Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

A CFPB report says the bank is the most expensive bank for college students; lenders would be banned from mailing high-interest loans disguised as checks.

December 12 -

The Federal Reserve Board chairman told Sen. Elizabeth Warren in a letter that the central bank is actively reviewing the bank's progress in following a February consent order.

December 10 -

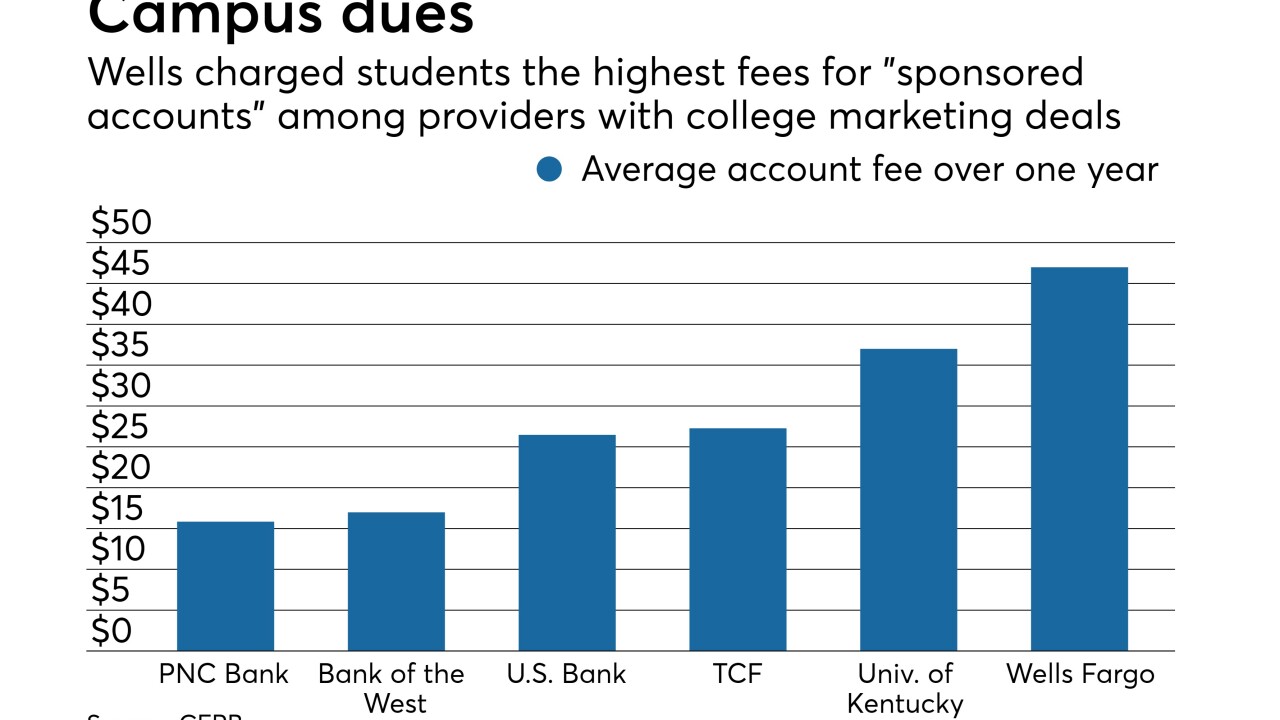

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

Blockchain backers concede the hype is turning off bankers; Mulvaney's CFPB name change could cost industry millions of dollars; the one banking bill Congress might actually pass next term; and more from this week's most-read stories.

December 7 -

The move means the cap on asset growth may stay in place longer; the German bank reportedly processed 80% of the money laundered through Danske Bank.

December 7 -

An eight-month-old consent order appears to be forcing the San Francisco bank to grapple more deeply than it did previously with the many failures that led to its account-opening scandal.

December 6 -

This may be “the first wave” of managers being held accountable for the phony accounts scandal; high prices discouraging cross-border acquisitions.

December 6 -

Since banks are under constant attack by hackers, the startup XM Cyber is offering them a simulator that seeks to do its virtual worst in order to prevent a real breach.

December 5 -

Readers react to trends in public banking, weigh potential changes for brokered deposits, consider oversight of foreign banks and more.

November 21 -

The megabank’s continued compliance problems suggest that all of its board members, along with 100 of its most senior managers, should be replaced to make way for real change.

November 20 -

Moelis submits a revised Fannie/Freddie blueprint; FASB considering a plan to have banks break out charge-offs and recoveries on year-by-year basis; Wells Fargo layoffs begin with 1,000 jobs in mortgage and tech; and more from this week's most-read stories.

November 16 -

Prosecutors are unlikely to buy Goldman's rogue banker defense, observers say; survey predicts recession within two years.

November 16 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Berkshire Hathaway plowed $13 billion into bank stocks in the third quarter that included new investments in JPMorgan and PNC and additional investments in Bank of America and Goldman Sachs.

November 15 -

Wells Fargo explains to the "girls" that there really is no gender bias, but that guy is retiring, OK? Rana Yared is one of Goldman Sachs' 18 new female partners. And Mary Meeker sets a huge target for the venture capital firm she'll create to invest in tech startups.

November 14 -

Will prosecutors believe a rogue banker was behind Malaysia fraud?; banks that changed standards in Q3 were more likely to ease underwriting.

November 14 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

Wells Fargo is considering a sale of its retirement-plan services business, which could fetch as much as $1 billion, according to people familiar with the matter.

November 8 -

The OCC is looking into problems in the bank’s technology operations; banks turn to untraditional methods to raise revenue from research.

November 8 -

The bank says a calculation error led it to deny help to distressed homeowners; a former U.S. deputy attorney general will help with in the 1MDB fraud scandal.

November 7