Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

It was a year to remember for women executives at SunTrust and Amex’s new CEO, and one to forget for Wells Fargo and investors in bank stocks.

December 25 -

Treasury Secretary Steven Mnuchin called top executives from the six largest U.S. banks over the weekend, he said Sunday on Twitter, a move that followed heavy losses in the stock market last week and a partial federal government shutdown.

December 23 -

Regulators give OK, but find “shortcomings” that need to be addressed; Labor Department says the bank is laying off U.S. workers while hiring overseas.

December 21 -

Atlantic Equities’ John Heagerty cut his recommendation on JPMorgan Chase to neutral, saying the bank now “offers the least upside” to price targets among the major banks.

December 19 -

Rich Baich, Wells Fargo's security chief and newly appointed security advisor to the White House, shares attack types he’s worried about and top defenses.

December 18 -

Augmented devices and automation will push banking services beyond the current mobile phone delivery model into a virtual world — but how, exactly? Bank of America, Wells Fargo and others are trying to find out.

December 13 -

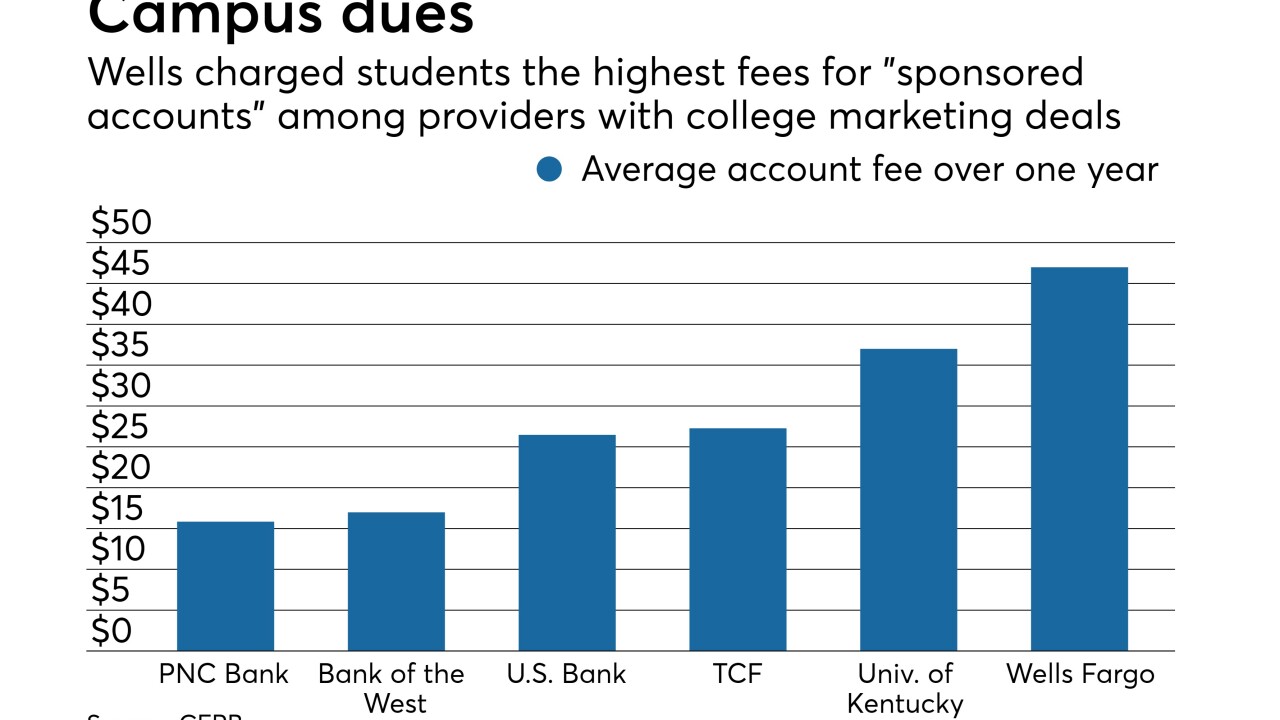

A CFPB report says the bank is the most expensive bank for college students; lenders would be banned from mailing high-interest loans disguised as checks.

December 12 -

The Federal Reserve Board chairman told Sen. Elizabeth Warren in a letter that the central bank is actively reviewing the bank's progress in following a February consent order.

December 10 -

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

Blockchain backers concede the hype is turning off bankers; Mulvaney's CFPB name change could cost industry millions of dollars; the one banking bill Congress might actually pass next term; and more from this week's most-read stories.

December 7