U.S. banks for a year. When it saw COVID-19 on the horizon, it retooled to include a ratings system predicting how borrowers will be affected by the pandemic.

June 5 -

The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

May 15 -

The Pittsburgh company has owned a 22% position in the money manager since 1995.

May 11 -

The biggest lenders seem to have handled the corporate rush for cash heading into the economic shutdown caused by the coronavirus pandemic. But their ability to collect is as uncertain as the economic outlook for the next year.

April 15 -

Reluctant to cancel what have become pipelines for developing talent, banks are delaying start dates or moving programs entirely online.

April 13 -

Truist, Key, Fifth Third and PNC became the latest banks to restrict branch access to the drive-through window or appointment only.

March 19 -

They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

March 16 -

A Denver company says that the $410 billion-asset bank used its confidential information to create a copycat product and poach its customers. PNC is contesting the allegations.

February 17 -

A New Jersey jury has put banks and other businesses on notice about their liability for incidents involving clients who mistreat employees in the workplace.

February 12 -

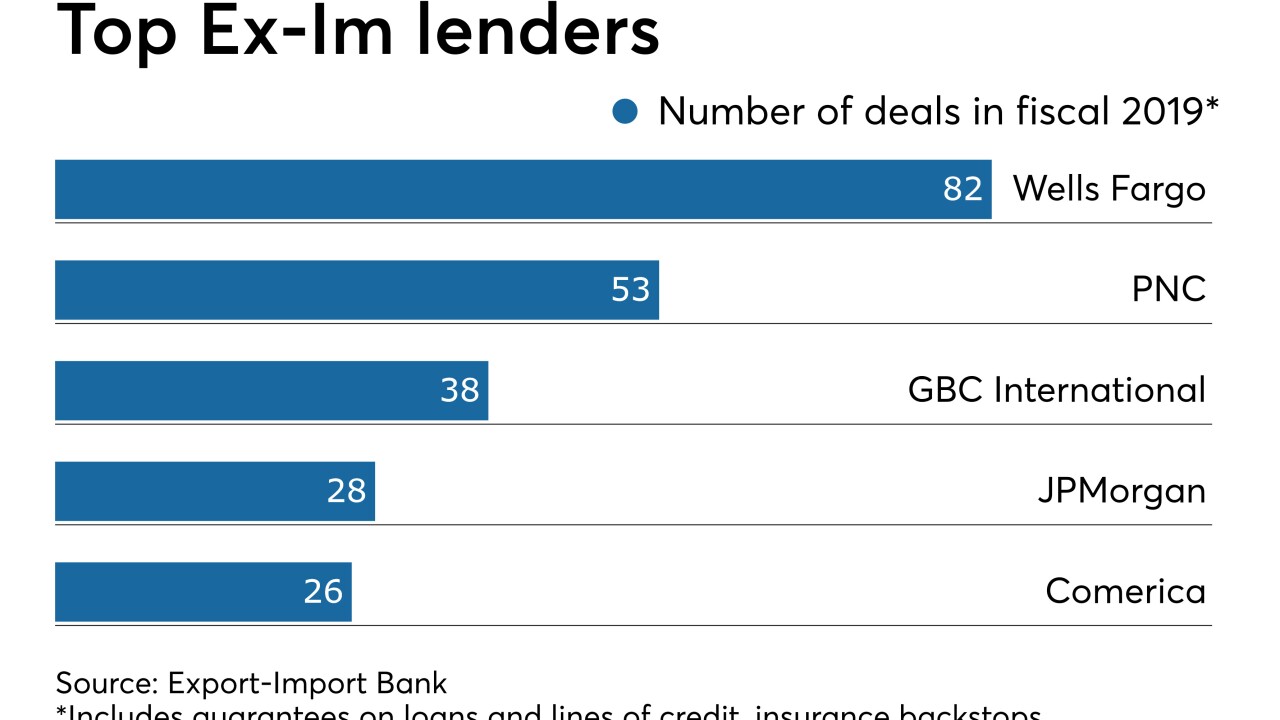

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

Citizens Financial Group’s fourth-quarter results highlight the challenges regionals face in generating top-line growth.

January 17 -

Plaid may be a more problematic acquisition than Visa made it out to be. But without Visa, those problems were likely to get a lot worse.

January 16 -

CEO William Demchak said the bank has witnessed "a lot of mischief" among customers who open checking accounts to collect bonuses and then never use the accounts again.

January 15