Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Comptroller of the Currency Joseph Otting on Thursday again took issue with Senate Democrats over their concerns about the pace of internal supervisory changes.

January 25 -

The bank tweeted that website and mobile app service were restored after an outage that lasted much of the day.

January 25 -

A plan by the largest U.S. bank to use part of its tax windfall to enter new markets (including Washington and Boston) could become a serious threat for banks of all sizes in those cities — or looked backed upon someday as a pricey overexpansion.

January 23 -

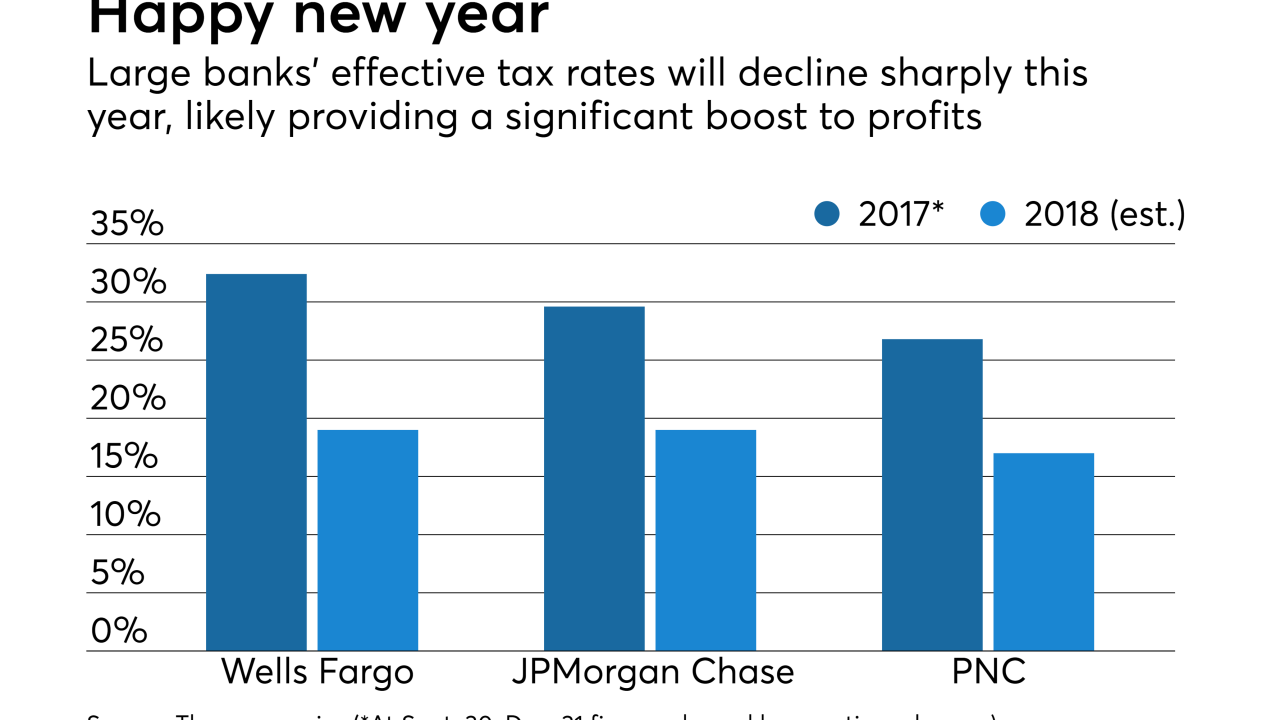

Look for banks to boost dividend payouts, expand into new markets, increase their tech spending and, eventually, ramp up their C&I lending. But don't expect much in the way of M&A.

January 21 -

Wells may have settled with former employee Claudia Ponce de Leon because it wanted to avoid the "massive exposure" of a jury trial, an expert says. It is unclear how the agreement will affect Wells’ other cases.

January 20 -

Wells Fargo joins the list of banks recently hobbled by tech outages. Is there a better response than "Sorry for the inconvenience"?

January 19 -

The Seante looks to forge its own path on GSE reform, breaking to the right of a plan from the FHFA; a new candidate to lead the CFPB emerges as its current director tells the Fed, "Thanks, we're good on funding."

January 19 -

Comptroller of the Currency Joseph Otting blasted a letter from Senate Democrats criticizing his agency for not implementing recommendations on supervision in the wake of the Wells Fargo scandal.

January 18 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

America's biggest banks just spent a week regaling shareholders about brighter days ahead, when tax cuts add billions of dollars to the firms' annual profits. About 8,000 people are getting left behind.

January 18 -

The San Francisco bank said that Michael Loughlin's departure is unrelated to the sales scandal that has dogged the company for the last 16 months.

January 17 -

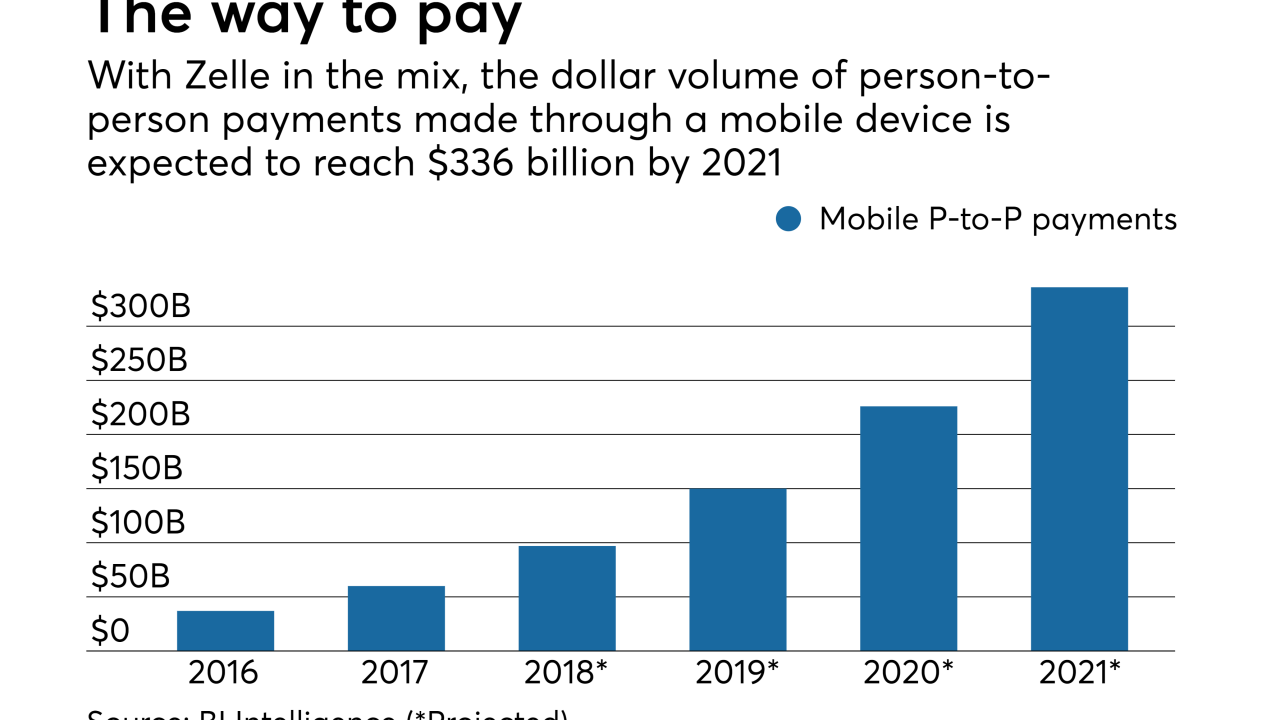

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Tax reform and other regulatory factors could allow Citigroup — and other banks — to maintain high capital levels and strong rewards for shareholders.

January 16 -

Though business owners are more optimistic about the direction of the economy since the tax law was passed, it's doubtful their borrowing will increase meaningfully until they see more signs of more robust growth, bankers say.

January 16 -

The two banks' tax reform expectations differ as they move in opposite directions; bank bows to pressure to report pay discrepancies.

January 16 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

The JPMorgan Chase CEO is rejecting arguments that banks are poised to loosen underwriting standards to win more mortgage business. He said what's needed to encourage banks to make more loans to borrowers with spotty credit files are changes to FHA rules and other policy fixes.

January 12 -

Cryptocurrencies continue to dominate much of the news, with a warning on bitcoin taking the top spot and a story about Ripple's partnership with MoneyGram doing well. Housing finance reform, Wells Fargo and the CFPB also featured.

January 12 -

Executives of large banks told investors and analysts what they wanted to hear Friday when they said they plan to increase returns to shareholders.

January 12 -

Wells Fargo had another surprise for investors in the form of its biggest legal charge yet, showing the lender is not yet past its consumer banking scandals.

January 12