Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The firm warned Friday that it may take a charge of as much as $1 billion to settle a U.S. probe of its consumer business.

April 13 -

A $1 billion penalty being bandied about; Deutsche’s problems may be too big to eradicate.

April 10 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

Retail banking chief Christian Sewing will become CEO immediately; higher deposit rates could trim lending margins as banks head into earnings season.

April 9 -

GSE reform a likely scratch from this year’s to-do list; banks’ difficulties in speaking emoji; reactions to Mick Mulvaney’s plans for the CFPB; and more.

April 6 -

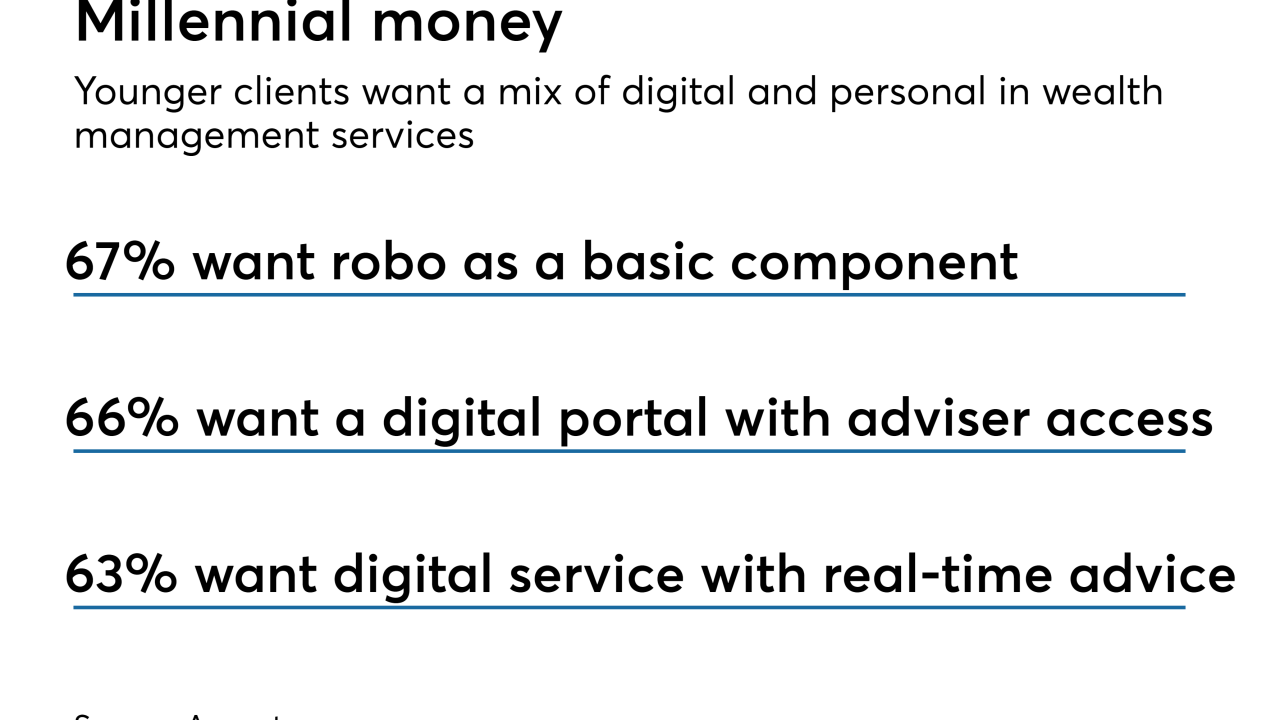

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

KPMG has been the bank's auditor since 1931. Critics say it's time for a change.

April 5 -

Some clients of Wells Fargo's wealth management division were steered into investments that weren't always in the best interests of clients, according to several people familiar with the unit.

April 5 -

San Francisco Fed President John Williams is not suited to lead the most important of the regional Fed banks, given his inability to detect the phony-accounts problems at Wells Fargo. He also lacks Wall Street experience.

March 28 -

San Francisco Fed chief is reportedly leading candidate to replace Dudley in New York; four senior officers to retire as OCC readies penalties against the bank.

March 26