Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Look for banks to boost dividend payouts, expand into new markets, increase their tech spending and, eventually, ramp up their C&I lending. But don't expect much in the way of M&A.

January 21 -

Wells may have settled with former employee Claudia Ponce de Leon because it wanted to avoid the "massive exposure" of a jury trial, an expert says. It is unclear how the agreement will affect Wells’ other cases.

January 20 -

Wells Fargo joins the list of banks recently hobbled by tech outages. Is there a better response than "Sorry for the inconvenience"?

January 19 -

The Seante looks to forge its own path on GSE reform, breaking to the right of a plan from the FHFA; a new candidate to lead the CFPB emerges as its current director tells the Fed, "Thanks, we're good on funding."

January 19 -

Comptroller of the Currency Joseph Otting blasted a letter from Senate Democrats criticizing his agency for not implementing recommendations on supervision in the wake of the Wells Fargo scandal.

January 18 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

America's biggest banks just spent a week regaling shareholders about brighter days ahead, when tax cuts add billions of dollars to the firms' annual profits. About 8,000 people are getting left behind.

January 18 -

The San Francisco bank said that Michael Loughlin's departure is unrelated to the sales scandal that has dogged the company for the last 16 months.

January 17 -

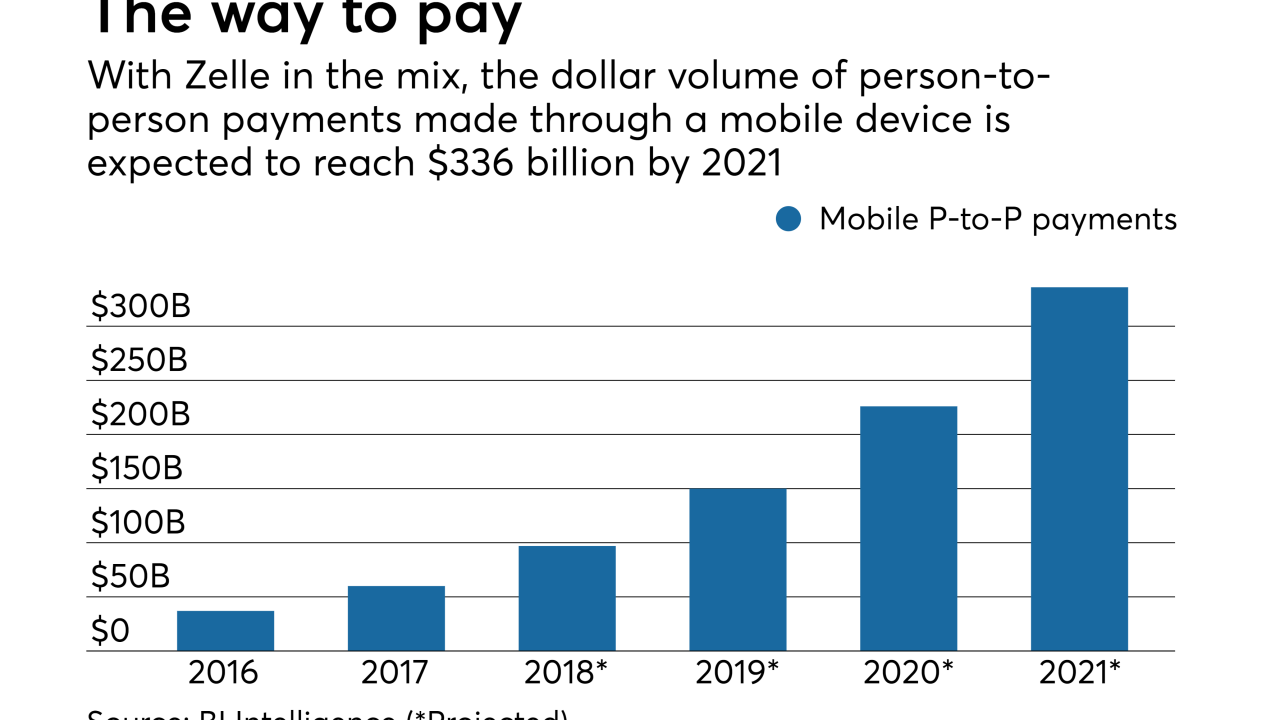

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Tax reform and other regulatory factors could allow Citigroup — and other banks — to maintain high capital levels and strong rewards for shareholders.

January 16