Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The Federal Reserve Board announced that Vice Chairman of Supervision Randal Quarles will recuse himself from matters related to Wells Fargo “to avoid even the potential appearance of a conflict of interest.”

December 15 -

A measure passed by the city council, which still needs final approval, would require banks that want city contracts to disclose whether they set individual or branch-level sales requirements. It comes in response to the Wells Fargo fake account scandal.

December 14 -

Rather than charge set fees, Aspiration offers customers name-your-fee accounts and donates to charities based on the amount of money it makes.

December 12 -

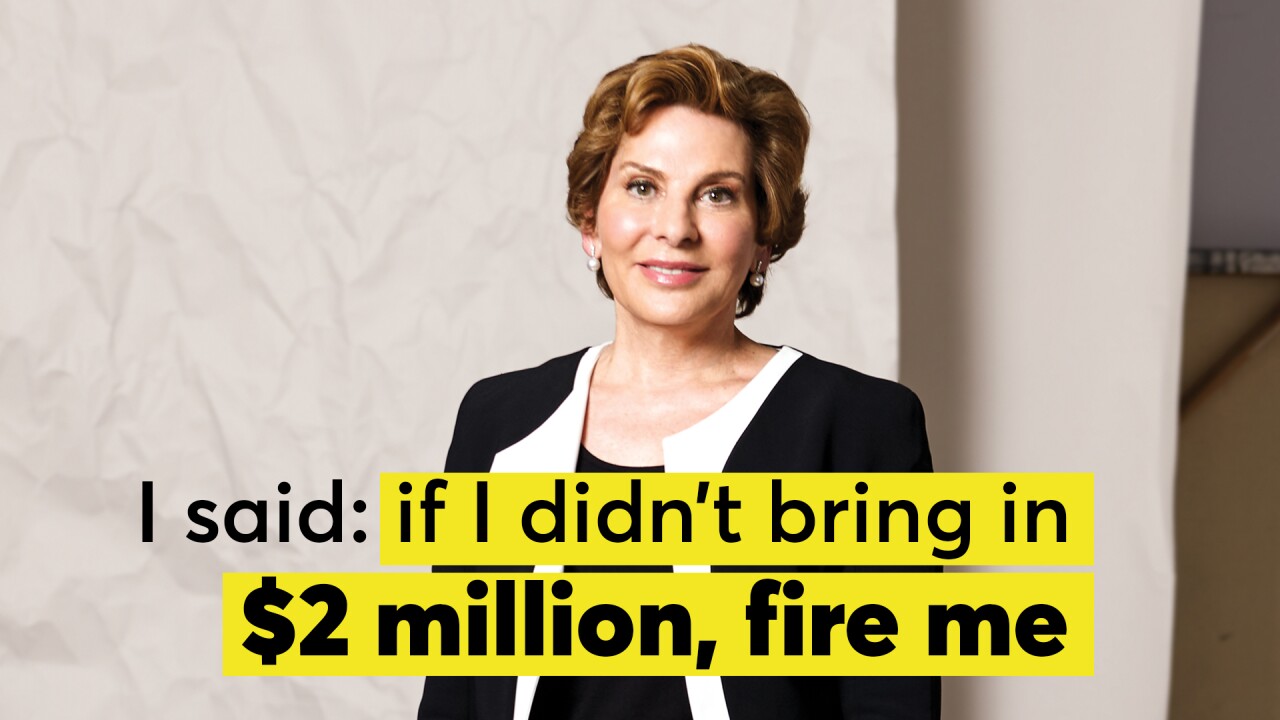

I said: If I didn't bring in $2 million, fire me.

December 12 -

House and Senate bills contain a provision that would let financial firms in all states use digital scans of photo IDs to verify identities of prospective customers. That could ease the account-opening process for consumers in areas where branches are few and far between.

December 12 -

Some are in new roles or replacing legends, others are embracing new strategies or eyeing big deals and at least one is currently out of banking — but could soon resurface. Here are the industry executives to keep an eye on in 2018.

December 11 -

House and Senate bills contain a provision that would let financial firms in all states use digital scans of photo IDs to verify identities of prospective customers. That could ease the account-opening process for consumers in areas where branches are few and far between.

December 11 -

The five-year window on HSBC's deferred prosecution agreement connected to a money laundering case expires; profile says outgoing Fed Chairman Janet Yellen has become "a pop culture phenomenon."

December 11 -

The president wrote Friday on Twitter that penalties against the San Francisco bank will be maintained, or possibly strengthened. The comments are likely to fuel a growing controversy about the independence of federal financial regulators.

December 8 -

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

America’s largest lenders made an epic mistake a decade ago when they cashed out of Visa and Mastercard through initial public offerings, says Chenault, who will step down in February as CEO of American Express.

December 5 -

During an industry conference Tuesday, executives from PNC, Wells Fargo, JPMorgan Chase and elsewhere offered differing takes on whether the Republican tax plan will boost loan demand.

December 5 -

Introducing limits on federally guaranteed loans to graduate students, instead of letting them borrow whatever schools charge, would create a multibillion-dollar opportunity for private lenders.

November 30 -

Digital currency jumps through $11,000 before falling below $9,500 in a volatile day of trading; bank faces growing regulatory scrutiny.

November 30 -

Virtual assistants at banks in Israel, Canada and Hong Kong are getting smarter thanks to artificial intelligence.

November 29 -

The $1.9 trillion-asset bank has been facing pressure to shake up a board that failed to head off a reputation-scarring scandal.

November 29 -

Bank faces a formal enforcement action for problems in mortgages and auto insurance; Judge throws out lawsuit, although plaintiff promises an appeal.

November 29 -

The San Francisco bank will immediately begin winding down its marketing of personal insurance products and plans to exit the business for good during the first quarter of next year.

November 28 -

The CFPB's data-sharing guidance was widely applauded, but mistrust remains between banks and aggregators. Advocates want regulators to take action.

November 28 -

Judge says he will move quickly on who should head the agency; group allegedly overcharged hundreds of clients.

November 28