Next up for BB&T-SunTrust: Deciding where to unload branches

(Full story

Cheat sheet: Trump administration's road map for GSE overhaul

(Full story

PNC goes live on RippleNet

(Full story

Why the CFPB's payday rule is in the hands of a Texas judge

(Full story

CFPB should have a say in bank mergers

(Full story

Tribes push for historic carve-out in CRA reform plan

(Full story

Temenos will buy digital banking software vendor Kony

(Full story

Traditional banks continue to flirt with obsolescence

(Full story

Let's put some perspective around the small-dollar loan debate

(Full story

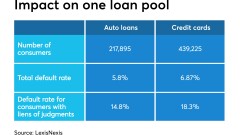

Has removing tax lien data from credit records led to more bad loans?

(Full story