-

Many sellers are ditching the loans to avoid the cumbersome forgiveness process. For others, the Paycheck Protection Program was never a strategic fit.

August 5 -

Besides reauthorizing the Paycheck Protection Program, Congress should upgrade the loan forgiveness process, offer businesses the chance to take out a second loan and ensure the pricing satisfies lenders, bankers say.

August 4 -

Over 90% of loans from CUs in the Empire State are eligible for forgiveness using the $150,000 threshold.

August 4 -

The Senate Republicans' coronavirus relief package, known as the HEALS Act, would continue to make the loan program available to businesses, but any final bill would need to be negotiated with House Democrats.

July 28 -

The Senate Republicans' coronavirus relief package, known as the HEALS Act, would continue to make the loan program available to businesses, but any final bill would need to be negotiated with House Democrats.

July 27 -

Many bankers want to focus more on the forgiveness process, assessing the status of deferrals and pursuing traditional lending opportunities.

July 21 -

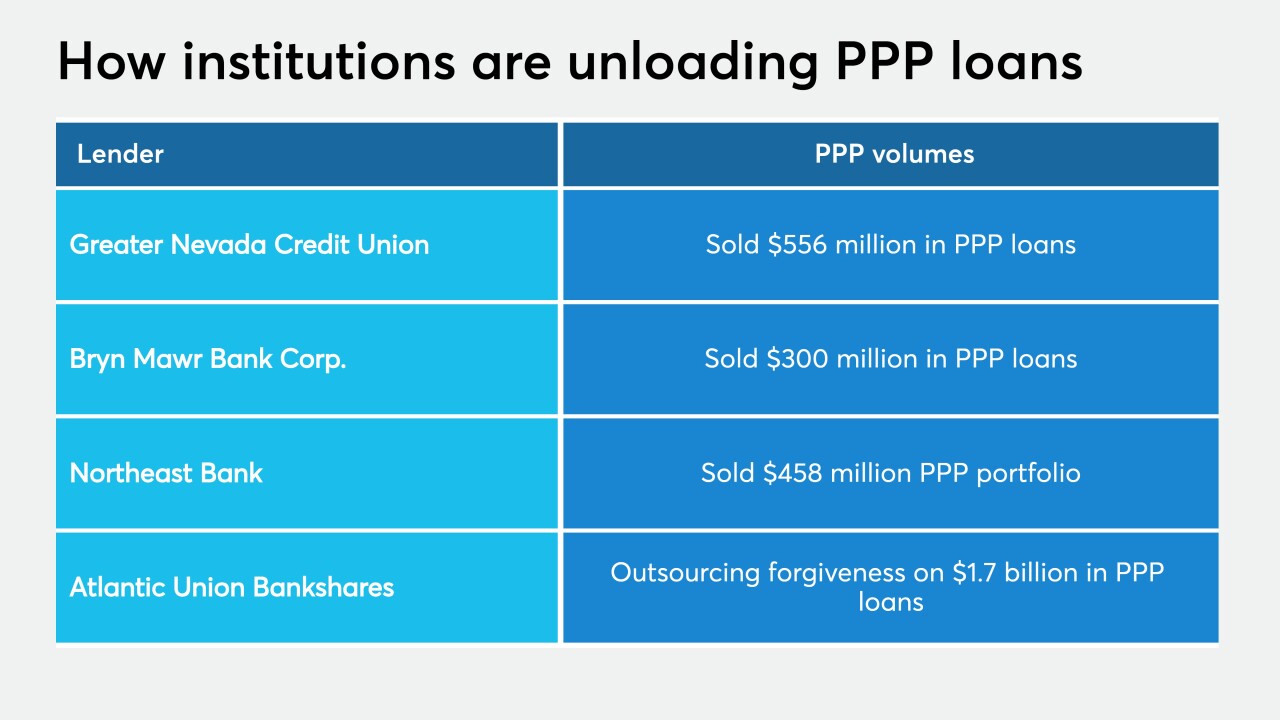

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15 -

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

Pedro Bryant will oversee a $3 million effort to fund small businesses in disadvantaged communities.

July 14 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 13