-

Congress is in session, but actions at NCUA, FASB and more will dominate the upcoming week in Washington for credit unions.

September 16 -

The vote Friday was a victory for consumer advocacy groups that have been pushing for years to rein in lenders that charge triple-digit rates.

September 13 -

A proposal to define wages-on-demand would protect consumers and serve as an example for others.

September 12 University of Houston Law Center

University of Houston Law Center -

The chairman of the National Credit Union Administration gave CU Journal more details on the agency’s forthcoming rule providing guidance for credit unions purchasing banks.

September 10 -

Next up for BB&T-SunTrust: deciding where to unload branches; how the Trump administration would reform Fannie Mae, Freddie Mac; why the CFPB's payday rule is in the hands of a Texas judge; and more from this week's most-read stories.

September 6 -

Consumer Financial Protection Bureau Directors Kathy Kraninger is under pressure to ask a federal judge to lift a stay that has kept the agency's short-term-lending rule from going into effect.

September 3 -

A growing number of companies, led by Walmart, are offering payroll advance loans to their workers; Christian Sewing said he will invest 15% of his net earnings in the German bank’s struggling shares.

September 3 -

The debate over the CFPB's plan to revamp its payday lending regulation should focus on the benefits for borrowers.

August 30

-

Readers react to jilted GSE legacy shareholders and a proposal making it harder to cite disparate impact, criticize Democrats asking the CFPB to stop its payday rule revamp and more.

August 29 -

House Financial Services Committee Chairwoman Maxine Waters and over a hundred other lawmakers want the agency to go forward with a mandatory underwriting requirement for payday loans.

August 23 -

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

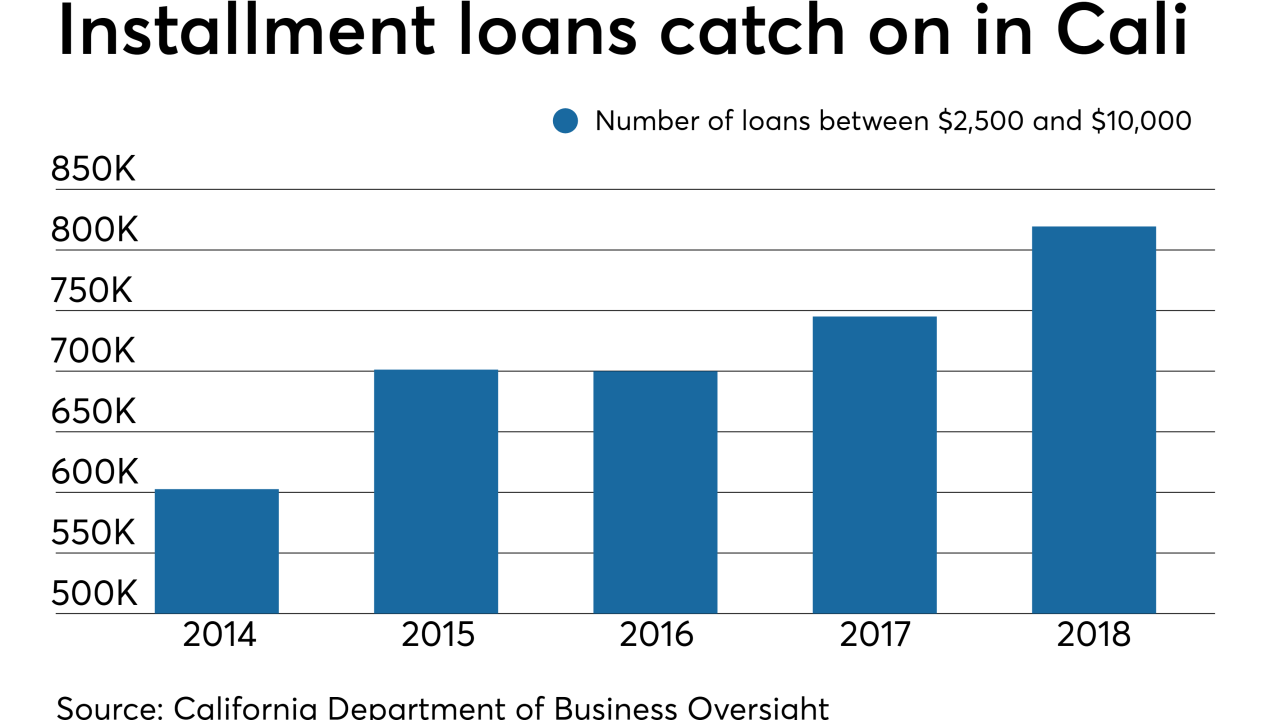

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

Companies that offer early access to earned wages want a regulatory framework for their fast-growing industry. But the bill under consideration in Sacramento is exposing big divisions in the sector.

June 24 -

Readers respond to BB&T-SunTrust's rebranding, consider the future of home equity loans, debate the number of credit unions buying up community banks and more.

June 13 -

The CFPB issued a final rule late Thursday to delay the compliance date for mandatory underwriting provisions of the 2017 payday lending rule.

June 7 -

Critics have knocked the product, which provides workers access to their wages before payday, as another form of predatory lending. But California has a new bill that would create a legal framework for this short-term lending alternative, and policymakers elsewhere should follow the state's lead.

June 3 Nevcaut Ventures

Nevcaut Ventures -

Banks and credit unions “push back” against an FCC proposal to limit calls; Miami gets the next assistant the bank says is not intended to replace humans.

May 30