-

Legal experts say it is now more likely that the Supreme Court will strike down the single-director governance framework for Fannie Mae and Freddie Mac’s regulator.

July 2 -

The Consumer Financial Protection Bureau's leadership structure could be set for a revamp, but there may be political reasons for both parties to maintain the status quo. Either option could prove problematic for the industry.

July 1 -

Credit unions won the day as the Supreme Court rejected an appeal that would have limited consumers' access to financial services. Now Congress must act to remove those field-of-membership restrictions entirely.

June 30 America's Credit Unions

America's Credit Unions -

Supreme Court says the president has the power to remove the director at will; the bank is the only one of the six largest U.S. banks to say it will cut its dividend next quarter.

June 30 -

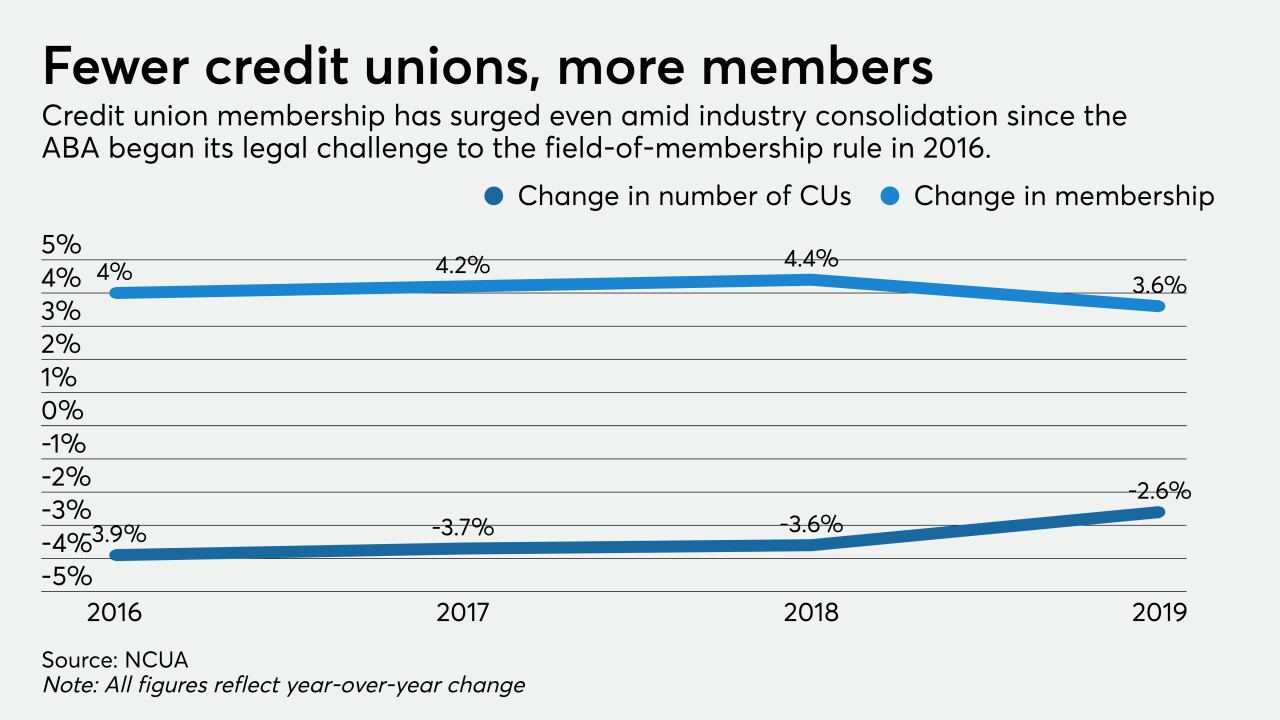

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30 -

The Supreme Court threw out a key statutory provision concerning the agency’s leadership structure, but the presidential election and possible legislative reforms could bring about more changes to the embattled bureau.

June 29 -

The Supreme Court ruled the Consumer Financial Protection Bureau's leadership structure is unconstitutional and refused to hear a lawsuit over the NCUA's field of membership rule. Credit unions are watching to see what happens now.

June 29 -

The court's decision not to consider an appeal from the American Bankers Association is likely to be the last step in a legal saga dating back to 2016.

June 29 -

In a split 5-4 decision, the justices gave presidents new power to remove the agency's head at will. The ruling could have far-reaching implications for other regulators with single directors.

June 29 -

With just 13 decisions remaining on the docket this session, the high court's highly anticipated ruling in a case challenging the agency's leadership structure could come as early as next Monday.

June 25 -

The Supreme Court is poised to decide the fate of the Consumer Financial Protection Bureau's leadership structure, but the implications could reach far beyond the bureau.

June 17 -

The National Credit Union Administration has filed a brief in opposition to the American Bankers Association's request that the court consider its challenge of the agency's field-of-membership rule.

May 27 -

Industry groups have called for a variety of measures to help CUs weather the pandemic’s economic fallout, including more money for funds that aid community development financial institutions.

May 4 -

Fed makes emergency cut, JPMorgan tests contingency plan; the justices appeared divided on whether to give the president power to fire the agency’s director.

March 4 -

The court’s liberal bloc and Chief Justice John Roberts, who holds a crucial swing vote, appeared reluctant to remove a contentious provision that limits a president’s ability to fire a sitting director of the bureau.

March 3 -

The disease could lead to less lending business and more loan defaults; Sergio Ermotti will join the insurance company as chairman in 2021.

March 3 -

John Roberts could play a familiar role as the swing vote in determining whether the Supreme Court curbs the consumer bureau’s power.

March 2 -

The Consumer Financial Protection Bureau heads to the Supreme Court on the same day as 95 credit union-supported candidates take part in the year's first congressional primary races.

March 2 -

The group, which serves community development credit unions, filed a brief suggesting that changing the bureau to a bipartisan commission could have an adverse impact on smaller institutions.

January 28 -

Democratic lawmakers, state attorneys general and others filed briefs with the Supreme Court rebutting claims that the agency’s leadership structure is unconstitutional.

January 24