Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The CFPB and OCC are expected to assess a $1 billion fine against Wells Fargo for allegedly overcharging customers for auto insurance and home loans.

April 19 -

The bank revealed Friday that it is facing hefty regulatory penalties and will likely have to restate first-quarter earnings. Declines in loan balances and fee income and questions about upcoming stress tests are only adding to investors' worries.

April 13 -

Bankers hoped the tax overhaul would stimulate a boom in business borrowing, but several said this week that hasn’t happened yet. PNC’s Bill Demchak warned that the tax cuts could be encouraging lenders to underprice loans.

April 13 -

Banks should rethink even existing services, such as the branch experience, said top executives at the Oracle Industry Connect conference.

April 13 -

The firm warned Friday that it may take a charge of as much as $1 billion to settle a U.S. probe of its consumer business.

April 13 -

A $1 billion penalty being bandied about; Deutsche’s problems may be too big to eradicate.

April 10 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

Retail banking chief Christian Sewing will become CEO immediately; higher deposit rates could trim lending margins as banks head into earnings season.

April 9 -

GSE reform a likely scratch from this year’s to-do list; banks’ difficulties in speaking emoji; reactions to Mick Mulvaney’s plans for the CFPB; and more.

April 6 -

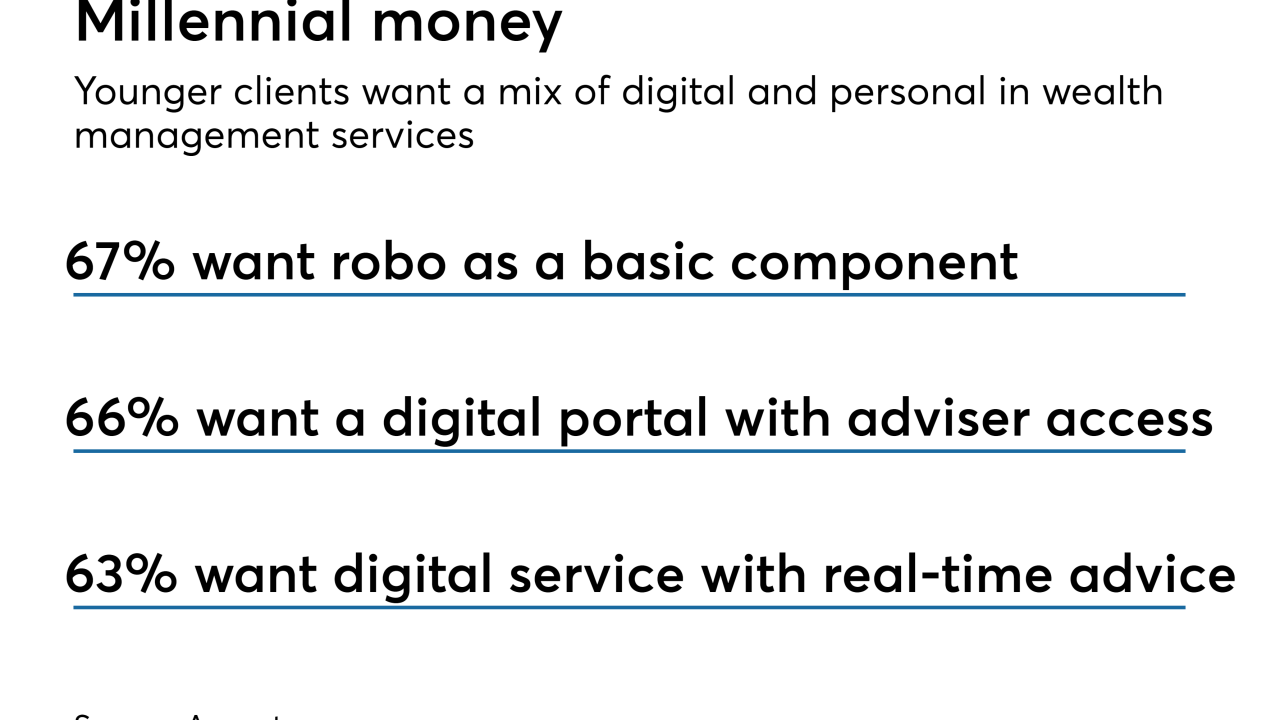

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6