-

The Federal Reserve is temporarily altering the growth restriction it placed on Wells Fargo in 2018 so that the bank can make additional loans to small and midsize business that need funding to weather the coronavirus pandemic.

April 8 -

The regulator must speed up its capital reform efforts while taking immediate steps to reduce the examination burden.

April 7 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The most effective way to avoid cloud payment breaches is by dramatically reducing access, says CloudKnox Security's Balaji Parimi.

April 6 CloudKnox Security

CloudKnox Security -

The U.S. Treasury is talking to digital payments providers about quick ways to disburse funds to recipients of stimulus checks within a couple of weeks, but payments industry experts foresee troubling security issues even with most of the obvious options.

April 3 -

Mastercard has increased the contactless payment limit to CA$250 across Canada to provide consumers with a safer way to pay during the coronavirus pandemic.

April 3 -

Interchange fees are a major part of the costs merchants pay to accept payment cards. While merchants seek relief from fees during a time in which their businesses face serious damage from stay-at-home edicts because of coronavirus, the credit card companies and banks quickly began to dig in their heels.

April 1 -

Payments gateway and financial crime compliance technology provider Pelican is partnering with Banking Labs to serve banks and corporations in Canada.

April 1 -

While much of the world is sheltering at home to deter the spread of coronavirus, there's still a need for essential workers to travel — and an opportunity for the development of in-car payments technology, which could allow consumers to pay for gas or food without handling cash or other potentially infected surfaces.

April 1 -

With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

March 31 -

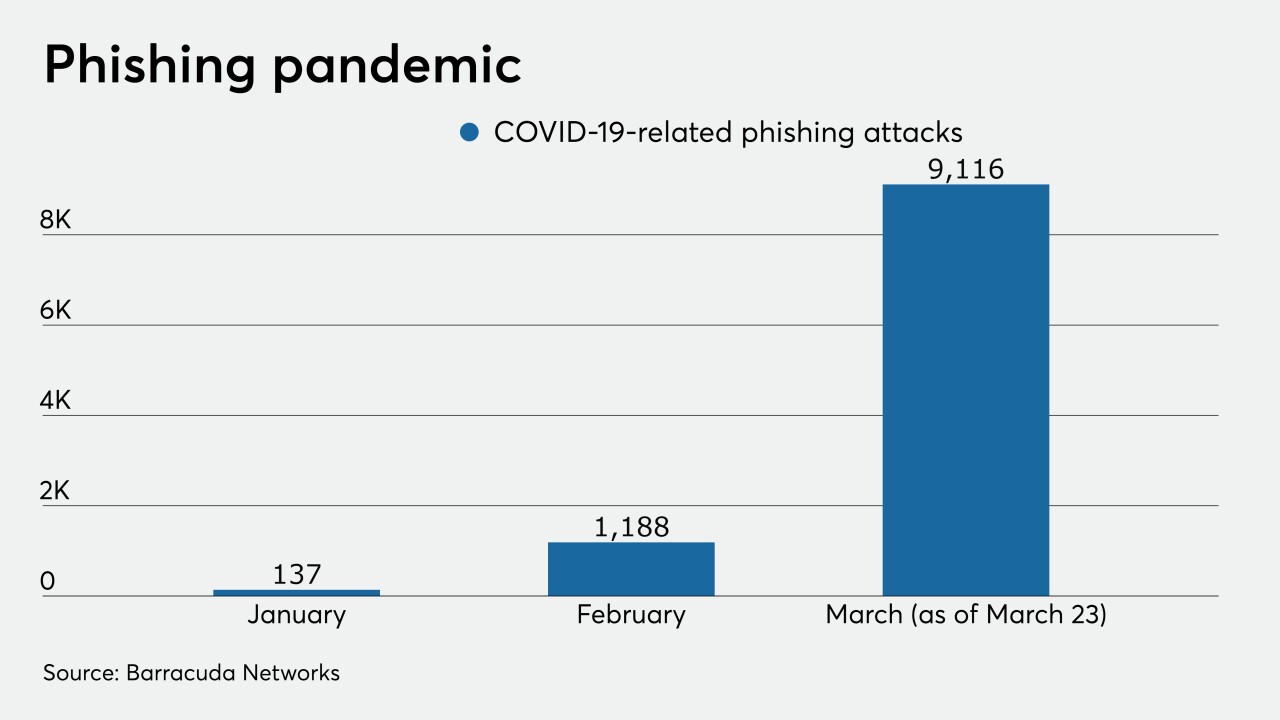

Hacker emails disguised as pleas for aid have surged in the past month, and they're targeting bank employees and the many others working from home.

March 30