Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Atlantic Equities’ John Heagerty cut his recommendation on JPMorgan Chase to neutral, saying the bank now “offers the least upside” to price targets among the major banks.

December 19 -

Rich Baich, Wells Fargo's security chief and newly appointed security advisor to the White House, shares attack types he’s worried about and top defenses.

December 18 -

Augmented devices and automation will push banking services beyond the current mobile phone delivery model into a virtual world — but how, exactly? Bank of America, Wells Fargo and others are trying to find out.

December 13 -

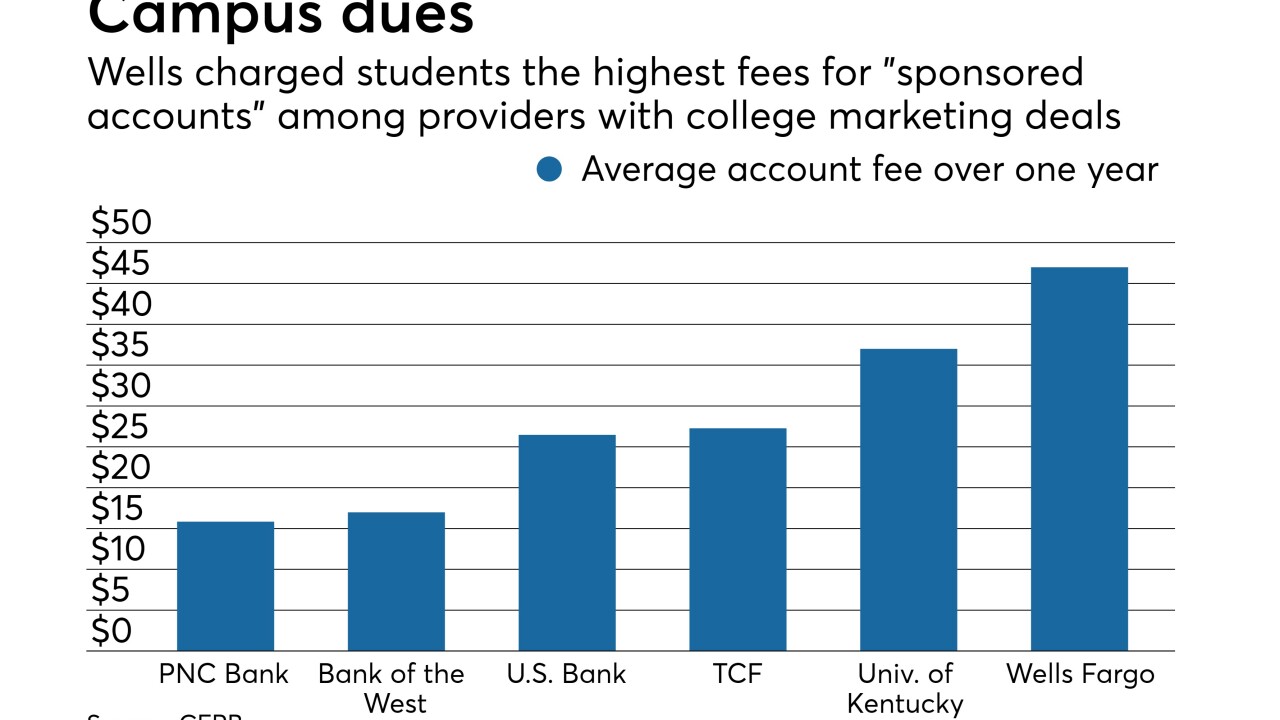

A CFPB report says the bank is the most expensive bank for college students; lenders would be banned from mailing high-interest loans disguised as checks.

December 12 -

The Federal Reserve Board chairman told Sen. Elizabeth Warren in a letter that the central bank is actively reviewing the bank's progress in following a February consent order.

December 10 -

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

Blockchain backers concede the hype is turning off bankers; Mulvaney's CFPB name change could cost industry millions of dollars; the one banking bill Congress might actually pass next term; and more from this week's most-read stories.

December 7 -

The move means the cap on asset growth may stay in place longer; the German bank reportedly processed 80% of the money laundered through Danske Bank.

December 7 -

An eight-month-old consent order appears to be forcing the San Francisco bank to grapple more deeply than it did previously with the many failures that led to its account-opening scandal.

December 6 -

This may be “the first wave” of managers being held accountable for the phony accounts scandal; high prices discouraging cross-border acquisitions.

December 6